On March 16, 2022, the Fed raised rates for the first time since 2018. The reason? The Fed is trying to dampen rising inflation by increasing rates. (Higher interest rates tend to encourage savings and reduce spending. They also make borrowing more costly. Thus, demand is stymied, decreasing inflationary pressures.)

Why now? The Fed felt comfortable hiking rates because the economy is strong, especially the labor market—where unemployment is now at 3.6%1—despite the recent fall in the stock market and uncertainty emanating from the Ukraine war. And more rate increases are expected this year as the Fed has indicated up to six additional moves, for a total of about 1.75% this year alone.2 But that’s not a surprise. The markets (clearly visible in the bond markets but also impacting stocks) already anticipated last week’s rise and are pricing in more this year.

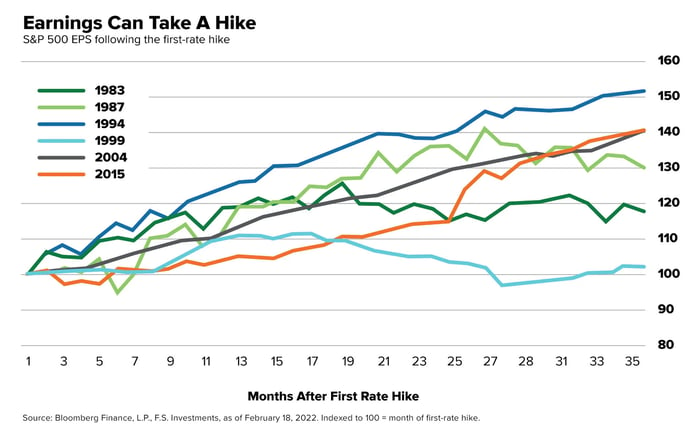

More importantly, investors want to know: How could this first-rate hike impact companies’ earnings? This chart looks at various first-rate increases since the 1980s.

In every instance shown, 12 months after a first-rate hike, earnings were higher. And three years later? Again, they were all positive.

In every instance shown, 12 months after a first-rate hike, earnings were higher. And three years later? Again, they were all positive.

What about during high inflationary periods? Look at 1983 as a proxy since the early 1980s faced high inflation. As you can see, earnings did not falter and continued to grow over time.

We cannot say with certainty that this time will follow the same pattern. But history offers a guide for investors to understand the potential impact of the recent rate hike on earnings over the next three years.

Like what you're reading?

Join the thousands of readers getting stories like this delivered straight to their inbox every Thursday — for free. Give it a spin, enter your email to sign up.

Related Articles

.jpg)

What Do We Take Away From Earnings Calls?

When the Securities and Exchange Commission (SEC) adopted Regulation Fair Disclosure (Reg FD) in...

Emerging Market Equities – An Undervalued Opportunity?

Many investors are underweight or not invested at all in emerging markets (EM) equities.1 This is...

3 Ways to Lower Income Tax in Retirement

Even if you’re not working in retirement, you probably generate income and pay tax on it. How, you...