Stock Picking

When considering potential investments for our strategies, we prize quality above all. Quality may seem like a vague term, but to us and in the world of investing, it means something very specific. It’s a 360-degree investment approach that takes into account both quantitative and qualitative factors.

Sure, algorithms can run the numbers on revenue, P/E ratio, profit growth, etc. But they tend to struggle when it comes to assessing factors like management credibility, brand loyalty, and company trajectory.

We believe that taking into account qualitative – or “soft” – data, along with the hard numbers gives us an advantage when it comes to discovering the companies that have the most wealth-building potential for our clients.

The Four Pillars of Quality

Every holding is rigorously vetted by us against these standards. If we believe a potential investment does not measure up, we don’t invest. Period.

Pillar of Quality #1: Management, Culture, and Incentives

In our view, great companies make great investments. And great companies start with visionary leadership. We look for management teams that can not only articulate their strategies, but rally their entire organizations around executing them. They cultivate a culture filled with smart, motivated employees, and incentivize them to do ground-breaking work.

When management and employees are personally invested, whether financially, emotionally, or — preferably — both, businesses should be poised to thrive.

Pillar of Quality #2: Economics

Of course, all the passion and devotion in the world can’t overcome the basic rules of supply and demand. Quarter-over-quarter and year-over-year, we want to see growing revenue, increasing profits, and a business model that should support and scale them well into the future. Preferably, every extra dollar of revenue contributes more to the bottom line than the last. We look at traditional factors like cost structure, revenue models, and capital efficiency, along with other considerations like customer loyalty and pricing power.

We always like to see a healthy balance sheet when it comes to cash on hand and corporate debt obligations.

Pillar of Quality #3: Competitive Advantages

Next, we broaden our perspective to assess the competitive landscape in which our prospective holdings operate. Have they been a dominant player in their given sector? Or are they a promising up-and-comer and potential industry disruptor? How crowded is the space with competitors, and how does our prospective holding stack up? Competitive advantage looks different for various kinds of businesses.

We love to see a unique strategy, product, service, or business model that stands out from the competition, and which may potentially dominate the landscape for years to come.

Pillar of Quality #4: Trajectory

Our final pillar involves looking forward and assessing the potential of each business. We love fast-growing companies, but is that growth sustainable? What are the keys to growth, and how might shifting consumer tastes, regulatory trends, and the competitive landscape affect their potential? Can the company scale its business model and keep its culture intact as it does so?

We like to see growing companies within expanding industries. These companies take a bigger and bigger slice of the pie within their sector, all while the sector itself continues to grow.

Portfolio Construction

When you invest with Fool Wealth, your assets will be allocated across a combination of actively managed strategies that are exclusively available to Fool Wealth clients. Each has specific parameters and specific goals. Click on any of the strategies below to learn more about it.

U.S. Large Cap Aggressive Growth

Seeks to create wealth by building a portfolio of some of the most innovative companies of our time.

Highlights

ObjectiveBuilding a diversified portfolio on some of the most innovative companies of our time. Acting like owners of a business by being very reluctant to sell.

Portfolio ManagersJeremy Myers, CFA, Tony Arsta, CFA

Who should investInvestors who want a portfolio of businesses that are looking to move the world forward. Investors need to have a long-term mindset, as some of the innovations may take as much as a decade to truly take hold in the marketplace.

U.S. Large Cap Core

Seeks to achieve long-term capital appreciation through a diversified portfolio of great businesses

Highlights

ObjectiveAchieve long-term capital appreciation by owning a diversified portfolio of great businesses.

Portfolio ManagersJeremy Myers, CFA, Tony Arsta, CFA

Who should investInvestors who are seeking a Foolish take on domestic company exposure for their portfolio and have a long-term investment horizon of at least three years.

U.S. Large Cap Dividend

Seeks a reliable, significant, and growing stream of dividend income from large domestic companies

Highlights

ObjectiveWe seek to provide a reliable, significant, and growing stream of dividend income from large domestic companies.

Portfolio ManagersTony Arsta, CFA, Jeremy Myers, CFA

Who should investInvestors who identify as “conservative” or who prefer dividends should consider this strategy. Investors may prefer dividend paying equities because dividends are historically responsible for about half of long-term total stock returns, because dividend payers tend to be established and stable businesses, or because dividend stocks experience lower volatility than non-dividend payers.

Hedged Equity

Seeks to make a diversified portfolio better by improving its risk-adjusted return

Highlights

ObjectiveWe seek to make a diversified portfolio better by improving its risk-adjusted return. In pursuing this objective, we will focus on achieving long-term capital appreciation, modest correlation to other asset class returns, and lower maximum drawdowns than other equity allocations.

Portfolio Manager Jeremy Myers, CFA

Who should investInvestors searching for potential for a more attractive return/risk profile, and reduced maximum drawdowns that offer numerous benefits.

U.S. Small and Mid-Cap

Seeks to find the best domestic small and mid-cap companies built for the long term

Highlights

ObjectiveWe seek to earn market-beating returns by searching for high-conviction, high-quality companies among the small and mid-cap companies based in the United States.

Portfolio ManagersBill Barker, CFA

Who should investWe believe that all long-term investors benefit from investing in smaller and mid-cap companies in the United States, as they tend to be less followed than their large-cap peers. In time, investors with a significant enough time horizon should benefit from being able to buy (and sell) at advantageous points in time.

International

Scours the globe to find great companies selling at great prices

Highlights

ObjectiveWe seek to improve the performance of a diversified portfolio by exposing it to assets located in markets around the globe that have markedly different characteristics than markets of the United States.

Portfolio ManagersTony Arsta, CFA, Michael Olsen, CFA

Who should investWe believe international exposure is appropriate for nearly every investor with an equity portion of their portfolio and a three to five-year investing horizon.

Fixed Income

Seeks to pad your portfolio with prudent income-generating investments

Highlights

ObjectiveSeeks to improve the total risk-adjusted performance of a portfolio by adding a different asset class, bonds, to an equity portfolio — and to mitigate some of the inherent risk in having an overly stock-centric portfolio, with the overall goal of making net portfolio losses from peak to trough less severe.

Portfolio ManagersNate Weisshaar, CFA, Tony Arsta, CFA

Who should investIf you will need the money in less than a year, keeping funds in a cash account is more appropriate than taking on the risk inherent in investing in fixed income.

Building Portfolio Strategies for Multiple Possible Futures

We focus on finding quality companies that we believe can be the bedrock of your investment strategy, no matter what the future holds.

Our Portfolio Managers can’t see the future (we’re working on our crystal ball technology, but so far, no luck). Questions about what legislation will be passed, how much inflation may spike, how interest rates might change, or how international trade agreements will take shape are difficult for anyone to answer definitively.

But that’s OK! We don’t attempt to precisely forecast macroeconomic trends. Instead, we strive to find companies that we feel can weather any potential storm that comes their way, and take advantage of more bullish periods.

Our goal is to outperform our benchmarks over rolling 3-year periods, and keep your hard-earned savings compounding over time, so hopefully you can achieve the financial goals you’ve always dreamed of.

Here are some of the tenets our analysts and Portfolio Managers use in striving to consistently build resilient portfolio strategies for our clients.

Put quality first

Regardless of what’s going on in the markets, or in the world, we do our best not to own anything that doesn’t meet our quality threshold. We assess every holding against our Four Pillars of Quality, and consider only those that receive top marks from our team.

Look to forecast risk

We have to look not just at potential returns, but at possible risks that may impact the investments in our clients’ portfolios. We analyze risk, set probabilities, and allocate accordingly. We identify the major factors we feel might impact each of the holdings and we monitor them continuously, making regular updates to our thesis, and fundamentally asking, are we still on track? Are our clients invested in our highest conviction ideas? Do those ideas still have growth potential?

Study businesses over months and years, not days or weeks

We diligently monitor the companies’ performance, cashflow, new product announcements, shareholder meetings, mergers, acquisitions, and more. We keep careful tabs on the companies' industry environment and competitors in the space. We study potential investments for months, sometimes years. We do not invest based on the latest “hot tip.” We are investors, not traders.

Over time, we develop a thesis around where we think the company – and the stock price – is potentially headed, and we invest based on that thesis. We generally start with a relatively small position, then we wait… and watch.

If our initial thesis holds true, we may add to the position over time.

Winning should compound, losing should not

We monitor companies closely, and constantly update our thinking on their current and future potential. Sometimes, we have to be able to admit when a holding is not living up to expectations, and reallocate accordingly. At the same time, we need to be able to let the winners run.

We can’t simply sell and enjoy our profits, because the portfolios need to work indefinitely. We hunt for the companies we believe are poised to generate returns year-over-year and make sure our clients remain invested in them. Our goal is for our clients to benefit from compounding growth.

That means we may not beat our benchmarks every quarter, or even every year. Instead, we evaluate our results over rolling three-year periods, because we are focused on long-term growth, not simply short-term gains.

We are confident that in the long run, Quality should reign supreme, and that Quality stocks should be the strongest foundation for building resilient portfolios. We’d love to put this philosophy to work for your retirement or investment account.

Asset Allocation

Studies show success in the stock market isn’t only driven by which stocks you invest in, but in what combination. That’s why asset allocation is so important.

Once we learn about your financial situation, we can determine which of our seven exclusive portfolio strategies are right for you — and in what combination. By allocating different percentages of your cash to different strategies, we can fine-tune your allocation according to your current needs and your future goals.*

Here are the main factors that determine what asset allocation is potentially best suited to your needs*:

Goals

Why are you investing?

These days we think wealth looks more “motley” than ever. Peoples’ dreams are as unique as they are. We have clients who travel the world, live on sailboats, own cattle ranches, and have wild hobbies like rocket paragliding. We believe that your wealth strategy should be built around your goals, your priorities, and your needs.

Risk Capacity

What's your ability to afford losses?

Given a long enough time horizon, the market has historically moved up and to the right. But we must consider how the temporary ups and downs could affect our clients. We’ll line up your portfolio with your timeline — whether it’s intended for short-, intermediate-, or long-term goals — as well as the spending needs that you have communicated to us, to seek to ensure you don’t take on more risk than you can reasonably afford.

Risk Tolerance

What's your psychological reaction to potential market declines?

When it comes to investing in the stock market, we often say that volatility is the price of admission. And an ability to stomach volatility is key to long-term success. We can repeat these maxims until we’re blue in the face, but if the fluctuations in your account balance causes you to lose sleep at night, it’s not the right plan for you. We’ll work to find an allocation that can potentially keep you on track toward your goals without inducing unnecessary anxiety. Because our goal isn’t only to grow your wealth; it’s to improve your overall quality of life.

Asset Allocation

What percentage of each asset class should be in your portfolio?

As you may have noticed, we consider ourselves a “stock shop.” And we believe firmly in the long-term wealth building potential of our individual stock selections. But depending on the factors above, we may find it appropriate to allocate portions of your portfolio to bonds, certain ETFs, cash, hedged strategies, or options. Even within the realm of stocks, your allocation may skew more heavily toward more conservative large-cap, dividend-paying companies, or toward more aggressive, high-growth-oriented stocks. Your precise allocation depends on the factors mentioned above.

Monitor Performance

Are you on track?

Even for the best investors, markets can often prove unpredictable. We strive to prepare your portfolio to face multiple possible futures, but even the pros can’t anticipate every eventuality. You can track your performance through our client dashboard which puts key information at your fingertips.

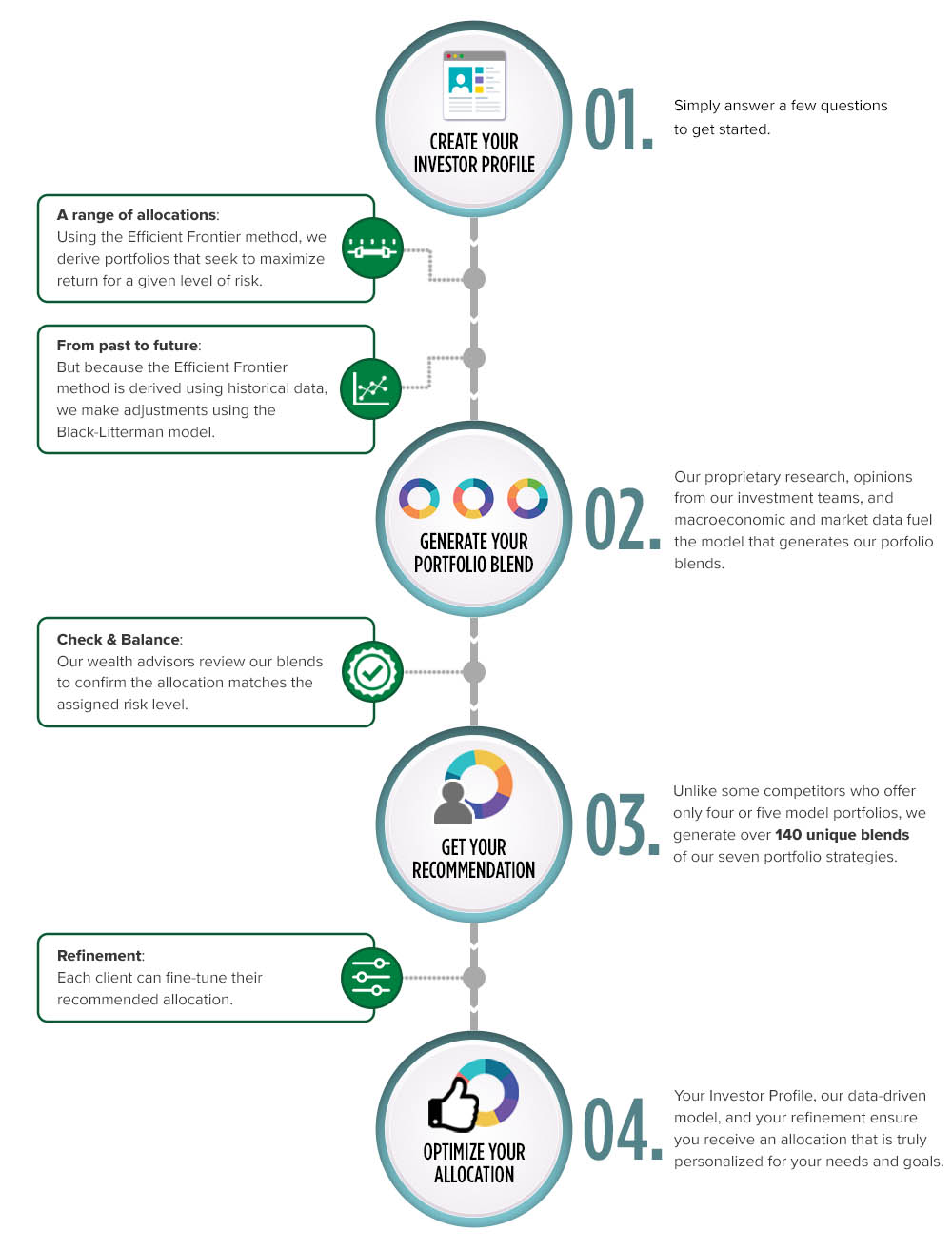

Ready to see the asset allocation we’d recommend for you? Here’s how it works…

Your Asset Allocation Process

Your recommended asset allocation may include a mix of large U.S. companies, small or midsize companies, and International stocks — along with certain ETFs, bonds, and options that may help to diversify your portfolio and mitigate risk.

Your precise asset allocation is tailored to you! Create your Investor Profile by filling out the form below, and see the allocation we’d recommend for you.

Join our email list for updates

Stay in touch by signing up for our weekly newsletter. You’ll be the first to hear the latest updates about Fool Wealth’s transition to Apollon, plus fresh insights on investing and financial planning.