What does “real wealth” mean to you?

Many people automatically answer with a dollar sum—a million dollars—or ownership of an asset—a luxury yacht or a vacation home. Others have a vaguer definition: Wealth means having “more.”

But what does “more” mean? It may be an accumulation of assets or an abundance of time to spend doing something they love.

People don’t always contemplate the answer to this deeply. But when individuals consciously think about their own wealth, they realize it can go beyond the amount in a bank account or the number of possessions they own. Instead, many discover that the intention behind having wealth is about fulfilling a mission—achieving a goal or objective. It's about comparing the life you're currently living to the one you really want.

It all starts with a family wealth plan

Uncovering your most important aspirations in life can actually be a critical part of the wealth planning process. It’s something we discuss frequently with new and existing clients in order to create investment plans we think can be better suited to help potentially bring those aspirations to life.

It's also not just for those with a six-figure bank account or individuals nearing retirement. Nor is it just for the older generations. Families—with members of all ages—should get together and draw up a wealth plan together. And there’s no better time than during the holiday season to start.

Eat and meet

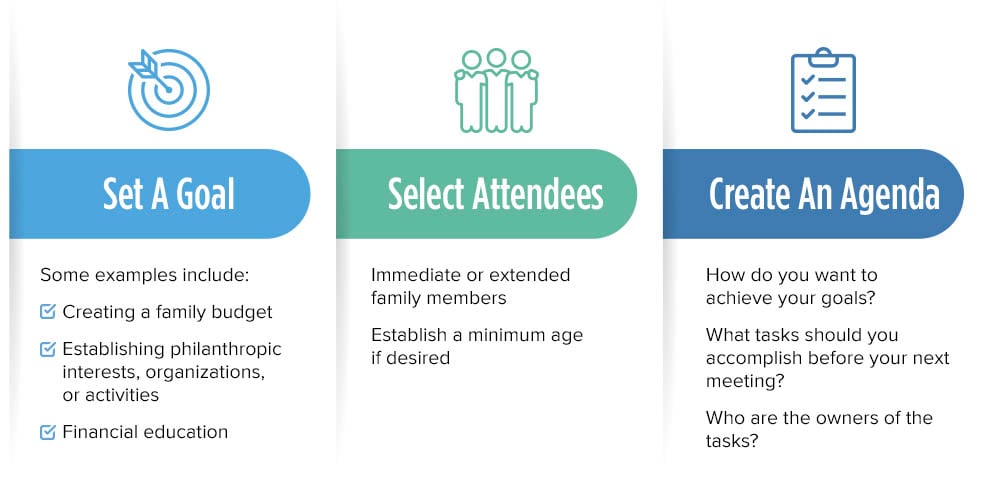

Devising a wealth plan as a family should start with a family meeting.

We know, a family meeting might sound a little awkward or intense. And for some, it probably is. That's why planning a time to chat during the holiday season is a good idea. Not only does it solve the logistics of getting everyone in the same place, but holidays hold a certain sense of joy that may ease tensions that often arise when discussing finances and other uncomfortable topics.

Plus, you can lure your loved ones with the promise of a delicious family meal!

Once everyone is gathered around, you can dive in.

How do you get started? These questions can serve as a guide.

What is the goal of your time together?

Gathering everyone together is an opportunity to accomplish many tasks. For example, do you want to spend your time together learning, like going through your family's budget? Or do you want to look at long-range financial strategies, such as switching control of accounts or the family business? Maybe you'd like to use this opportunity to coalesce around a particular activity, such as volunteering opportunities? Below are three impactful goals you could consider for your family meeting that we hear often from our clients:

- Financial literacy: Some individuals are interested in ensuring their children understand money and financial decisions.

- Wealth transfer and legacy: Are your heirs prepared to take the reins of family wealth? Some families may not feel comfortable disclosing their assets or transfer plans, but it's vital to prepare the next generation for running a family business or being good stewards of an inheritance.

- Charitable giving and philanthropy: What important causes do you want to support? Support can come in the form of a donation, but it can also be about giving time through volunteerism or voice through petitioning or activism.

Who should participate?

Family gatherings can be limited to immediate members or extended ones. You may also elect to have a minimum age—say high school or older. Or you may feel it’s important to start young and have everyone involved, even if they still struggle to pronounce the word “fiduciary.”

When it comes to working with our clients, we don’t believe “just trust us” is good policy. That’s why we strive to deliver strategies that can make sense to our clients, explain the decisions we make within their investment portfolio clearly, and help them rest easier in their financial circumstances. You should consider taking the same approach with your family members, even those who may not have a natural interest in finances.

What are the most important discussion topics?

Once you reach an agreement on attendance and the overall goal of your meeting, it’s time to set an agenda.

For example, if it's around a day like today—Thanksgiving—you could parlay the discussion of giving thanks to giving back. You may decide to use this family meeting as a discussion around philanthropy. Every member can have a voice on what matters to them and how they’d like to help.

Discovering your “why” will go a long way to implementing the “how”

If this is your first family huddle, it's also an opportune time to identify your family's mission, vision, and values. In other words, your "why."

Start by identifying each member's values and goals. For instance, you may value happiness while your spouse values job success. Your daughter may feel strongly about social justice. At the same time, helping animals is your son's passion.

After articulating values, focus on how to achieve them. Alongside values and goals, your family should consider your desired lifestyle. How do you want to live? Is creating generational wealth a focus, or would you instead gift surplus wealth to charity?

The answers to these questions can have major impacts on how you invest and how you allocate your assets. You may want to stash what you’ve saved in the relative safety of a conservative asset allocation. Or, if you have a longer timeline—perhaps one that even extends beyond your lifetime—you may opt for a more aggressive growth strategy.

There’s no one-size-fits-all answer, but knowing what mission you’ve set out to accomplish can help guide your family’s financial strategy, even if you pivot along the way.

Like what you're reading?

Join the thousands of readers getting stories like this delivered straight to their inbox every Thursday — for free. Give it a spin, enter your email to sign up.

Related Articles

2 Layers of a Sustainable Retirement Investment Strategy

What does your pie-in-the-sky retirement look like? For some, it’s buying an RV and traveling the...

New Job? Should You Roll Over Your 401(k)?

Transitioning to a new employer can be stressful. And for most people, their retirement account is...

What Does Inflation Mean for Your Wealth?

Rising prices are scary for many people, especially for those on fixed budgets. But while the...