2022 was a bad year for stocks, not just in the United States. The MSCI All Country World Index, a benchmark of how global stock markets (including ours) perform, fell by 20% in 2022. What happened? Speculative assets (like cryptocurrencies and unprofitable companies' stocks) and safer assets (like blue chip stocks and U.S. bonds) crashed, interest rates increased, and economic pessimism grew. For example, corporate profits were hit especially hard in emerging markets, down 15% from 2021.1

But should U.S. investors care about the rest of the world? We think so.

Here are three reasons why we think international investing opportunities could be plentiful.

Reason 1: International stocks tend to be much cheaper than U.S. ones

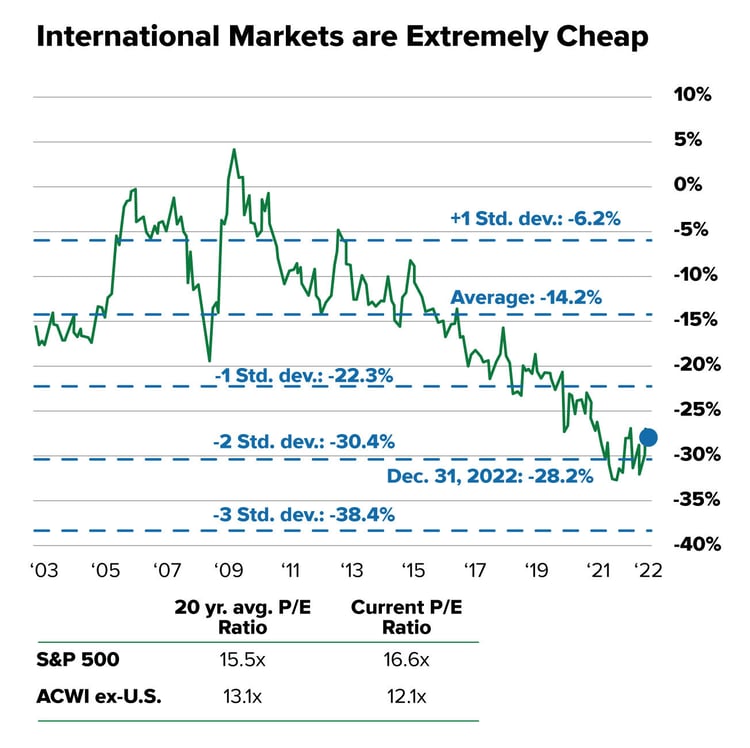

The U.S. stock market is well below its highs but is considered expensive compared to most of its foreign counterparts. When we say "expensive," we are not talking about the market price at which you can buy or sell a share of stock. Rather, we mean the valuation multiple—in this case, price-to-earnings (P/E) for the last 12 months. Compared to the U.S., many key international stock markets are valued much cheaper.

Data source: MSCI and S&P Dow Jones. P/E means price-to-earnings ratio. TTM means trailing-12-month. NTM means next-12 months. Data as of Jan 31, 2023.

Of course, there are a few exceptions. For example, India's stock market was trading 22.1x trailing-12-month earnings at the end of 2022.2 But in our viewpoint, most foreign markets are generally considered more attractively valued than the U.S. market.

What does this mean for investors? If two companies are the same in every way (hypothetically speaking), and one is based in Germany while the other is in the U.S., you could buy the German company for roughly a third less. Of course, this scenario is unrealistic because no two companies are identical, and it assumes that each company’s next-12 months (NTM) P/E is comparable to the figures above. We also ignored other factors, like currency. However, the premise still holds that there are attractive opportunities outside the U.S. in addition to those in the U.S.

Reason 2: Today’s discount happens roughly 5% of the time

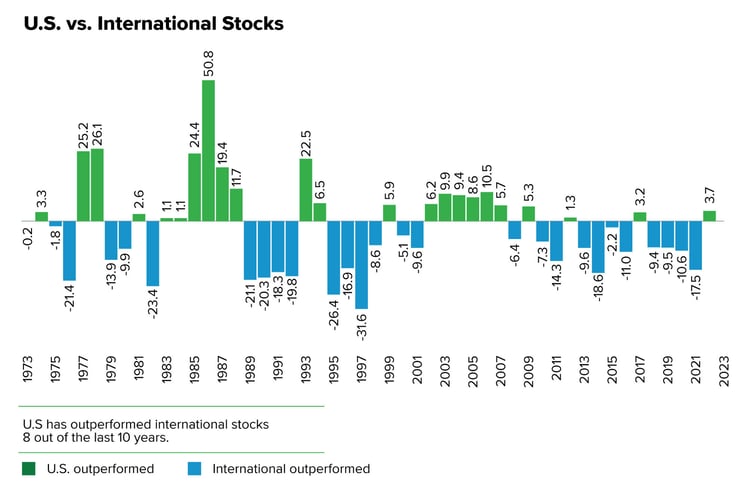

When comparing the S&P 500 index (U.S. stocks) to the MSCI EAFE NR index (international stocks), foreign markets underperformed the U.S. in eight out of the past 10 years.3 Plus, the performance gap widened in recent years before the downturn in 2022. For example, international stocks underperformed their U.S. counterparts by 17.5% in 2021 and 10.6% in 2020 after falling behind by more than 9% in 2018 and 2019.4 So when you look at the non-U.S. market and compare it to the U.S. market using this data, you see a large performance gap. In statistical terms (yup, we're pulling out statistics again!), the size of this gap happens roughly 5% of the time! Why is this?

Source: FactSet, MSCI, Standard and Poor's, JPMAM. As of Dec. 31, 2022

Source: FactSet, MSCI, Standard and Poor's, JPMAM. As of Dec. 31, 2022

For one thing, in our opinion, many of the largest U.S. companies were well-positioned to perform well during the pandemic. In contrast, many of the largest international companies—especially in emerging markets—were hit significantly harder. For example, in China, one of the largest international stock markets, COVID-19 lockdowns weren't lifted until recently. Additionally, the war in Ukraine has had a much more significant effect on many major international markets in Europe than it has in the U.S. We believe all of these forces combined to dramatically slow down an already decelerating globalization trend.

Foreign exchange headwinds have recently created yet another negative catalyst for international stock returns. The U.S. Dollar Index has risen by nearly 16% since the start of 20215 In simple terms, assets priced in foreign currencies are cheaper in U.S. dollars than just a couple of years ago. Or said a different way, nearly 40% of the loss for U.S. investors in foreign markets was caused by a negative currency return in 2022. For example, if the local currency return was 9% and the U.S. dollar impact was an additional loss of 6.5%, the total return for a U.S. dollar investor was -15.6%.6

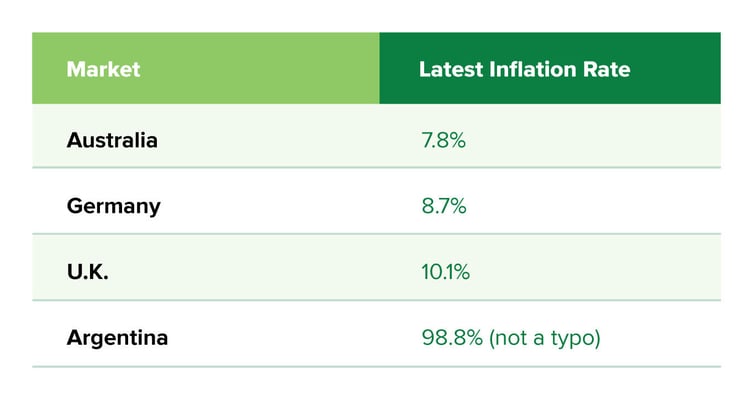

Finally, many foreign markets have more economic uncertainty. For example, most Americans think inflation is high in the U.S. (and it is, historically speaking) at 6.4% as of January 2023.7 But consider the latest inflation numbers in some other major markets worldwide.

Data source: Trading Economics. As of Jan. 2023, except Australia is as of Dec. 2022

What does this mean for investors? Ok, none of that may inspire confidence that international markets are poised to do well. But as these headwinds ease, we feel the opportunities within the international markets should be compelling with the current relative valuation gap. We’ve already seen COVID restrictions lifted, and the USD has begun its retreat. In addition, lessening the energy crisis and stabilizing geopolitical forces could help propel foreign company earnings. So as inflation abates, many of the pressures may lift. With that said, it may not matter…because here’s the caveat…

Reason 3: Quality companies are found all over the world

It probably won’t come as a surprise that the U.S. stock market is the largest in the world…by far! In fact, the U.S. makes up more than half of the world’s total market capitalization. But another way to look at this is if you invest only in U.S.-listed stocks, you are ignoring nearly 50% of the world’s investment opportunities.8

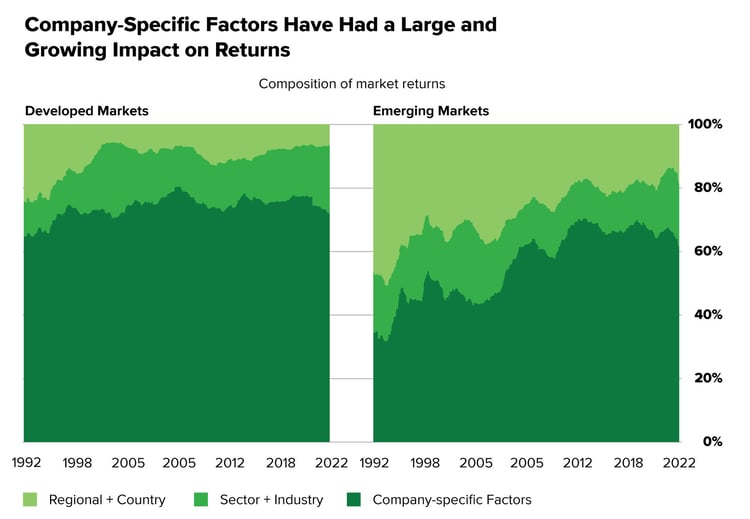

Unfortunately, U.S. investors often forget they can find good companies even in challenged overseas regions. This can be especially true in developed markets, where company-specific factors, such as sales growth from new product launches or cost-cutting initiatives, tend to influence returns significantly more than the sector or region. For instance, European companies generate only 44% of their revenue from their home countries.9 The rest come from sales to other countries and regions. We believe company-specific factors and outside sales are growing more influential, even in emerging markets.

Source: Empirical Research Partners. As of Sept. 30, 2022. The analysis provided by Empirical Research Partners using their developed market and emerging market stock universes that approximate the MSCI World Index and the MSCI Emerging Markets Index, respectively. Data show the percentage of market returns attributed to various factors over time, using a two-year smoothed average. Past results are not predictive of results in future periods.

Moreover, we feel regardless of regional inflation or geopolitical uncertainty, investors can find potentially high-quality, best-in-class companies outside the U.S., often at a valuation discount.

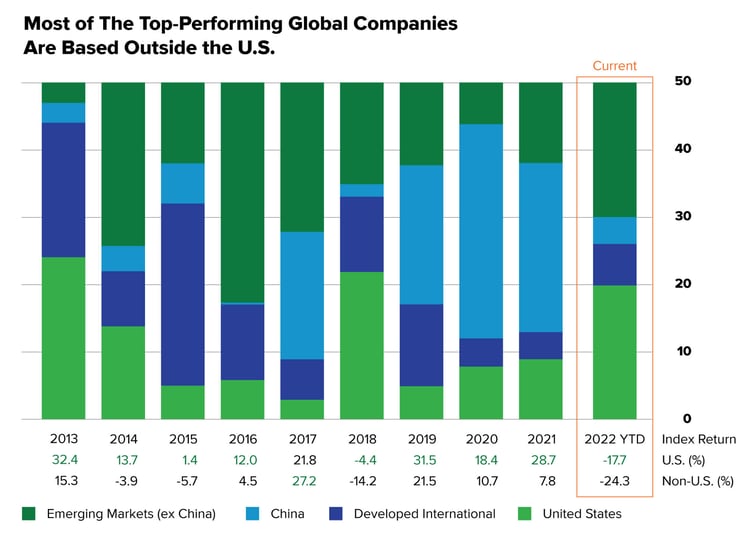

A little-known fact is that three-fourths of the top-returning companies since 2013 are located outside the U.S. In 2022, many of those were in emerging markets (excluding China), while in the previous three years, Chinese companies were the drivers. So despite index returns favoring the U.S., high-quality companies exist outside the U.S.

Source: MSCI, RIMES. 2022 data is year-to-date as of Oct. 31, 2022. Returns in U.S. dollars. The top 50 stocks are the companies with the highest total return in the MSCI ACWi each year. The returns table uses S&P 500 and MSCI ACWI ex-USA indexes for U.S. and non-U.S., respectively.

What does this mean for investors? First, data show that some overseas markets, like Europe, are not doing well. That's true. But we think it doesn't matter. Because as we showed earlier, company-specific fundamentals, rather than geographic orientation, often drive returns. Thus, stock picking is critical.

Additionally, since the U.S. dollar has remained strong for the most part (although it's weakened recently) against other major currencies, many international stocks can represent relative bargains and offer attractive returns for U.S. investors.

Will international stocks outperform in 2023?

Although nobody knows, 2023 could be another slow year for international markets. We already mentioned the elevated inflation rates in many foreign countries, which could hurt consumer spending even more than it does domestically. And since adjustable-rate borrowing (rather than fixed-rate) is common overseas, rising interest rates could harm consumer spending more than in the U.S.

But we think there are bright spots. First, growth expectations for this year and 2024 should favor economies outside the U.S. For example, the forecasted 2023 real GDP (real growth—growth adjusted for inflation—is what you should look at with rising or high inflation) for the U.S. is 0.5%, which is slightly higher than Europe (0.0%) but far below emerging markets (3.4%), including China (4.3%) and India (6.6%).7 2024 forecasts follow the same pattern.

Second, we assume many foreign-based companies do not necessarily rely solely on local consumers, so even if their economies are hurting, other consumers can make up a sizeable percentage of sales.10

Last, despite the recent underperformance and uncertainty of 2023, we feel that many international stocks have solid long-term track records, and we believe their businesses could translate into robust equity performance in the years ahead. We believe they could also help diversify the returns of a U.S.-centric stock portfolio by potentially picking up the slack when the U.S. falters. Although this isn’t always the case, especially when there are big macro shocks—like COVID or a global financial crisis—international stocks may have the potential to help smooth returns in more normal markets.

Source: Morningstar. As of Dec. 31, 2022. U.S. stocks are represented by the S&P 500 Index. International stocks are represented by the MSCI EAFE NR Index. Past performance does not guarantee future results. Index performance is for illustrative purposes only. You cannot invest directly in an index.

Source: Morningstar. As of Dec. 31, 2022. U.S. stocks are represented by the S&P 500 Index. International stocks are represented by the MSCI EAFE NR Index. Past performance does not guarantee future results. Index performance is for illustrative purposes only. You cannot invest directly in an index.

Like what you're reading?

Join the thousands of readers getting stories like this delivered straight to their inbox every Thursday — for free. Give it a spin, enter your email to sign up.

Footnotes

1J.P. Morgan Asset Management - Global Equity Views 1Q 2023 - Jan. 18, 2023

2Siblis Research, as of Dec. 31, 2022

3Morningstar. Data as of Dec. 31, 2022

4BlackRock - International Stocks: Why Bother - Data from Morningstar - Dec. 31, 2022.

5YCharts. Accessed Feb. 10, 2023

6Data as of Dec. 31, 2022 for the MSCI All Country World ex-U.S. Index

7Trading Economics, as of Jan. 2023

8Source: UBS Financial Services. Jan 12, 2022

9Bloomberg, FactSet, Societe Generale, JPMAM, MSCI. Indexes used: Europe: MSCI Europe, Japan: MSCI Japan, U.S.: S&P 500, Emerging markets: MSCI EM. Revenue exposure vs. country of listing as of Dec. 31, 2022

10JPMAM, Data through Dec. 31, 2022. Revenue exposure vs country of listing is the % of revenue from home countries.

Related Articles

Should Dividends Be Part of Your Recession Investing Playbook?

Many investors have largely ignored dividend stocks in recent years, and to be fair, it probably...

Value? Growth? How About Quality

Difficult market environments often cause investors to rethink their investment strategy....

Recession Obsession: How Scared Should Investors Really Be?

Traditionally recessions are characterized by slowing economic growth, job loss, rising...