When the taxman comes a-calling, he now needs a Roadmap

By Amanda Kish, CFP®

Aug. 5, 2019

In both the U.S. and Japan, most workers have taxes withheld from each paycheck. But get this: Japan employs "precision withholding." Come tax time, workers receive a postcard summarizing their withholdings and taxes due, and the numbers are so correct that most people simply accept them.

Overpayments are automatically directly deposited and amounts due are automatically withdrawn from bank accounts.

In other words, the system is so simple that most workers don't have to do anything.

As you undoubtedly know, things are a bit different in the US...

But you may not know that there is an independent organization within the IRS called the Taxpayer Advocate Service. This organization exists to ensure that every taxpayer is treated fairly and understands their rights. And the head of this organization is the NTA, or National Taxpayer Advocate.

Well, our National Taxpayer Advocate (NTA), Nina Olson, has long lamented our unnecessarily complicated tax system.

Every year, Olson presents a report to Congress and routinely conveys how overly complex our tax code is, among other problems that plague taxpayers.

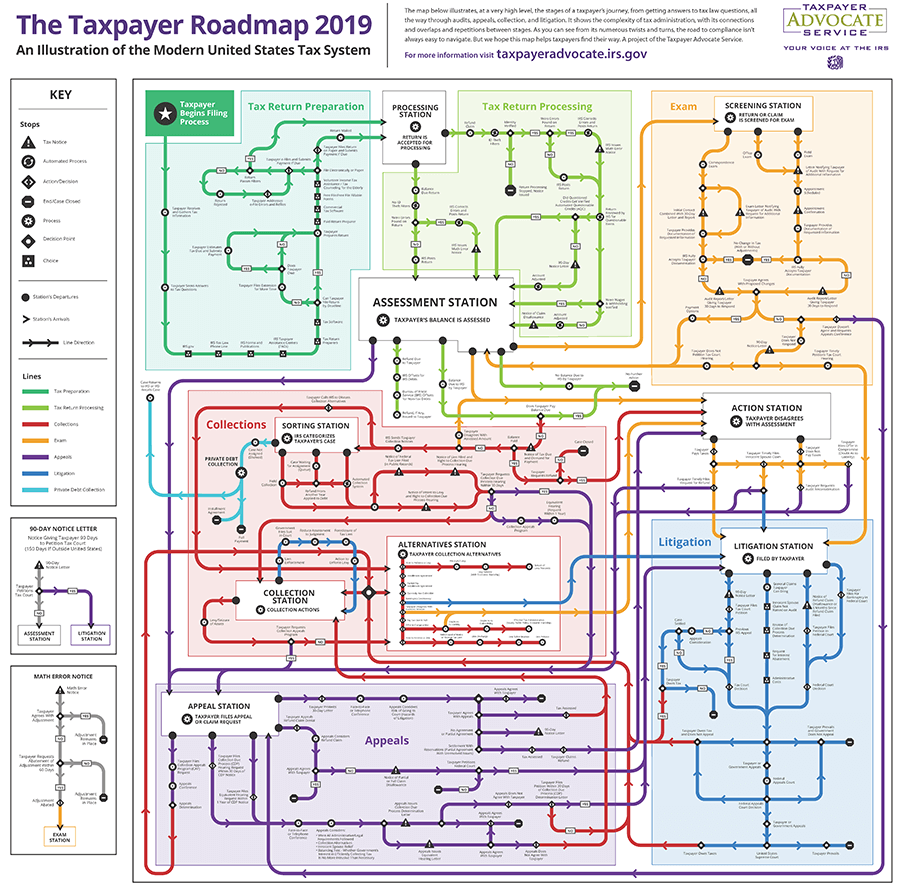

This year, she released a " Taxpayer Roadmap" that lays out paths that taxpayers need to travel to get various tax-related tasks accomplished:

View high-resolution PDF version

As you can see, the U.S. Taxpayer Roadmap is more complicated than most cities' subway maps. Its aim, in the words of the Taxpayer Advocate Service, is to show "the taxpayer's 'journey' through the tax system -- from getting answers to tax law questions and preparing a tax return, through return processing, audit, appeals, litigation, and collection."

Olson notes that, "For every step shown on the map, there are tens of steps and interactions that are impossible to represent in a single document," which is why her office is developing an interactive digital version of it to help taxpayers.

Just how complicated is the U.S. tax code?

This isn't the first time Advocate Olson has addressed complexity in our tax code.

In her 2016 report to Congress, she criticized the complexity of the U.S. tax code, noting:

"IRS data shows that taxpayers and businesses spend about six billion hours a year complying with tax-filing requirements. To place this in context, it would require three million full-time employees to work six billion hours, making 'tax compliance' one of the largest industries in the United States."

The National Taxpayer Union Foundation offered similar numbers for those preparing and dealing with 2017 taxes .

It estimated that complying with the 2017 tax code "...consumed nearly 8.1 billion hours for recordkeeping, learning about the law, filling out the required forms and schedules, and submitting information to the Internal Revenue Service (IRS)."

It went on to estimate the total value of the time spent on tax return preparation along with out-of-pocket expenses and came up with a grand total of $303.77 billion -- for tax compliance in 2017.

The U.S. federal tax code itself takes up several thousand pages and contains roughly 4 million words. (For context, the entire original seven-book Harry Potter series contains close to 1 million words.)

It's no wonder taxpayers quickly get confused!

How to deal with the complex tax code

So how can you best deal with the complexity of our tax code?

- At the risk of sounding trite, write to or call your representatives in Washington to let them know that you'd like a simpler tax-preparation process.

- Stay current with all these changes by using tax-preparation software such as TurboTax, TaxAct, or one of many other options. Good software packages will incorporate the latest tax laws and can help you take advantage of available tax breaks while minimizing or eliminating any math errors. Depending on the complexity of your situation, you may do best hiring a tax pro to prepare your return. If you go this route, ideally use a Certified Public Accountant (CPA), enrolled agent, or tax lawyer, as they can represent you before the IRS if needed.

- Get familiar with the Taxpayer's Bill of Rights, which the NTA's office pushed the IRS to adopt. The 10 rights include the right to pay no more than the correct amount of tax, the right to appeal an IRS decision in an independent forum, and the right to a fair and just tax system.

At the end of the day, we believe the most important advantage that you can create for yourself as an investor is to stay invested in the market over the long-term.

Our clients are invested in the proprietary investment solutions we devised to be able to tailor and adapt our asset allocation recommendations based on each individual's personal financial situation. Taking into account your time horizon, risk tolerance, investing temperament, and personal financial goals, we are able to custom-tailor a "Personalized Portfolio" for you.

And what's more, we're able to invest your money ON YOUR BEHALF, according to that custom plan.

It's really that simple. If you are an investor with assets of $500,000 or more, we'd like to show you how our personalized investing solutions can work for you. Simply click here to learn more or to book an appointment with one of our knowledgeable investment advisors today!