You’ve spent your entire life building up your savings and preparing for retirement. Now that you’re a few years away, it may be time to shift your thinking. Smart retirement income planning could help you make the most of your savings, minimize your tax liability, and allow you to enjoy your newfound freedom.

A solid retirement income plan focuses on generating income, providing growth potential, and giving you enough flexibility to handle any changes that might come your way. The following three-step retirement income planning guide could help you position yourself to achieve these goals.

Step 1: Determine your retirement income needs

The first step is to determine your income needs. Estimate your expenses in retirement, keeping in mind that this may change as you become more comfortable with your new lifestyle.

When estimating your expenses, remember that some costs, like work clothes and gas for your daily commute, are likely to disappear while others, like the cost of new hobbies or healthcare, may increase.

Step 2: Examine your sources of retirement income

Once you know how much income you’ll need to generate each month, it’s time to examine potential income sources.

This includes fixed income from Social Security and a pension. You may also receive monies from other retirement accounts—like a 401(k) or an IRA—or investment assets outside your retirement accounts. Do you have real estate, annuities, or whole life insurance? They can generate income as well. Also, consider an inheritance or if you plan on working part-time in retirement.

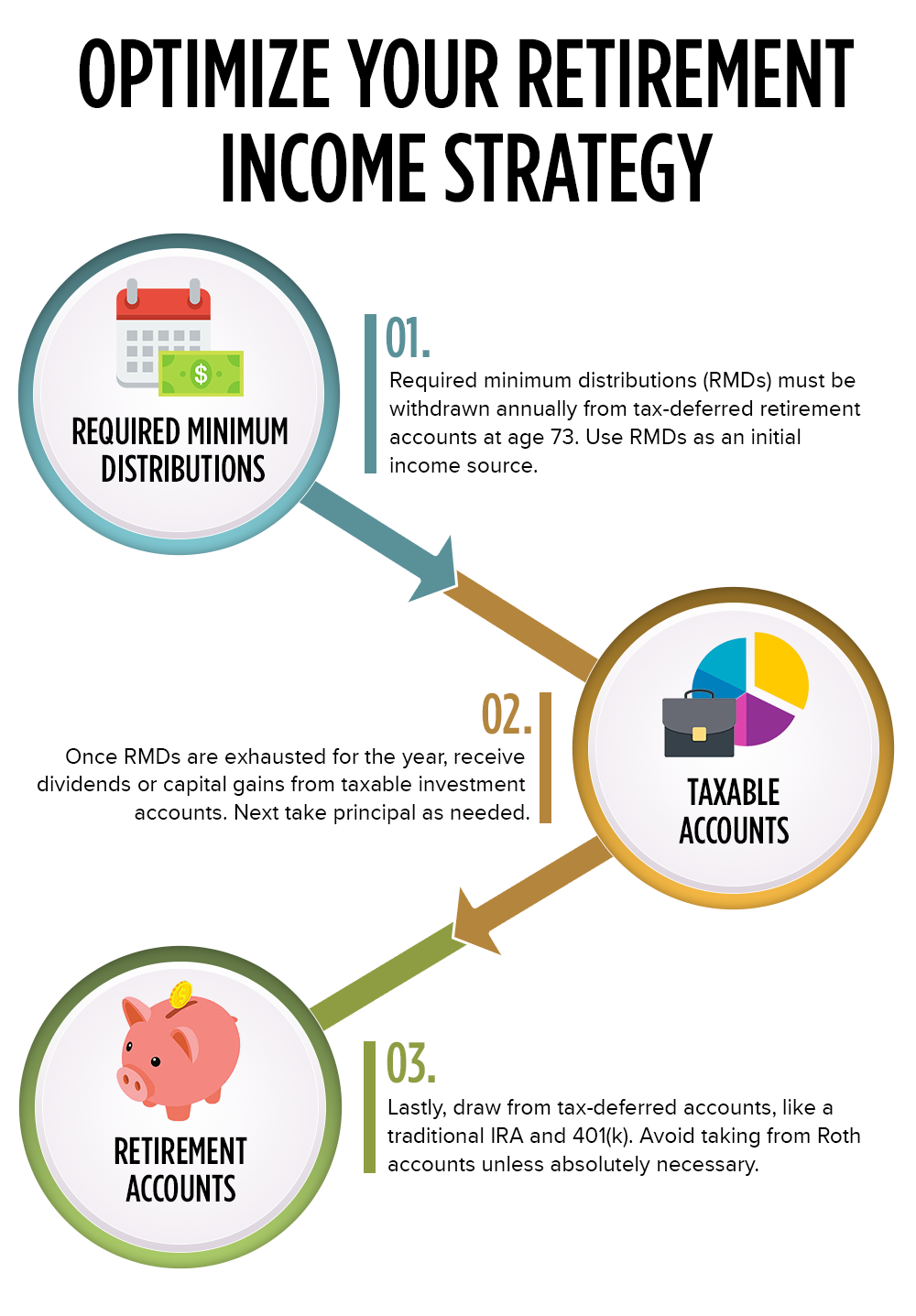

Step 3: Optimize your retirement income strategy

This is where your retirement income plan gets truly strategic, but it may be less complicated than you think. Most retirees have a gap between the income they can count on each month and their expenses. To make this up, create a strategy for taking withdrawals from investment accounts and other assets.

Determining an ideal withdrawal strategy will go a long way toward ensuring you can enjoy the retirement you envisioned without worrying about depleting your nest egg too fast. To do this, focus on an optimal, tax-efficient retirement withdrawal strategy with three main components.

Optimal withdrawal strategy for retirement income portfolios

- Required minimum distributions. When you reach 73 years old and have tax-deferred retirement accounts, you'll need to take withdrawals every year. The IRS determines this required minimum distribution (RMD) based on account balances and life expectancy.

Many retirees use their RMDs to supplement their income needs. However, if the funds are not needed, consider reinvesting them. Depositing the remaining funds into a taxable investment account will boost growth potential. Think about putting them in a Roth IRA so they can grow tax-free forever and be gifted to heirs. Another option is to donate them to charity, which may allow you to take a charitable tax deduction. - Taxable accounts. Once RMDs are exhausted for the year, turn your focus on tax-efficient withdrawal strategies to further bridge a retirement income gap. Begin by receiving dividends or capital gains rather than reinvesting them.

Next, take principal from taxable accounts as needed. Before touching any tax-advantaged retirement accounts, pulling from taxable investment accounts allows tax-deferred assets to grow for as long as possible.

If you don’t need to take withdrawals or you're bringing in income that exceeds your expenses, consider depositing Social Security income into a taxable account and investing it. This will allow for even more potential growth. - Retirement accounts. If you’ve depleted the assets in your taxable accounts and spent your RMDs, it’s time to look toward your retirement accounts. Begin with tax-deferred accounts, like IRAs and 401(k)s.

Avoid taking withdrawals from Roth IRAs and Roth 401(k)s unless it's absolutely necessary. Since these accounts do not have required minimum distributions, they'll retain many of their tax advantages even after being passed down to your heirs, making them a critical part of legacy planning.

Getting to retirement is only part of the battle

You may have spent your entire career as a solo investor. However, as you switch your focus to retirement income planning, now is the ideal time to seek professional advice.

Balancing the need for growth, income, and flexibility can be difficult, but partnering with a professional Wealth Advisor can help you rise to the challenge. Because the challenge is not only ensuring you have enough money to retire, it’s managing your nest egg with a focus on growth to last through your retirement years.

Like what you're reading?

Join the thousands of readers getting stories like this delivered straight to their inbox every Thursday — for free. Give it a spin, enter your email to sign up.

Related Articles

Practice Makes Perfect: Rehearsing Retirement

Practice makes perfect Athletes practice before they take the field. Actors and musicians rehearse...

.jpg)

Planning Your Retirement Income? 3 Things to Know

Will I have enough retirement income? This is one of the most common concerns people have. And so,...

Could an In-Service Distribution Be a Good Idea for You?

If you have a retirement plan at work — especially if you're at least 59 ½ years old — you may have...