Tax Day is April 18, 2023. While you technically get an extra few days to file, the deadline will be here before you know it. So if you're like many Americans who waited until the last minute, here are some tips to proceed with speed. And if you’re ahead of the game, use these tidbits to guide your preparations for next year.

Top priorities for last-minute tax filings

Tip #1: Time efficiency.

While everyone wants to minimize how much they pay in taxes or get back the highest refund possible, be smart about how much time you spend looking for possible deductions. For example, should you hunt downs all of your explanation of benefits (EOB) statements or call every doctor, lab, dentist, and pharmacy you may have visited last year to tally all of your out-of-pocket medical expenses? Unless you had a major medical expense, probably not. Why? Because most medical expenses do not exceed the standard deduction AND 7.5% of your adjusted gross income (AGI). Therefore, many people end up taking the standard deduction, which is as follows:

2022 Standard Tax Deduction

| Single taxpayers | $12,950 |

| Married couples filing jointly | $25,900 |

| Married filing separately | $12,950 |

| Head of households | $19,400 |

Source: IRS.gov

But if you think your itemizing will exceed the standard deduction, exhaust every possible deduction. Check out IRS.gov for some common ones.

Tip #2: Don’t forget your charitable contribution.

As we mentioned, many individuals will take the standard deduction. But if you itemize your deductions on your taxes, don’t forget to take all your eligible charitable deductions. And if your charitable gifts do not exceed the standard deduction, consider bunching your giving in one year to get a higher deduction.

Tip #3: Let’s talk about last-minute IRA contributions.

There are very few opportunities to go back in time to get a tax deduction. But contributing to your IRA before April 18, 2023, can do just that.

Retirement savings vehicles—like 401(k) or 403(b) plans and IRAs—can be the most accessible way for many individuals to maximize their tax deductions. And while only IRAs allow you to contribute after the end of the year and still get a tax benefit for the prior year, most retirement savings vehicles are tax beneficial in some way.

The IRS has set limitations on annual plan contributions, so if possible, try to max out your contributions each year. For example, the total contributions you can make each year to all your IRAs—traditional plus Roth—cannot exceed $6,000 ($7,000 if you're 50 or older).

And if your plan has an employer match, even better. It’s free money for saving toward retirement.

How do retirement savings impact taxes? The amount you contribute to a traditional IRA, 401(k), 403(b), or other employer-sponsored plan reduces your taxable income. In other words, you contribute pre-tax dollars to these accounts. Therefore your taxable income is lower than it would be otherwise. In addition, the earnings from these accounts are tax-deferred, meaning you only pay taxes when you withdraw your money. A Roth IRA differs from these in that you contribute after-tax dollars, but the earnings grow tax-free, so withdrawals are not taxed.

Tip #4: Keep an eye on tax changes.

New tax legislation was signed into law at the end of 2022. Dubbed the "Secure Act 2.0," the law implemented several changes for retirement saving, including:

1. Increased the age for RMDs from 72 to 73 starting on January 1, 2023, then to 75 starting in 2033. The increase in age would allow Americans to save for retirement longer.

2. Higher catch-up amount for workers who are ages 60-64. The proposed catch-up for a 401(k) and 403(b) would rise to the greater of $10,000 or 150% of the regular catch-up contribution amount for 2024 and for a SIMPLE IRA, to the greater of $5,000 or 150% amount for 2025. These limits would then be indexed for inflation every year.

3. Eliminates RMDs for Roth accounts in qualified employer plans beginning in 2024.

4. Allows SIMPLE IRAs and SEP IRAs to accept Roth contributions.

5. Allows employers to deposit matching or non-elective contributions to employees’ Roth accounts (in a 401(k) or 403(b) plan).

6. High-income earners (income greater than $145K) must contribute catch-up monies for a 401(k), 403(b), and 457(b) to a Roth starting in 2024. (Catch-up contributions for IRAs are not required to go into a Roth.).

7. New surviving spouse benefits when taking RMDs.

8. Catch-up contributions for IRAs and 401(k) will adjust for inflation starting in 2024.

9. Annual QCD amount will be indexed for inflation. Also offers a one-time opportunity to use a QCD to fund various charitable trusts or annuities such as CRUT, CRAT, or CGA.

10. Employers can match based on student loan repayment.

Tip #5: Assemble your finance support team.

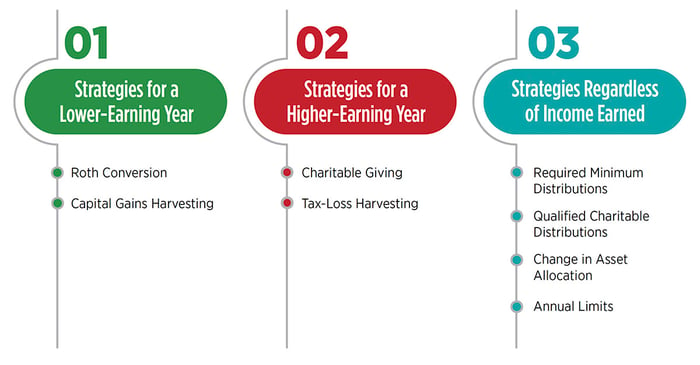

Preparing your taxes, especially last minute, may be overwhelming. This is especially true if your income varies significantly from year to year. For example, what strategies should you consider if you have a low-income-earning year? What about if your income is unusually high? Planning ahead can help you maximize your tax deductions or lower your taxable income each year. In addition, there are some potential strategies that you should think about every year, regardless of income level.

You also may have questions about your taxes in general, such as, are you capturing all possible deductions? Or, what if you make a mistake?

Suppose you have these or similar questions. In that case, you may want to consider working with a finance support team, including a wealth advisor, tax professional, and perhaps even an attorney for legacy planning. You should always consult with qualified tax professionals for all tax questions or advice. The goal is to create a blueprint for your money (and therefore your taxes) year-round—to think ahead and not get caught unaware. Because when it comes to taxes, there are many contribution limits and withdrawal requirements based on the calendar year. Unfortunately, you generally cannot make up for lost time if you miss one.

Interested in learning more about tax strategies? Download our free report.

Like what you're reading?

Join the thousands of readers getting stories like this delivered straight to their inbox every Thursday — for free. Give it a spin, enter your email to sign up.

Related Articles

What Every Retiree Should Know About Taxes

Tax planning doesn’t end with retirement. In fact, tax planning can be equally, if not more...

Should I Gift Assets While I’m Alive?

Do you plan to give away your money to charity or your heirs but aren’t sure when you should gift...

How to Take Advantage of a Market Downturn

For long-term investors following a disciplined investment strategy, a market downturn usually is...