Have you been dreaming about the day you'll hand over the keys to your office and say "Sayonara" to your working life? Before you embark upon your retirement, make sure you've positioned yourself and your family for success.

For years, you've hopefully been saving and growing your assets for this moment. But now that retirement is around the corner, should you potentially revise your strategy to help better ensure you have enough money to live out your days as you wish? Retired life will likely differ vastly from today; how you spend your time and money will change. So to be confident that you have enough money to live and meet your long-term goals, you may wish to analyze your retirement investment options and your money's distribution. Here's a closer look at some of the factors to consider when choosing your ideal retirement asset allocation.

Understanding asset allocation

In simple terms, asset allocation is the percentage of each asset class in your portfolio. There are many subcategories of assets. The three primary are stocks, bonds, and cash. Some individuals also use "alternative” strategies (such as hedge equity or “long-short” strategies) and private fund investments (e.g., private equity or venture capital) to round out their portfolio if they have the appropriate level of assets and financial sophistication.

Historically, stocks have had the highest returns but also the greatest amount of risk. So while they generally offer the most growth potential, they may also lead to significant losses. Bonds are usually less volatile than stocks but typically deliver more modest returns. Cash and cash-like strategies (like money market funds) are considered the safest investment. However, they yield meager returns.

The trade-off between returns and risk is critical. Because if returns don't keep up with inflation—despite the consistency of those returns—you run the risk of losing buying power.

Asset allocation allows investors to "balance out" their portfolios' potential risks and returns. For example, market conditions that create poor or average returns in one asset class may boost others. Therefore, properly diversifying your portfolio may lower the volatility of your investment returns without sacrificing potential gain. While this is important for all investors, it is even more crucial when investors don't have the time horizon or earnings to offset significant portfolio losses.

Do you need to change your allocation as retirement nears?

As you prepare for life without a paycheck, you don't necessarily need to change your portfolio. You should review your allocations relative to your retirement goals and your unique needs.

For example, you may have dual goals of funding your retirement income and leaving a legacy for your heirs or a favorite charity. How do you want to structure your gifts? Some retirees wish to leave a lump sum, while others want to provide ongoing support via a trust or an endowment fund. You may also have shorter-term goals to fund, like taking your dream vacation or purchasing a second home.

Each of these goals would create different investment time horizons and may require additional adjustments to your asset allocation in retirement. Therefore, your plan should set aside separate buckets of money. Each bucket would use a different asset allocation designed to meet your short-term and long-term goals.

Risk tolerance: conservative vs. growth

When considering the best asset allocation, it's essential to factor in your risk tolerance and risk capacity. Risk tolerance refers to how much potential downside you can take before constant worry keeps you up at night. On the other hand, risk capacity is your ability to afford potential losses.

It's important to consider both. If the risk of loss causes constant anxiety, then it's not your proper asset allocation. Likewise, if a significant market downturn could result in a devastating loss, it's time to adjust.

The goal is to balance a conservative asset allocation with one that positions you for continued growth.

Map out the best retirement asset allocation for you

There are a variety of retirement asset allocation models, but traditionally, many investors used the "100 minus age" rule of thumb. It states that subtracting your age from 100 will tell you the percentage of stocks your investment portfolio should hold. For example, an investment portfolio for a 70-year-old would contain 30% stocks and 70% bonds.

However, we believe that this approach is flawed: Most Americans live longer than they had in the past, so they need the extra growth that stocks can offer. For this reason, many financial professionals recommend subtracting your age from 110 or 120 instead of 100. This formula will give you a general idea of your recommended portfolio allocation, but it's overly simplified.

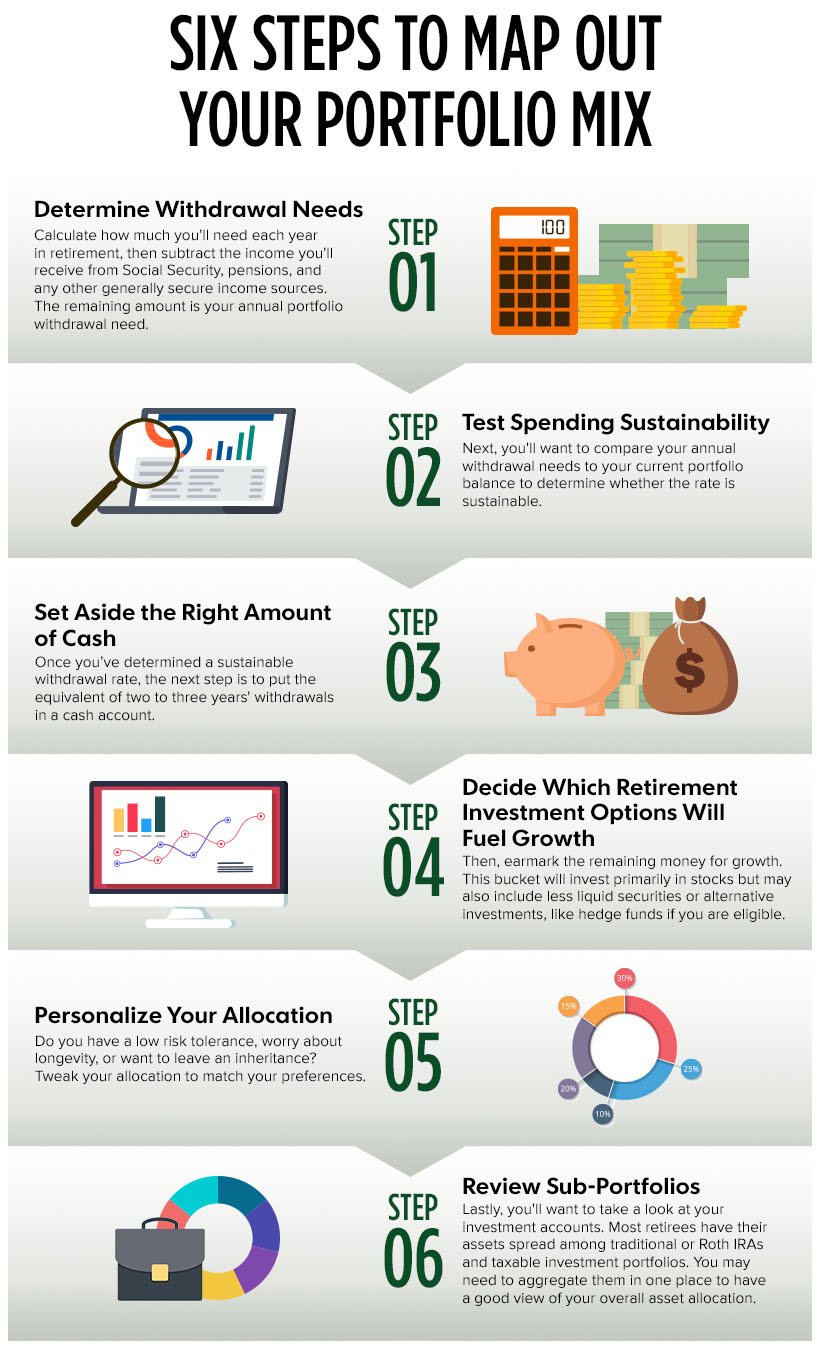

You'll need to take a deeper dive to get an accurate idea of your optimal asset mix. The following six steps could help you get started.

Finding your asset allocation for retirement

- Determine withdrawal needs. As you prepare for your retirement, you'll want to get a solid grasp of your spending. Some rely on the 80% rule, meaning retirees plan to spend approximately 80% of their income earned while working. However, this scratches the surface just like the "100 minus age" rule.

For example, you may have some more considerable healthcare expenses as you age. Downsizing, moving, planned vacations, and other factors may also impact your spending.

Once you grasp how much you'll need each year, subtract the income you'll receive from Social Security, pensions, and any other generally secure income sources. The remaining amount is your annual portfolio withdrawal need. - Test spending sustainability. Next, you'll want to consider comparing your annual withdrawal needs to your current portfolio balance to determine whether the rate is sustainable. In the past, retirees assumed they could withdraw 4% of their portfolio each year and remain comfortable.

If you determine your spending rate is too high, you may potentially need to re-evaluate some of your decisions. In this case, it's an excellent time to seek professional financial advice. - Set aside the right amount of cash. Suppose you've determined that your planned withdrawal rate is sustainable. In that case, the next thing you'll want to do is consider putting the equivalent of three to five years of withdrawals in a cash account. While it won't earn much income, doing so will help ensure you don't have to change your plans immediately if the markets don't cooperate or an unforeseen expense pops up.

- Decide which retirement investment options will fuel growth. Then, earmark the remaining money for growth. If you are eligible, this bucket will invest primarily in stocks but may also include less liquid securities or alternative investments, like hedge funds.

Within stocks, strategies fall along a spectrum of risk—from those focusing on income-generating, low-growth companies to those targeting high-growth companies. So, the most favorable allocation may consist of various stock strategies combined with other asset classes to drive overall portfolio growth. - Personalize your allocation. While the first four steps will give you a general idea of your asset allocation, it's also important to consider your circumstances. For example, suppose you have a low-risk tolerance. In that case, it may make sense to allocate a lesser portion of your portfolio toward stocks. While creating a more conservative allocation may necessitate lower spending in retirement, you may find that the peace of mind is well worth it.

On the other hand, if you're worried about longevity or want to leave an inheritance for your children, you may want to invest a bit more aggressively to extend the life of your portfolio. - Review sub-portfolios. Lastly, you'll want to take a look at your investment accounts. Most retirees have their assets spread among traditional or Roth IRAs and taxable investment portfolios. You may need to aggregate them in one place to have a good view of your overall asset allocation. You don't want to be surprised by overly aggressive or conservative strategies that shift your intended allocation!

Additionally, each type of account has distinct tax implications and withdrawal rules. These differences may influence when you decide to take assets and from which account. For example, it may make sense to withdraw from some early on while others should grow as long as possible. As a result, your asset allocation for each may tilt slightly more aggressive or conservative depending on the withdrawal vs. growth decision.

Build flexibility into your retirement asset allocation

These six steps offer a potential roadmap for readying your portfolio for your retirement needs. But as is the case with life in general, anticipated circumstances may shift as retirement draws closer or while you live out that chapter of your life. Your allocation will likely need to adjust, too. That's why it's crucial to build flexibility. You or a professional advisor should review your plan regularly because you've worked hard to get to this point; don't let a surprise catch you off guard!

Like what you're reading?

Join the thousands of readers getting stories like this delivered straight to their inbox every Thursday — for free. Give it a spin, enter your email to sign up.

Related Articles

Supersize Your 401(k) Catch-Up Contributions in 2025

As pensions have all but gone by the wayside in corporate America, defined contribution plans like...

Wealth Planning for Empty Nesters

Wow, it’s been a couple of decades in the making. You've cuddled, fed, rough-housed, counseled,...

2 Layers of a Sustainable Retirement Investment Strategy

What does your pie-in-the-sky retirement look like? For some, it’s buying an RV and traveling the...