What does your pie-in-the-sky retirement look like?

For some, it’s buying an RV and traveling the country. Others may look forward to leaving the corner office to spend time with their grandchildren or pursue a life-long passion. Whatever retirement looks like to you, many individuals don’t grant themselves permission to dream big until they feel financially secure. This two-layer retirement investment strategy can set you on the path to reaching your dreams.

How to start retirement planning for the short and long term.

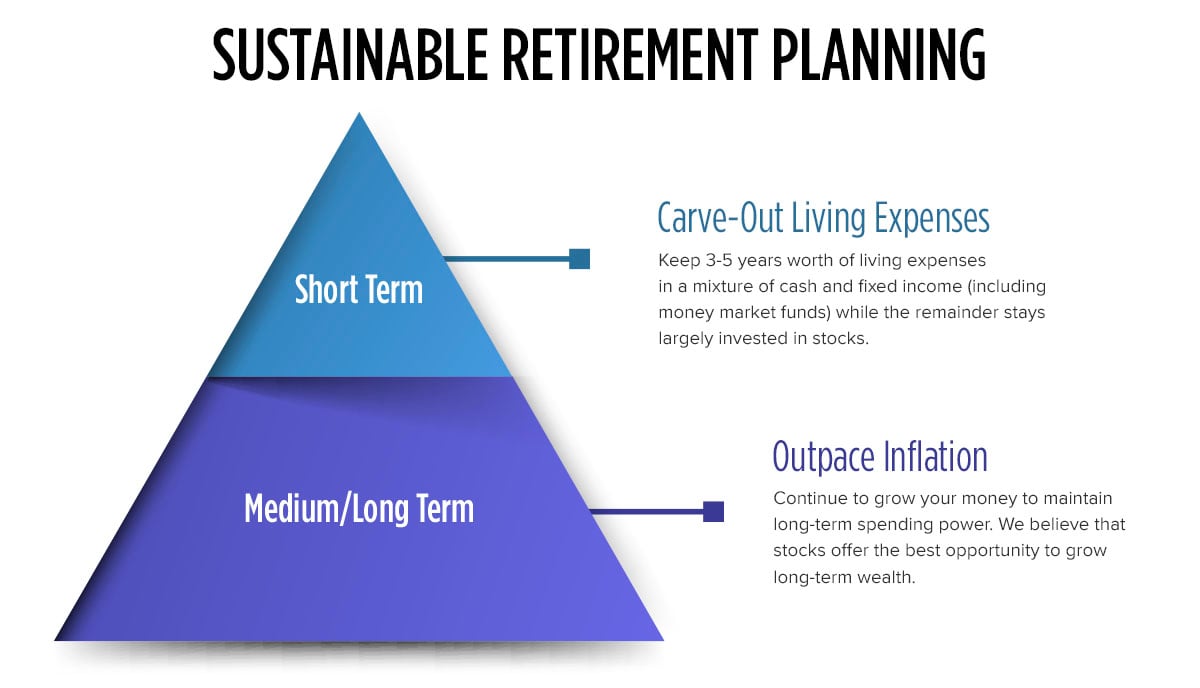

Your goal is to identify what you need, at the right time, so you are not a victim to the market, and so your long-term savings can continue to grow. We believe there are two layers to a sustainable financial strategy—this is true regardless of the amount of money you have or the retirement you want.

The first layer is a retirement planning strategy for short-term needs.

You can develop a retirement investment strategy to help you rest easy even during the most volatile times. Dubbed the “cash carve-out strategy,” this retirement planning strategy will have you put three to five years' worth of living expenses in a mixture of cash and fixed income (including money market funds) while keeping the remainder largely invested in stocks. There are two benefits of this strategy:

- Weather volatility: By holding at least three years' worth of living expenses in cash or fixed-income investments, short-term market volatility should have little effect on your lifestyle choices. This reduces the chances of wanting to sell based on short-term fear.

- Flexibility: Extra cash gives you options: you can pause your conversion to cash for a few years to avoid selling at market bottoms, or even get aggressive and reinvest some of that cash at lower valuations in pursuit of additional gains as the market recovers over time.

The amount you need to set aside in cash may feel daunting. But keep in mind all of your retirement cash flows—like Social Security, pensions, rental properties, or other sources of retirement income—when calculating your cash carve-out.

Calculating Your Cash Carve-Out

- Take your current level of annual spending right now

- Subtract any expenses that will cease—like savings contributions or commuting to work—once you retire

- Add in any additional spending outside of your core expenses—like travel or buying a beach house

- Once you have that number, multiply it by as little as three—or as many as five—and you have the amount you'd keep in a cash carve-out

The second layer emphasizes the importance of retirement planning for the medium to long term.

Once you’ve set aside your cash and fixed income for the next few years, the rest of your money needs to keep growing, ideally outpacing inflation along the way. The key here is that you can rest easy knowing different accounts can serve different purposes. Because of the conservative nature of the cash carve-out retirement investment strategy, you can continue being aggressive with other parts of your portfolio to potentially build additional wealth.

A common misconception among retirees or near-retirees, in our view, is that your days of stock investing should end around the same time as your working career. But we hold to the thesis that stock investing offers superior returns over the long term (despite volatility over short periods). So, why sacrifice years or even decades of potential growth?

Retirement is a journey.

Many folks’ retirements can span two, three, or even more decades. By implementing a retirement investment strategy and carving out the cash you’ll need for your short-term needs, you give the remainder of your money the opportunity to continue growing.

How to start retirement planning by investing those long-term funds specifically is up to your discretion. And how aggressively your portfolio is positioned depends on your own specific goals, needs, and appetite for risk. But we believe stocks—whether large, mid, or small, dividend, or aggressive growth—can continue to play an important role in almost any portfolio long after you retire, and have the potential to improve the quality of your retirement over time.

Related tags

Financial Planning Social Security Retirement Asset Allocation Earning Years Retirement Red Zone

Like what you're reading?

Join the thousands of readers getting stories like this delivered straight to their inbox every Thursday — for free. Give it a spin, enter your email to sign up.

Related Articles

3 Keys to Effective Retirement Income Planning

You’ve spent your entire life building up your savings and preparing for retirement. Now that...

Practice Makes Perfect: Rehearsing Retirement

Practice makes perfect Athletes practice before they take the field. Actors and musicians rehearse...

.jpg)

Planning Your Retirement Income? 3 Things to Know

Will I have enough retirement income? This is one of the most common concerns people have. And so,...