Rising prices are scary for many people, especially for those on fixed budgets. But while the concern may be high costs today, should you worry about the impact on your long-term wealth? The answer may be rooted in your investor behavior. Let us explain.

Why the fuss?

Inflation is the rise in prices. Or stated another way—it's the loss of spending power. Inflation has several causes. We group them into two broad buckets for simplicity's sake: supply/demand imbalances and the amount of money in circulation.

Supply/demand imbalances cause inflation when there is high demand for little supply. Think of the hot toy—a Cabbage Patch Kid—during the holiday season. The demand for that Cabbage Patch Kid was sky-high during the peak shopping season, yet supply was limited. So, what did enterprising individuals or independent retailers do? They jacked up the price of their inventory, of course! While that's inflation, it's short-lived and particular to that toy.

More worrisome inflation has broader implications. Take the price of oil. When supply is limited, oil prices increase. Imbalances can arise when demand is high—during a colder-than-normal winter, for instance—or during a supply disruption—such as a hacker interrupting the east coast pipeline. This imbalance usually takes a while to correct. Hence, the inflation is less transitory than it was for a holiday toy. And because consumers are paying more for heating oil or gasoline, they have less to spend on other goods and services. Thus, energy inflation can cause a ripple effect on different parts of the economy.

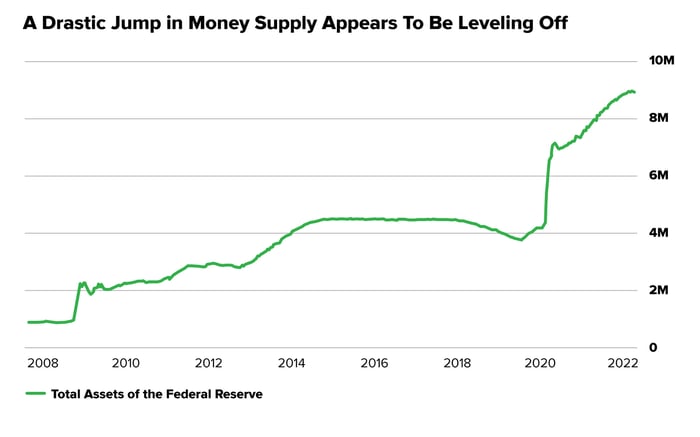

However, the price change of one good or service—like a hot toy or oil—does not indicate sustained inflation. To have a widespread, lasting impact, prices need to change for a basket of goods and services produced in the economy. That is directly influenced by the amount of money in circulation. For example, during the 2020 COVID pandemic and in the following years, the U.S. government offered stimulus packages and other measures to ease economic woes. As a result, the supply of money in circulation grew by the highest percentage since WWII.1

Source: federalreserve.gov. Data from Jun 30, 2007 through May 18, 2022. Total assets in millions of dollars.

When the money supply grows but the speed of money exchange and the output of goods and services do not, an increase in prices ensues.

How does the Federal Reserve view inflation?

How does the Federal Reserve view inflation?

The Federal Reserve (Fed) generally targets inflation around 2%, but it allows inflation to fall above or below the 2% mark to a certain extent. When inflation is significantly higher than 2%, a major way the Fed tries to bring it back down is to increase interest rates. (Higher rates tend to correlate with fewer loans, which restricts the speed at which money changes hands.) But if inflation is moderately above the target range, the Fed may let it remain there for a period. So, how can moderately higher inflation impact your wealth?

Inflation and your wealth

Higher inflation can increase the cost of living—everything from groceries to rents—which reduces the spending power of your money. To those individuals living off a fixed budget—like many in retirement—significantly higher prices are concerning.

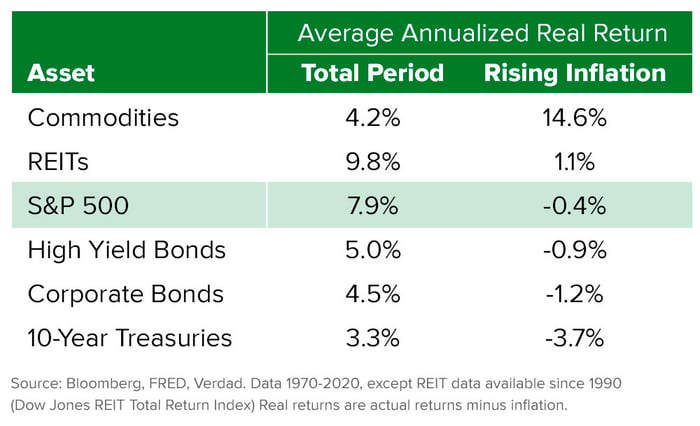

But inflation can be good for holders of assets whose values rise faster than inflation. Real assets—like real estate or commodities—are oft-cited examples (see the returns in the “Rising Inflation” column below). But over the long term (i.e., 50 years) —inflationary periods included—investors holding commodities fared worse than those holding stocks (see the returns in the “Total Period” column below). Bondholders were also not rewarded.

What’s best: stocks, bonds, or cash?

Bond investors receive two sources of return—a coupon and the principal at maturity. A coupon is a cash flow that happens in the future. So, when inflation—or the fear of future inflation—goes up, those future cash flows become worthless. That's because if the market believes that there is higher inflation on the horizon, bond yields will rise. Bond prices will fall to compensate for the loss of the purchasing power of future cash flows.

Stock investors get paid (assuming and when they sell) when a security's price rises above the price at which that investor originally purchased it. Stock prices tend to be a function of a company's profits. Rising inflation can cause earnings to decline if input costs increase or revenues decrease as consumers purchase fewer goods. If a company needs to borrow money, its borrowing costs may also be higher during inflationary periods. Some companies, though, can combat the effects of rising input costs by passing them along to consumers; they have pricing power. So, after the initial shock of inflation, Quality companies can often overcome the impact on their earnings.

But the level of inflation matters. Analysis of the S&P 500 reveals that real returns are greatest when inflation is between 2%-3%.2 While recently, inflation has run above that range, the Congressional Budget Office expects inflation will be 3.3 percent in 2023 and 2.4 percent in 2024.3

What about holding cash? The value of cash also decreases over time as inflation moves higher. That is because a dollar today can buy more than a dollar tomorrow if prices rise.

Don't be short-sighted

Inflation, when it is elevated, is not expected to remain there forever. So, buying an asset that does well only in inflationary environments often leaves investors worse off in the long run. Instead, investors who hold assets that perform well over the long term—in various conditions—can potentially navigate higher-price environments without sacrificing overall returns.

Stocks have historically been among the best at accomplishing that goal. So while it may be tempting to invest in perceived inflation-protection assets, over the long term, that choice may actually cause more harm to your wealth than weathering short-term inflationary blips.

Like what you're reading?

Join the thousands of readers getting stories like this delivered straight to their inbox every Thursday — for free. Give it a spin, enter your email to sign up.

Footnotes

1visualcapitalist, Apr. 7, 2022

2Calculations by Motley Fool Wealth Management for annual returns of the S&P 500 in relation to U.S. Consumer Price Index from 1957 through 2020

3cbo.gov, Feb. 2023

Related Articles

Should You Have Bonds in Your Investment Portfolio?

88%. That’s the percentage of return that comes from asset allocation for most investors.1 So it’s...

Are We in a Recession?

Many people fear a recession. And for good reason! A recession generally means the economy is...

Wealth Planning: Raising a Family

“The best inheritance a parent can give his children is a few minutes of his time each day.” —...