Being good at what you do doesn’t mean you win all the time. Even the greatest quarterback of all time, Tom Brady, loses games! But having a bad game, or underperforming your peers, shouldn’t stop you from achieving your goals.

The same can be true in investment management. No one style of investing is always in fashion. Nor is one fund the best in its category every quarter. And even the strongest companies don’t always top the market each year.

Not win all the time

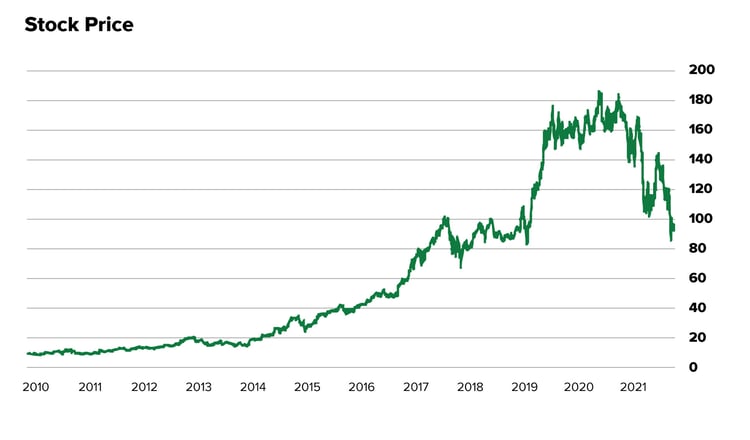

Take Amazon.com (AMZN), for example.* We looked at its daily stock performance from January 2011 through November 2022 and discovered several notable findings:

- 39% of the time, AMZN shares were 10% or more below their high

- 480 trading days—nearly two years of trading days—AMZN was 20% or more below its high

- Five out of the last 11 calendar years—or 45% of the time—AMZN underperformed the S&P 500 (and it’s very likely 2022 will be another year of underperformance)

In isolation, these stats may paint a picture of a poorly performing stock. But that is far from the truth. In fact, during this period, Amazon’s stock increased by roughly 970%, or at a compounded annual growth rate of 22%.1

Source: S&P Capital IQ

Source: S&P Capital IQ

Lessons to takeaway

We can glean a few lessons from this example.

First, underperformance can be both common and expected.

Second, sticking with a winning strategy, even during down periods, can potentially get rewarded in the end.

Third, weathering difficult periods can be easier with a long-term approach. Short-term-mindedness and allowing feelings to drive investment decisions may prompt some investors to sell at exactly the wrong time.

Think about it like this...

Could you imagine if Tom Brady gave up after being drafted in the sixth round and sitting as a backup for years? The trajectory of the New England Patriots may have looked completely different.

That’s why, for investors, it’s important to recognize that there can be fits and starts along the way. Things don't typically move in a straight line, but you can still get to your destination over time.

Like what you're reading?

Join the thousands of readers getting stories like this delivered straight to their inbox every Thursday — for free. Give it a spin, enter your email to sign up.

Footnotes

1S&P Capital IQ. Data from Dec. 31, 2010 through Nov. 30, 2022

*Certain of our Personal Portfolio strategies may hold Amazon. This message is not a recommendation to buy or sell any security (including, without limitation, Amazon) by Motley Fool Wealth Management. The security identified and described in this article does not necessarily represent the securities purchased or sold for our portfolios. You should not assume that an investment in this security was or will be profitable, and there is no assurance, as of the date of this message, that the security has been or will be in any model portfolio. Rather, the discussion is solely intended to describe the up and down movement of stock prices over time.

Related Articles

Quality vs. Growth: Is One Better For Your Long-Term Wealth?

Since the early 2000s, high-growth and quality stocks often seemed like one and the same. What...

.png)

Generational Wealth: How and When Should You Transfer Wealth to Your Heirs?

$80+ trillion.1 That’s the amount set to pass down over the next 20 years from older generations to...

Timing the Market Can Often Mean Missing the Best Days

Watching your portfolio decline is never fun. And when it happens day after day… the pain is...