Will I have enough retirement income?

This is one of the most common concerns people have. And so, if you’re like most people, you’ve likely asked yourself that question, too. And, by way of an answer, you’ve probably taken stock of the value of your investment and banking accounts.

Where do you stand?

That makes sense because how much you save and how you invest that savings not only play significant roles in financial security, they also seem to be among the few things you can control. Many other variables—such as Social Security, interest rates, and inflation—are determined by forces beyond your control.

With a bit of planning, you can marshal all your resources and hopefully improve your chances of living the retirement you want. Start with a financial inventory to know where you stand.

Then think about where you’d like to be—your dream retirement.

What does a fulfilling retirement look like to you?

It may sound surprising as the first question. Many individuals tackle the dollars and cents of retirement head-on but forget to define their ideal retirement. It should not be expressed in terms of a specific dollar amount in the bank or a targeted rate of return on your portfolio. Instead, your ideal retirement should be characterized by your goals and how your wealth can help you achieve them.

So, before we jump into things like the "4% withdrawal" rule of thumb or a potential shift to a more conservative asset allocation that you’ve likely read about, you must first determine what you’re going to spend money on in retirement.

What’s your playbook for the later stages of your life? As your working life winds down, you may be daydreaming about your retirement days. Do you picture yourself traveling the world or creating an award-winning flower garden? Are you setting sail on the boat you’ve dreamed about or packing a lunch to take to the beach with your grandkids? Or now that you’re in retirement, has your vision of the decades to come changed?

We believe the confluence of essential relationships, core pursuits, and health—your “Prosperity Trifecta”—should drive how you live your retirement and how much money you need. Knitting these elements together will design your investment strategy for the short and long term and inform which sources of income you should access and when.

Where do you spend your money?

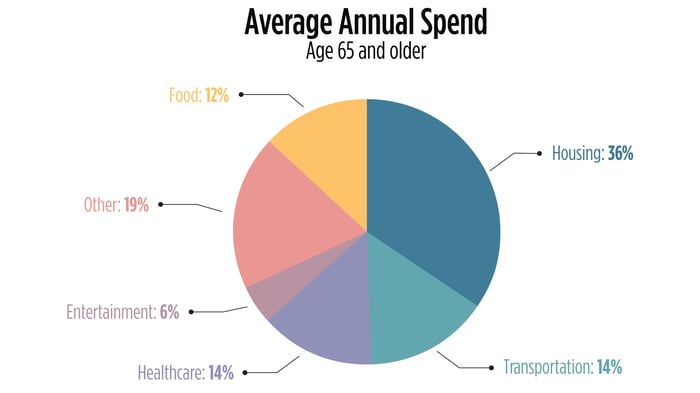

Before we talk about your income in retirement, it’s important to know where your money goes. Each individual spends money differently; it depends on what’s personally meaningful. Despite small proclivities, overall housing, transportation, and healthcare make up the majority—nearly 64%—of annual spending.

Source: BLS, 2021 Survey

Source: BLS, 2021 Survey

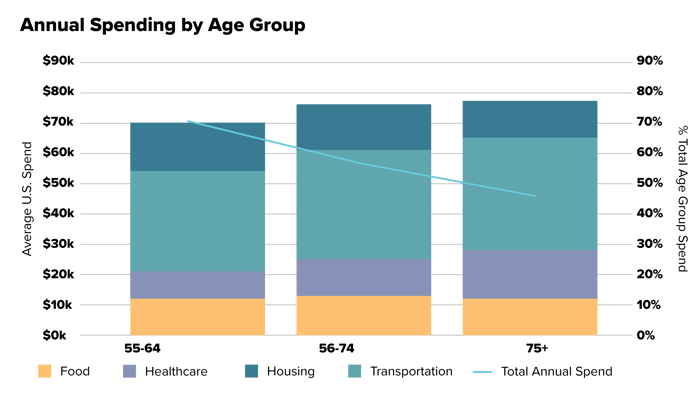

Most individuals spend less as they progress through retirement. Data show that of the total U.S. expenditures, Americans aged 45-54 spend the most. As they reach age 64, expenses decline slightly, but by 75 years old, spending is nearly one-third of what it was just 10 years prior. Even as overall costs fall, spending on certain categories shifts with age.

At ages 55-64, Americans spend roughly 35% more than those over the age of 65. Housing is the largest expense, while health care is just 26% of housing costs. But as individuals age, healthcare grows to 42% of housing costs.

Source: BLS, 2021 Survey

Source: BLS, 2021 Survey

Your retirement paycheck

Talk to any given circle of retirees, and you'll find that their retirement plans and activities are as varied as they are. You may retire at an older or younger age than your friends. Your sister may leave her corporate job and decide to work part-time at a dance studio to stay busy and satiate her love of dance! Your brother may call it quits and hit the links every day. And you may take art classes to fulfill your lifelong desire to learn how to paint watercolors. Whatever your retirement looks like, your retirement paycheck needs to satisfy your core living expenses and fuel your desired experiences.

Like what you're reading?

Join the thousands of readers getting stories like this delivered straight to their inbox every Thursday — for free. Give it a spin, enter your email to sign up.

Related Articles

3 Keys to Effective Retirement Income Planning

You’ve spent your entire life building up your savings and preparing for retirement. Now that...

Practice Makes Perfect: Rehearsing Retirement

Practice makes perfect Athletes practice before they take the field. Actors and musicians rehearse...

2 Layers of a Sustainable Retirement Investment Strategy

What does your pie-in-the-sky retirement look like? For some, it’s buying an RV and traveling the...

.jpg)