Technology has evolved virtually every aspect of our lives, so it makes sense that the way we trade and make decisions about our portfolios has evolved as well. In recent years, artificial intelligence (AI) has gone mainstream, and it plays a big role in how the market operates on a daily basis. But what sort of role does, or should, technology play in managing your own portfolio?

Let’s take a brief look at the role technology plays in the market, how AI is used today in trading, and what that all means for individual investors.

How technology changed the trading floor

The New York Stock Exchange (NYSE) is certainly one of the largest and well-known exchanges in the world. But do you know how it got its start?

In 1792, the NYSE rented a room on Wall Street (yes, this is how Wall Street got its famous start) and allowed brokers to meet twice a day to make trades, which were based on a list of 30 stocks and bonds.1

In the coming years, the number of securities on that list grew, as America itself grew too. By the late 1800s, the NYSE switched to a continuous market method, where stocks and bonds could be traded throughout the day on a large trading floor.

Things changed in 1971 when the Nasdaq Stock Market was created. Unlike the NYSE, the Nasdaq didn’t have a physical trading floor. Rather, it was developed using a network of computers that allowed brokers to make trades electronically. Not only did this make trading much more efficient, but it also reduced costs and enabled more widespread access to trades.2

In the decades following, the use of electronic trading grew more prevalent in the markets. Today, stocks are primarily traded electronically, though some trading floors (called “pits”) still exist today — including at the NYSE.

Technology’s impact on investing today

The internet enables financial professionals and investors to access market data in real time. Dozens of online trading platforms make it possible for anyone (professional or DIY-er) to open a brokerage account and buy or sell stocks and bonds right from their computer or smartphone.

Recent advancements in technology have virtually eliminated physical trading barriers, making it possible, for example, for an investor in California to instantly buy shares in a Dubai-based business. In that sense, technology has globally connected investors and markets, opening up the doors to a wider range of investment opportunities and asset types.

Here are a few other ways technology plays a role in the stock market today:

- Roboadvisors use AI-generated algorithms to analyze an investor’s data and deliver investment recommendations.

- Digital assets such as non-fungible tokens (NFTs) and cryptocurrency have become available for traders (though these markets remain unregulated and risky).

- Transparency and visibility have increased greatly since the days of physical trading on the floor, since market data is accessible online and in real-time.

What about AI?

More recently, the focus has shifted to artificial intelligence (AI), which powers a process called machine learning (ML).

Here’s a simple example of how machine learning works:

![]()

Envision two cups sitting in front of you, upside down. Now, imagine someone told you that underneath one of the two cups in front of you there was a $100 bill. You select the cup on the left, but there’s nothing. Next time, you select the cup on the right. No surprise, there’s the $100. You learned from your previous steps what not to do (choose the cup on the left), and instead made a decision that led to a more desirable outcome. That’s essentially what machine learning is trying to do — identify patterns in historical data and use algorithms (created by humans) to “learn” and make decisions.

![]()

High-frequency trading

“High-frequency trading” uses machine learning to analyze multiple markets and transaction orders, based on current market conditions. Keep in mind, this all happens in less than a second. While it sounds useful in theory, there are some notable drawbacks to high-frequency trading.

Namely, it provides a distinct advantage to large companies and institutional investors who have the resources necessary to accomplish high-frequency trading. Because trades move so instantaneously, they can create something called “ghost liquidity,” making it impossible for others to take advantage of the trades that are happening. In addition, the fast-paced trades can cause the market to artificially move one way or another for no particular reason.

Potential drawbacks of AI-driven investing

While technology has helped make investing more accessible to individual investors, there are a few drawbacks to managing your portfolio in such a digitally-driven environment.

It enables impulsivity.

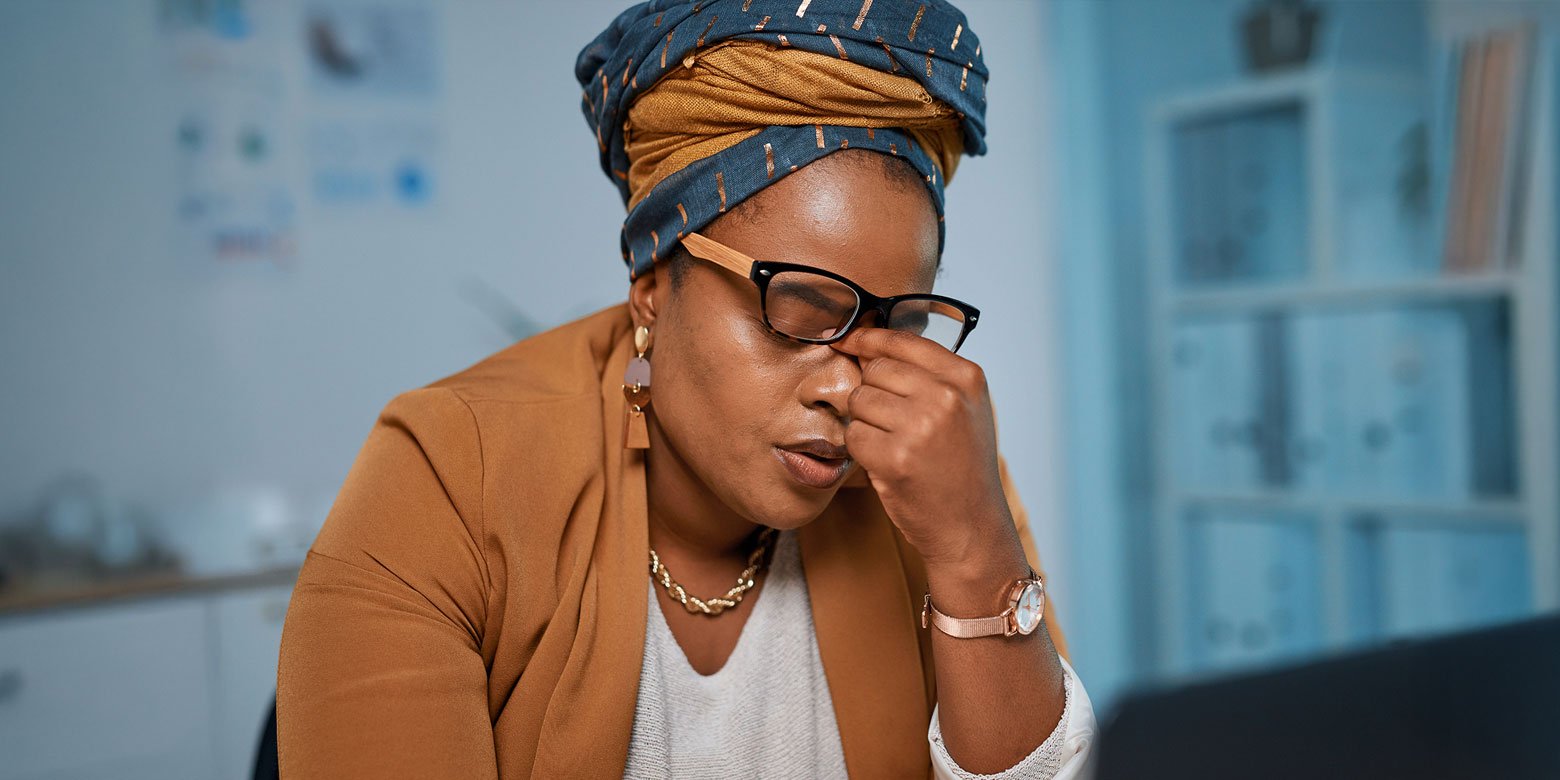

Having access to real-time investment data and market analysis can be a double-edged sword. Yes, you may be able to take advantage of a newly available investment opportunity, but it can also promote impulsive or emotionally-based decision-making.

We believe your investment strategy should reflect your long-term goals and needs, like funding your future retirement. Making sudden, off-the-cuff changes to your investments based on what’s happening right now is generally not conducive to that long-term strategy. In fact, making snap judgments based on short-term factors could even create lasting repercussions that may make it harder to achieve your future goals.

If you get stressed watching your portfolio’s value move up and down, having instant access to investment data can also be troublesome. Not only can it increase those feelings of stress and anxiety, but again, it may tempt you to make changes based on what’s happening now — as opposed to maintaining a long-term focus.

Humans still move the markets.

Despite all the technological advancements, humans still drive the market cycle with their reactions and emotions. While AI relies on formulas and data analysis to identify potential outcomes, ultimately it’s not a perfect predictor (and shouldn’t be treated as one).

Remember — AI uses historical market data to offer insights, but as we know, historical performance does not guarantee future results. All investing involves risk and may lose money. The market is volatile because humans are unpredictable and reactionary.

Can AI replace your advisor?

The short answer? No.

And here’s why we believe that.

While roboadvisors and other AI-driven tools look impressive at first glance, they tend to use general, formulaic assessments to build and monitor investments. Often, they’ll dilute you down to a few key data points (age, income level, expected retirement age, etc.) in order to deliver “personalized” recommendations.

By comparison, an advisor should take the time to really understand the person behind the portfolio. They know what keeps you up at night, what motivates you to build wealth, and how you envision your dream retirement. They are experienced industry professionals who are educated on how to align your portfolio to reflect your unique needs.

If you’re curious to see AI in action, you may feel comfortable playing around with AI-driven trading tools by using some discretionary funds (or “fun money”). But when it comes to your retirement and achieving other big life milestones? A wealth advisor can help you build a tailored, goal-focused portfolio and work with you to set every aspect of your financial life in alignment.

Like what you're reading?

Join the thousands of readers getting stories like this delivered straight to their inbox every Thursday — for free. Give it a spin, enter your email to sign up.

Footnotes

1 ”The History of NYSE” The New York Stock Exchange. Accessed April 5, 2024.

2 Mackintosh, Phil. ”Nasdaq: 50 Years of Market Innovation” Nasdaq. February 11, 2021. Accessed April 5, 2024.

Related Articles

How Has the Stock Market Performed During Recessions? You Might Be Surprised

A recession is loosely defined as a decline in economic activity and employment. There isn’t one...

How to Deal with Debt Stress

Debt is one of those four-letter words many consumers would rather avoid talking about altogether....

The 4 Stages of the Stock Market Cycle – And What Drives Them

People tend to view stock market trends linearly, meaning they look at a line that moves up and...