Why would a fire in a mine in South America three months ago cause the refrigerator you just ordered to be back-ordered? Or why did COVID cause the price of beef to skyrocket? Even more perplexing, why would the war in Ukraine lead to a lack of bread in Africa? The answer to questions related to a disruption in the supply of consumer goods and the elevation of their prices is one word: Globalization.

What is globalization?

By definition, globalization is “the process by which businesses or other organizations develop international influence or start operating on an international scale.”1 So when talking about economies, globalization describes the flow of capital and goods among countries and the access to foreign resources to maximize returns for a company while hopefully benefitting the greater good.

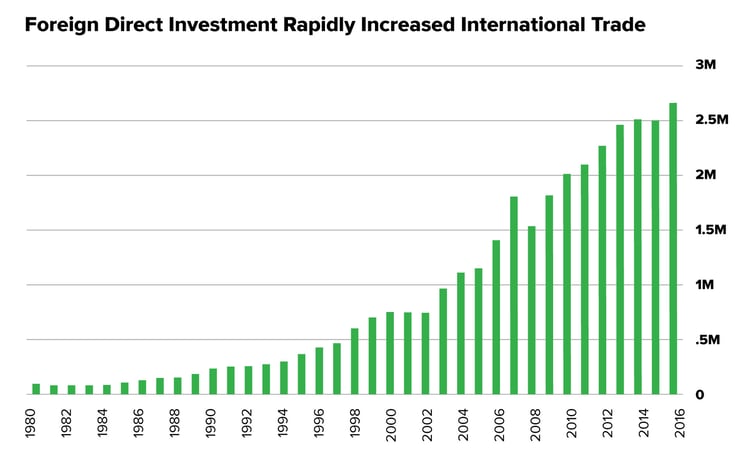

Globalization kicked into high gear between 1980 and 2010.2 Until then, most trade was between developed European nations and North America, with Japan jumping into the fray in the late 1970s. But starting in the early ‘80s, global trade took off as more countries reduced trade barriers and implemented domestic reforms so goods and services could move across borders. As a result, foreign companies entered those markets, rapidly increasing the speed of international trade.

Source: UNCTAD, 1980 through 2016

Source: UNCTAD, 1980 through 2016

What are the benefits of global trade?

Globalization has been a boon for many companies, even if it did introduce more competition in some areas. We see two main benefits.

First, as restrictions eased, goods, services, and capital could flow across borders. As such, a domestic company could outsource the production of goods or source inputs globally. This often allowed companies to more cheaply manufacture their goods or find lower-priced inputs that reduced their overall costs. So this access to cheaper labor and materials likely raised margins and profits.

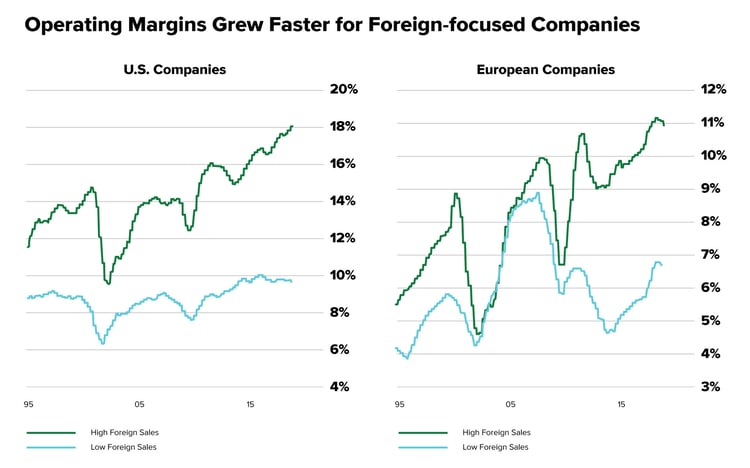

We see the benefit of a global presence on margins in the chart below. Operating margins (sales on the good or service minus the costs to produce that good or service) grew faster for companies with global sales (green line) than ones who had just domestic sales (blue line). In all likelihood, companies with a global presence, as indicated by a higher proportion of global sales, tapped into cheaper labor or inputs—globalization at work.

Source: Bridgewater Associates, Mar. 27, 2019

Source: Bridgewater Associates, Mar. 27, 2019

Second, it fostered specialization. Global trade opened the door for smaller niche or focused players to have a role in a part of the process rather than controlling the whole shebang.

Think about the assembly of a car. In the past, prominent automotive players produced all the components and parts that went into the car. Today, specialized players make various parts. For example, semiconductor companies manufacture multiple automotive chips. A different fabricator makes the components for the engine. Neither put the pieces together to make the car. Instead, they’ve carved out a space and taken the load off large automotive manufacturers without competing with them outright.

Plus, these specialized companies could deliver their chips or engine parts to every big car company—widening their market opportunity. Specialization allows them to develop more innovative products with highly skilled niche workers. Therefore, specialized markets tend to open the door for innovation.

A recent example of specialization is China. What did they specialize in? Manufacturing. China’s rise as the “world’s factory” was intentional. When it entered the World Trade Organization in 2001, its manufacturing prowess propelled the nation’s economic development and moved it beyond just making toys and footwear to producing electronics and other intellectually advanced, higher-end products.

How globalization benefits investors

The two benefits of globalization can reward investors. For example, profit growth can allow companies to reinvest in their businesses or make shareholder-friendly actions—like share buybacks or dividend payments—that can ultimately deliver strong returns.

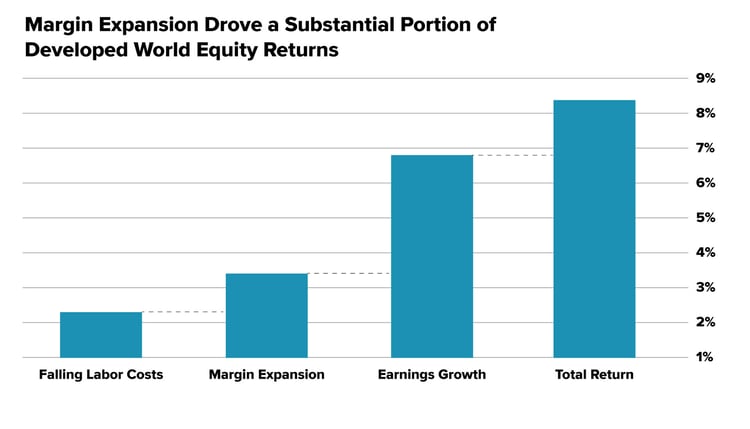

Similarly, higher earnings historically have driven up stock prices. Let's tie this together: From 1980 to 2013, global corporate after-tax profits grew 30% faster than global GDP.3 And estimates show that rising corporate profits have accounted for over half of developed world equity returns over the past 20 years.4

Source: Bridgewater Associates, Annualized 20-year data from 1995 through 2014. Published Mar. 27, 2019.

Source: Bridgewater Associates, Annualized 20-year data from 1995 through 2014. Published Mar. 27, 2019.

Specialization can also reward investors. For instance, they can invest in strong innovators who have the potential to deliver high growth. Sometimes companies specialize because they have a structural advantage, whether geographic or an outgrowth of a labor force characteristic. In these instances, specialized companies can operate at scale, thereby lowering costs and increasing profitability for all players across the value chain.

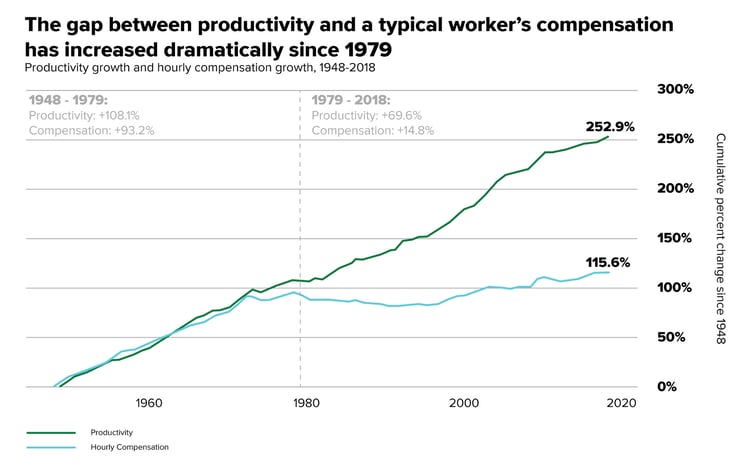

For example, production in the U.S. expanded by 69.6% between 1979–2018, in part aided by India and China's cheap labor.5 Contrastingly, the U.S. hourly wage only rose 14.8%—roughly one-fifth of the productivity gains.5 Thus, profit margins expanded. The difference in productivity gains and wage growth is a function of globalization.

Source: epi.org, Data from 1948 through 2020

Source: epi.org, Data from 1948 through 2020

What does de-globalization mean to companies’ bottom lines?

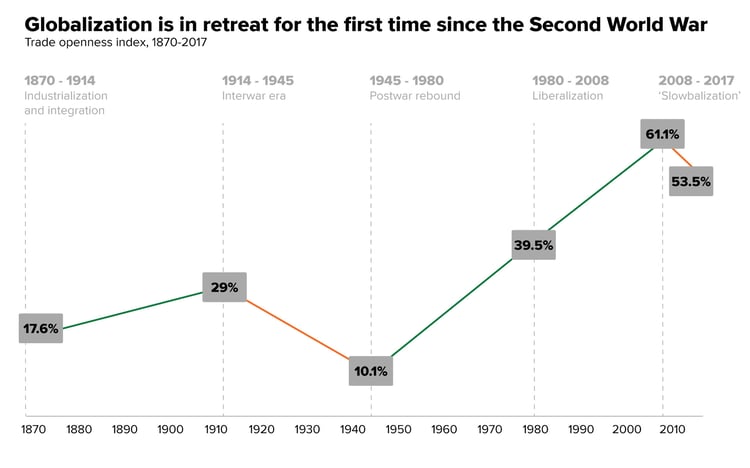

According to the World Bank, globalization has been retreating since 2008's Global Financial Crisis as the supply networks across countries stopped expanding.6 In concert, populism or nationalism has taken root in many countries.

For example, between November 2008 and November 2017, governments introduced 6,756 harmful measures, such as tariffs on imports or subsidies for domestic companies.5 Campaigns like "Make in India" and "Buy American," as well as the U.K.'s Brexit, are good examples.

As a result, global trade volume fell in 2019, despite the world's economic expansion. Even in China, the poster child for international trade, exports as a percent of GDP fell from 31% in 2008 to 17% in 2019 as it began focusing on strengthening state-owned enterprises.7

Source: PIIE, Apr. 23, 2020

Source: PIIE, Apr. 23, 2020

De-globalization can reverse the financial benefits global trade elevated. With a loss of foreign partners, input cost inflation is possible. It could coincide with input gathering friction (competing for raw materials) and structural inefficiencies. Some people believe this is part of the inflation problem we’re experiencing today. These can lead to falling margins as costs increase. As such, profits get crimped.

How to invest in a shifting economic regime?

We don't know whether global trade will continue to retreat or reverse course and grow again. Regardless, we believe that some companies are better positioned to navigate a changing landscape. For example, a company with pricing power should be able to pass higher costs to customers. The same should be valid for companies with loyal customers or other competitive advantages.

A typical example used when discussing globalization is the Apple iPhone.8 Many of its suppliers are China-based, so when there's a trade tiff or COVID lockdowns, the manufacturing of handsets may be slowed or cost more. However, despite the potential for higher costs, some investors believe that the iPhone is integral to every user's daily life. So if they have to pay more for it, most customers willingly do so.

Contrast that to a company whose product has many available substitutes and very little differentiation, so there's limited customer loyalty and little to no pricing power. This type of company may eventually get squeezed, its failure hastened by de-globalization. These examples highlight that while retreating globalization may change the economic landscape, we believe there are Quality companies that can win regardless of the shifting regime.

Like what you're reading?

Join the thousands of readers getting stories like this delivered straight to their inbox every Thursday — for free. Give it a spin, enter your email to sign up.

Footnotes

1Oxford Dictionary

2ecipe.org, Jan. 2018

3Bridgewater Associates: Peak Profit Margins? A Global Perspective, Mar. 27, 2019

4Bridgewater Associates: Peak Profit Margins? A Global Perspective, Mar. 27, 2019

5ecipe.org, Jan. 2018

6Wall Street Journal, Sept. 16, 2020

7PIIE, Apr. 23, 2020

8Certain of our personal portfolios may hold Apple Inc. (AAPL). The discussion of AAPL in this blog is not a recommendation or endorsement of this stock. Rather it is to describe Apple iPhone–a widely sold product–and its perceived relationship with its customers.

Related Articles

.jpg)

What Do We Take Away From Earnings Calls?

When the Securities and Exchange Commission (SEC) adopted Regulation Fair Disclosure (Reg FD) in...

How Does the Unionization Trend Impact Your Investments?

“[L]aymen and economists alike tend, in my view, to exaggerate greatly the extent to which labor...

Emerging Market Equities – An Undervalued Opportunity?

Many investors are underweight or not invested at all in emerging markets (EM) equities.1 This is...