I'll Take Investing For $2,000, Alex

By Megan Brinsfield, CPA, CFP

July 15, 2019

As you’ve probably heard, the now-famous Jeopardy! champion James Holzhauer was one of the most prolific Jeopardy! winners in the history of the game show.

And, we’d bet our Daily Double that Holzhauer’s unconventional strategy may be able to help you win with your investments, too!

There are several tactics Holzhauer employed that set him apart from the pack.

He started with the highest value clues, working his way up the board rather than down. He hunted for Daily Double clues and went “all in” when he found them, complete with the classic gambler’s gesture of pushing an imaginary pile of chips to the center of the table with both hands. To prepare for the game show, he read children’s books rather than encyclopedias.

And all of that contributed to amassing over $2.4 million in winnings, at a rate more than twice as fast as Ken Jennings’ streak back in 2004.

We believe that Holzhauer’s success boils down to one major lesson...

Find and exploit your edge.

At the core, your “edge” is defined as an area where you are better than average.

For Holzhauer, beyond being incredibly knowledgeable, his edge is in the realm of the Daily Double.

You might think that his day job as a professional gambler is what gives him the guts to bet it all, and while that may help, it is ultimately a choice of odds.

Statistically speaking, an even money bet should carry 50/50 odds. Once the odds are tipped in your favor, an even money bet becomes an easier choice.

Holzhauer estimates that the average Jeopardy! player has correctly answered 70% of Daily Double questions, already an attractive set of odds.

But his personal record for Daily Doubles stood at an impressive 94% correct as of the end of his impressive run. Suddenly, risking everything on a single clue doesn’t seem so crazy.

So, what is YOUR edge when it comes to investing?

I’ll share one that Motley Fool Wealth Management sees as the primary contributor to winning performance...

It’s time.

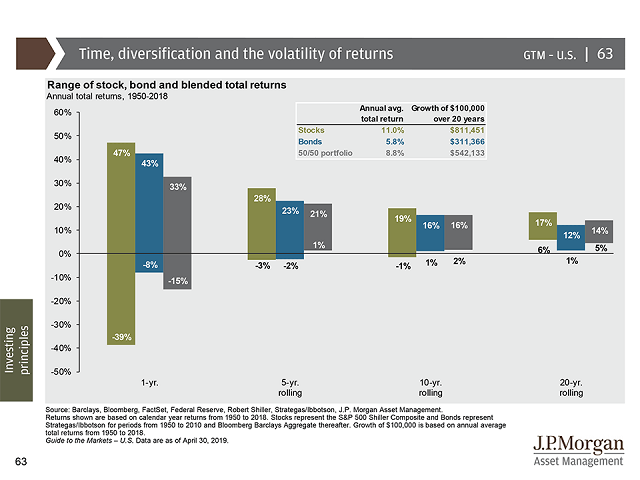

The chart below shows the historical range of outcomes based on an investor’s holding period.

Investors who are in the market for a one-year time frame are subjecting themselves to a wide variability of outcomes while investors who hold for five years or more both narrow AND improve their potential range of outcomes dramatically.

Depending on the source, the average investor holds an investment anywhere from two months to eight months.

Even the latter is astoundingly brief, in our view.

If you have a portfolio to invest over five years or more, you are already positioned to be able to drive successful investing results. That’s fantastic!

But what if you could do MORE to propel your portfolio even further?

If you’d like to see how our team can generate an asset allocation -- custom tailored for YOU -- that harnesses the expertise of our professional portfolio managers who pick stocks for you instead of trying to do it all on your own, click here, and join thousands of fellow Fools who have chosen Fool Wealth’s experts to manage their portfolios.

We have strategies with minimums ranging from $25,000 to $300,000, but we find that clients who are able to invest at the $300,000+ level tend to be the best fit for our program.

Click below to see what we can do for you today!

We believe the third-party data cited above is reliable; however, we cannot guarantee this data’s currency, accuracy, timeliness, completeness or fitness for any particular purpose.