Investors are worried about the national debt, following trillions spent by the government on pandemic relief and new programs coming out of legislation, like the Inflation Reduction Act.1 Is the rising national debt a cause for concern?

We answer three questions on the top of investors' minds.

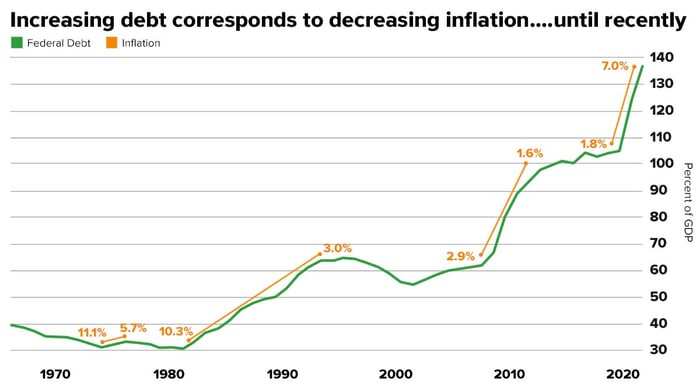

1. Does higher debt increase inflation?

Five decades of data show that rising debt as a percent of gross domestic product (GDP) has coincided with decreasing inflation.2

Source: OMB, St. Louis Fed. Inflation data sourced from Federal Reserve Bank of Minneapolis. Annual percent change of CPI indicates rate of inflation. Inflation in 1974 = 11.1% and 1976 = 5.7%. Inflation in 1981 = 10.0% and 1993 = 3.0%. Inflation in 2007 = 2.9% and 2014 = 1.6%. Inflation 2019 = 1.8%. Inflation 2021 = 7.0%.

But what about the recent spike in inflation over the past year, the worst level in 40 years? It's complicated, and there are many reasons for this rise in prices.

Inflation is coming from supply chain issues that still mare global trade, while increased spending from consumers, many of whom received some pandemic aid, is spurring higher prices, too. Energy and shortages of wheat and other commodities from the Russia/Ukraine war are other contributing factors. Lastly, another reason is labor shortages from reduced immigration and fewer workers returning post-pandemic. All-in-all, while government spending may be the cause of some inflation, the debt-to-GDP is not the driving force.

But high debt levels may lead to inflation if they cause the market to lose faith in the U.S. dollar, which would cause it to fall. A falling currency can increase imported goods' prices, raising inflation. Currently, though, the dollar is doing the opposite—it's at its strongest level in decades.

High debt loads, however, may adversely incentivize governments to curtail inflation. Unfortunately, it's often easier for elected officials to stomach inflation than be fiscally responsible.

2. Does rising debt choke economic growth?

Possibly. Nearly 70 years of data show that economic activity tends to be highest at a debt-to-GDP (debt/GDP) of 75% or lower. However, so does inflation. Conversely, debt/GDP above 105% corresponds to low economic growth and inflation. Another difference? Business investment tends to be meaningfully more significant with a lower debt/GDP.3

Despite these findings, the “why” remains a question: Does increasing government debt shut off the growth spigot, or does slowing growth spur higher government spending?

3. How will recent federal spending impact the future?

Unknown. According to Congressional Budget Office estimates, interest payments on the recent surge in government debt will grow faster than any other federal expenditure over the next 10 years.4 That makes sense—a surge in borrowing means interest payments will also swell. However, that is the growth rate of spending. The government will still lay out far more on social services.

Beyond higher interest payments, answering this question is not easy because of two unknowns. First, how will current spending impact the government's flexibility for future expenditures? Second, will borrowers demand higher yields because they view U.S. debt as riskier, increasing borrowing costs for the U.S. government?

Like what you're reading?

Join the thousands of readers getting stories like this delivered straight to their inbox every Thursday — for free. Give it a spin, enter your email to sign up.

Footnotes

2Charles Schwab, Bloomberg, as of Mar. 31, 2021

3Ned Davis Research

4Charles Schwab, CBO

Related Articles

How to Reduce Sequence of Returns Risk

It’s not unusual to have a year in which the overall market is down at least 10%. It’s not even...

Dynamic Spending in Retirement

You’ve probably heard of the 4% rule. It argues that, in order to make your retirement savings last...

3 Wealth Planning Tips for the Self-Employed

If you are considering going out on your own, or you’re already your own boss, you are part of a...