Everyone is at a different stage in his/her life. But for those nearing the end of their working years, transitioning from employment to retirement is often challenging. Although financial independence or retirement is “The Goal”—we look forward to it; we celebrate it—the reality is that it can be a difficult change.

Our personal identity is often wrapped into our professional identity. What we do can become a big part of how we see ourselves. We build communities in the groups we work in and tend to spend large chunks of our lives becoming experts in our field. Leaving that behind for a week full of Saturdays can be scary in its own right. And the financial shift can be just as daunting.

A shifting mindset

You’ve likely spent most of your professional life building a nest egg. But after the final paycheck gets cashed, your investing goals should shift to accommodate your new reality. You probably no longer have one singular goal of building a nest egg, but now two.

Goal 1: Protect the money you need in the short term from the volatility of the market.

Goal 2: Continue to grow your long-term wealth so that inflation doesn’t erode your buying power.

The question is how do you best protect from volatility and grow long-term wealth?

Invest to grow wealth

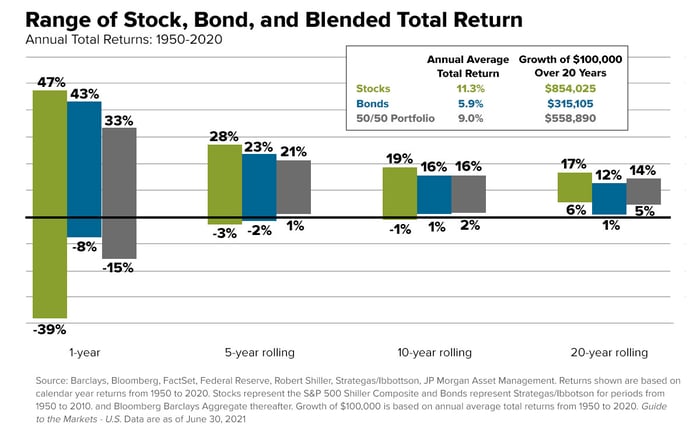

Many individuals invest primarily in stocks and bonds when they aim to accumulate wealth. But historically, these two asset classes have delivered vastly different returns and risk levels.

Over long periods of time, stocks have performed better than bonds. For example, the U.S. stock market has gone up in 31 out of the last 41 years. But they’re also more volatile. In any single year, the U.S. stock market can swing from being up 30% or more to down nearly 50%.

Are you able, and willing, to withstand the potential whiplash of the stock market?

Thinking back to how you reacted during the volatility of 2020 can offer valuable insight. The level of angst (or lack thereof), the type of worry, and the actions you took are worth noting, and depending on them, could warrant an adjustment to how you have allocated your assets.

Because how you react matters. During market downturns, you want to avoid pulling from your portfolio while stocks are in a meaningful drawdown. So, having a safe pool of funds (whether it be cash, money market mutual funds, or relatively lower risk bonds)—that aren’t as affected when stocks decline—allows you the time to wait out a bad market and ideally not have to sell a stock you love at a price you hate.

Freedom to reach for your goals

By protecting your short-term needs, you’ll have the freedom to be a long-term-minded investor with the rest of your portfolio. Sudden drops may be less jarring. And you can keep the desired amount of funds allocated towards assets that you believe will lead to better returns (within your risk tolerance, of course).

Like what you're reading?

Join the thousands of readers getting stories like this delivered straight to their inbox every Thursday — for free. Give it a spin, enter your email to sign up.

Related Articles

How Do I Know I’ll Have Enough in Retirement?

For most Americans, the greatest question plaguing their journey toward retirement is, “Will I have...

Could Your Health Savings Account Boost Your Retirement Readiness?

A health savings account, or HSA, is a specialized type of account designed to help people with...

How Safe is My Money? 3 Questions to Ask Your Advisor

Do you worry that your money is not safe when you hire a Wealth Advisor? A colleague’s story...