Everyone's looking for the sure thing. Investors are no different. Unfortunately, there are very few things in life that are sureties. (Well, maybe if you were a Buffalo Bills fan in the early 1990s, making it to the Super Bowl…and losing felt like it was written in stone!) However, life offers no guarantees, especially in investing. That’s why investors seek signs or signals that may point to positive stock returns.

Unfortunately, there are a crazy number of metrics investors can use to value a company and try to predict returns. For example, many use a market multiple—like price-to-earnings (P/E). Others may add growth to that measure to arrive at a price-to-earnings relative to earnings growth (PEG) ratio. Still, more investors may compare dividend yields or free cash flow yields. And the list goes on…and on.

Weeding through all the potential signals, we think one stands out as a robust driver of stock returns—profitability.

How do you measure profitability?

[WARNING❗: We’re going into a bit of accounting and financial analysis here!]

But which measure of profitability? There’s the bottom line, otherwise known as net income. There is also operating income and earnings before interest, taxes, depreciation, and amortization (EBITDA), and iterations on each. Some of the differences lie in the nuances of accounting rules, particularly around allowable non-cash deductions that fall on the income statement or give discretion to the company on what to include. Often these decisions or accounting adjustments can be “massaged” and distort true earnings, so many analysts "un-adjust" these adjustments. Messy? You bet.

Instead, some investors use a more straightforward metric, gross profit. Calculated as revenue minus expenses incurred by making the goods sold, it is a purer measure because it includes fewer adjustments or other costs that may lower income and are more at management’s discretion.

More importantly, historically, research has backed gross profits as a forecaster of stock returns. Data show that “more profitable companies today tend to be more profitable companies tomorrow. Although it gets reflected in their future stock prices, the market systematically underestimates this today, making their shares a relative bargain—diamonds in the rough.”1

Profitability is a robust measure. But we believe it doesn’t tell you how well a company uses its capital and resources to generate that income. So how do you know if a company is wasting resources and failing to generate adequate profits? In other words, if two companies have the same profits but one takes ten times more capital to generate that profit, should they be valued the same?

And that brings us to our second metric: Capital efficiency

Capital efficiency describes how effectively a company spends its money to operate and grow the business. Precisely, capital efficiency measures how much capital is put into the business (its investments) and how much profit it produces from that investment.

It's like when considering putting a pool in your backyard. Before giving the go-ahead, many homeowners ask: Will this pool make my house more valuable? (Or in investment speak: Will I get a return on that investment (via a higher selling price) when I sell my home?) If the pool lowers your home's value, it’s an inefficient use of money. But if it increases your home’s price, then that’s good. And if it increases it by at least the amount you spent to install the pool—and perhaps even more—that’s high capital efficiency. The result: The asset (pool) generates a return (higher selling price).

Of course, there are numerous ways to measure capital efficiency. Return on capital is a common one. Another variation is gross profit over assets (GPOA). And there are several more. Either way, by looking at the level of profitability relative to assets or capital, investors can get a sense of how well a company uses them to drive profits.

Why is it a strong signal?

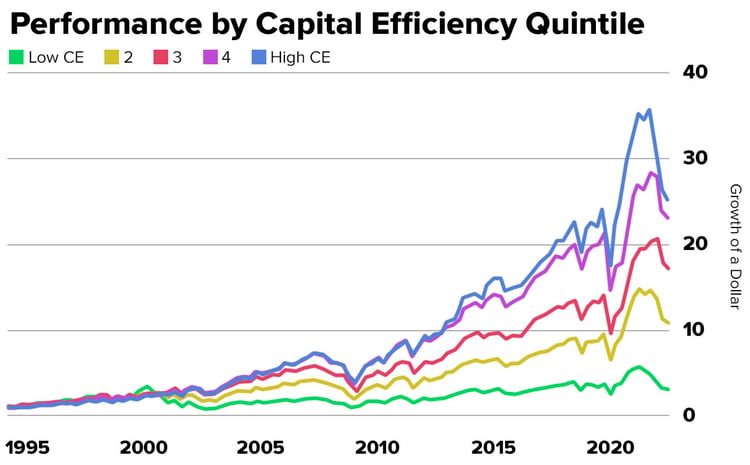

If you break it down, capital efficiency says even more. For example, if a company effectively uses its research and development (R&D) and marketing spend, capital efficiency tends to grow. Likewise, more stable companies can use financial leverage (debt) and return more to shareholders. So when capital efficiency is growing and stable, it tends to be a clearer signal of the health of a business. For example, three decades of data show that stocks with high levels and growth of capital efficiency outperformed by over 12% annually.2

This chart shows the growth of a dollar invested for five quintiles of companies segmented by level of capital efficiency. The highest capital-efficient quintile outperformed all others over the nearly 30-year period.

Source: S&P Capital IQ, Calculations by The Motley Fool, LLC. Chart shows the capital efficiency across ~3000 stocks each day. Capital efficiency is measured by the combined score of the level, growth, and inverse of volatility of GPOA. Data from March 1994 through March 2022.

Source: S&P Capital IQ, Calculations by The Motley Fool, LLC. Chart shows the capital efficiency across ~3000 stocks each day. Capital efficiency is measured by the combined score of the level, growth, and inverse of volatility of GPOA. Data from March 1994 through March 2022.

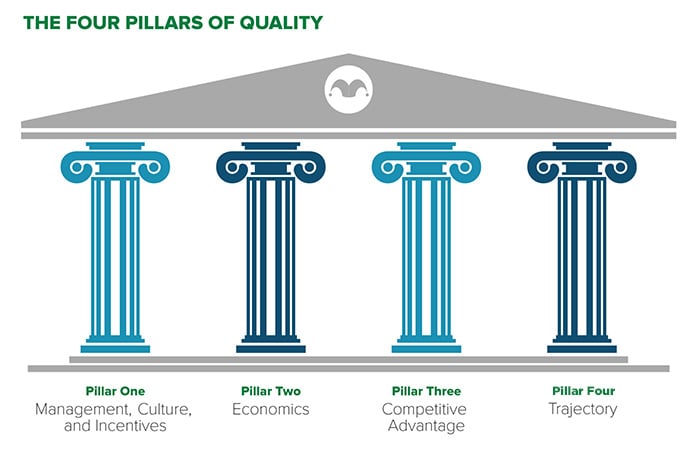

Capital efficiency is an integral component of our Four Pillars

Capital efficiency is not just lip service. In our four-pillared approach to analyzing companies, our investment team puts it to work in various ways. For example, strong marginal rates of return, especially in asset-light businesses, show up in our Economics pillar. And how companies use and reinvest their capital is part of our Management, Culture, &Incentives pillar. At the same time, high profit per dollar of asset may signal an undeniable Competitive Advantage, while growth in this metric (or anticipated future growth) is captured in Trajectory.

Capital efficiency as a sign of stock returns…even in today’s market

We believe companies with high capital efficiency generate stable profitability and growth over time. The reason? We feel capital efficiency is a robust signal of a company’s fundamental health—from how well the management team can execute its strategy and deliver competitive advantages to solid economics and the potential for a positive growth trajectory. Healthy companies, we believe, provide outsized long-term return potential. With that said, we recognize that in the short term, returns can be wonky and random. That’s why we believe a buy-and-hold strategy will allow the fundamentals, such as capital efficiency, to persevere through any short-term volatility.

This brings to mind the popular quote from Warren Buffett (who attributed it to Benjamin Graham), "In the short run, the market is a voting machine, but in the long run, it is a weighing machine." And the "weight" is determined by the value that a company creates, visible by metrics such as capital efficiency.

But in the recent market environment, investors were seeking the perceived safety of value stocks over growth stocks. So how does capital efficiency fit into this picture? Data show that “gross profitability factors generated value-like excess returns, even though they were growth strategies.”3

So growth and value…long and short term—capital efficiency appears to be a well-rounded, all-weather predictor of stock returns.

Like what you're reading?

Join the thousands of readers getting stories like this delivered straight to their inbox every Thursday — for free. Give it a spin, enter your email to sign up.

Footnotes

1sciencedirect.com, Jul. 2019

2spglobal.com, June 2018. Data from January 1988 – February 2018. Capital efficiency is measured by GPOA

3Novy-Marx, R., (2013) “The Other Side of Value: The Gross Profitability Premium” Jun. 2012

Related Articles

Is This Your Year to Try Tax-Loss Harvesting?

Nobody wants to pay more in taxes than they have to, so any time a tax-conscious investing strategy...

How Can You Pay Less Capital Gains Tax?

Do you feel you pay too much tax each year? It's (probably) a rhetorical question! We believe most...

Lump Sum vs. Regular Payouts—Which is Better?

A common folktale shares the story of a young girl who earns a favor from her village’s greedy...