Are you looking for ways to generate more return from your investments in this environment? Makes sense…especially if you rely on your portfolio to cover your living expenses in retirement, college tuition, or other near-term spending needs. So, where do you turn? Corporate bonds or Treasuries? Real estate? Dividend-paying stocks? They’re all logical choices. But they may not be the best options.

Where can investors find current income and higher total return today?

In volatile times, investors may naturally turn toward safer instruments, like bonds. But bonds may not be the best choice in a rising rate environment. Here’s why.

When rates move higher, bond yields tend to move roughly in tandem. But rising yields (which provide more income) correspond to falling bond prices (price depreciation). So as rates rise, bond prices fall. This benefits investors if they buy short-duration bonds that mature this year or next. However, that requires continuous recycling of new bonds into a portfolio—not the easiest to pull off for most investors.

Real estate is another good option. For those investors who don’t own investment properties, real estate investment trusts (REITs) can provide exposure to real estate. REITs—equity securities that trade like any other stock—invest in a pool of real estate investments where rental income generates dividend payouts. On the plus side, dividend yields tend to be higher than U.S. equities, more so than emerging market equities, U.S. equities, or bonds over the last 15 years.1 And because REIT dividends are taxed at your ordinary-income rate rather than as capital gains, you usually pay higher taxes on them than on dividends from stocks.

Another way to generate income is through dividend income funds. These strategies invest in stocks that provide regular payouts via dividend payments. But do dividend-paying stocks make sense during a rising rate environment?

If we asked that question 10, 20, or even 30 years ago, the answer would have probably been no. That's because, for most of the past few decades, as of December 31, 2021, the relationship between the relative returns of high-dividend-yielding stocks and changes in U.S. Treasury yields has been negative.2 In other words, when yields rose, dividend-yielding stock returns fell.

But that wasn't the case in 2022. Instead, dividend-paying stocks provide income and the potential for capital appreciation. But we believe that dividends alone aren’t the most optimal way to produce a return, and investors should widen their lens to generate better returns without a lot more risk. Instead, we feel that a combination of dividends and share buybacks—shareholder yield—may provide higher shareholder value.

What is shareholder yield?

Shareholder yield is the sum of a stock’s dividend yield and the percentage of net share buybacks over the previous 12 months. Let’s break this down for you.

Dividend yield is the percentage of a company's share price that it pays out in dividends each year. For example, if Company ABC has a share price of $25 and pays an annual dividend of $1.50. then its dividend yield is 6% ($1.50/$25=6%).

Share buybacks (also known as share repurchases) are when a company buys shares of its stock on the open market (just like you would). This can increase returns for shareholders in a few ways. First, earnings per share (EPS) would increase as profits are spread over fewer outstanding shares. Second, with fewer shares available for trading, demand may outstrip supply and boost the stock price. But why would a company repurchase its shares?

There are three main reasons:

- First, if a company’s management believes its stock is cheap (usually defined as trading below intrinsic value), it will repurchase shares. This is a good reason for share repurchases.

- Second, a company may want to offset share issuances because of employee stock grants. This is not a favorable reason for a share buyback.

- Third, sometimes companies will try to boost earnings through a share repurchase. Buying shares back intelligently will lift earnings per share and can push the stock price higher. But if they overpay to reduce the number of shares outstanding, so EPS rise, then that is not a favorable reason.

Because not all repurchase programs add value for shareholders, investors should consider the “net” buyback yield, which deducts shares sold from shares repurchased. Ideally, you would want a company to reduce its share count over time.

Unfortunately, not all buybacks are good for investors. Some companies may purchase shares when they are expensive. So investors need to be aware of the company’s valuation to determine if the buyback will create shareholder value or is just wasted money. But since it’s not always easy to know if shares are under or overvalued at a given point in time, especially for companies that are usually optimistic about their growth prospects, investors should look at management’s buyback track record to see if they made smart repurchases, on average.

Shareholder yield can offer the best total return

We believe that this metric may provide higher returns for investors. Several studies back this up.

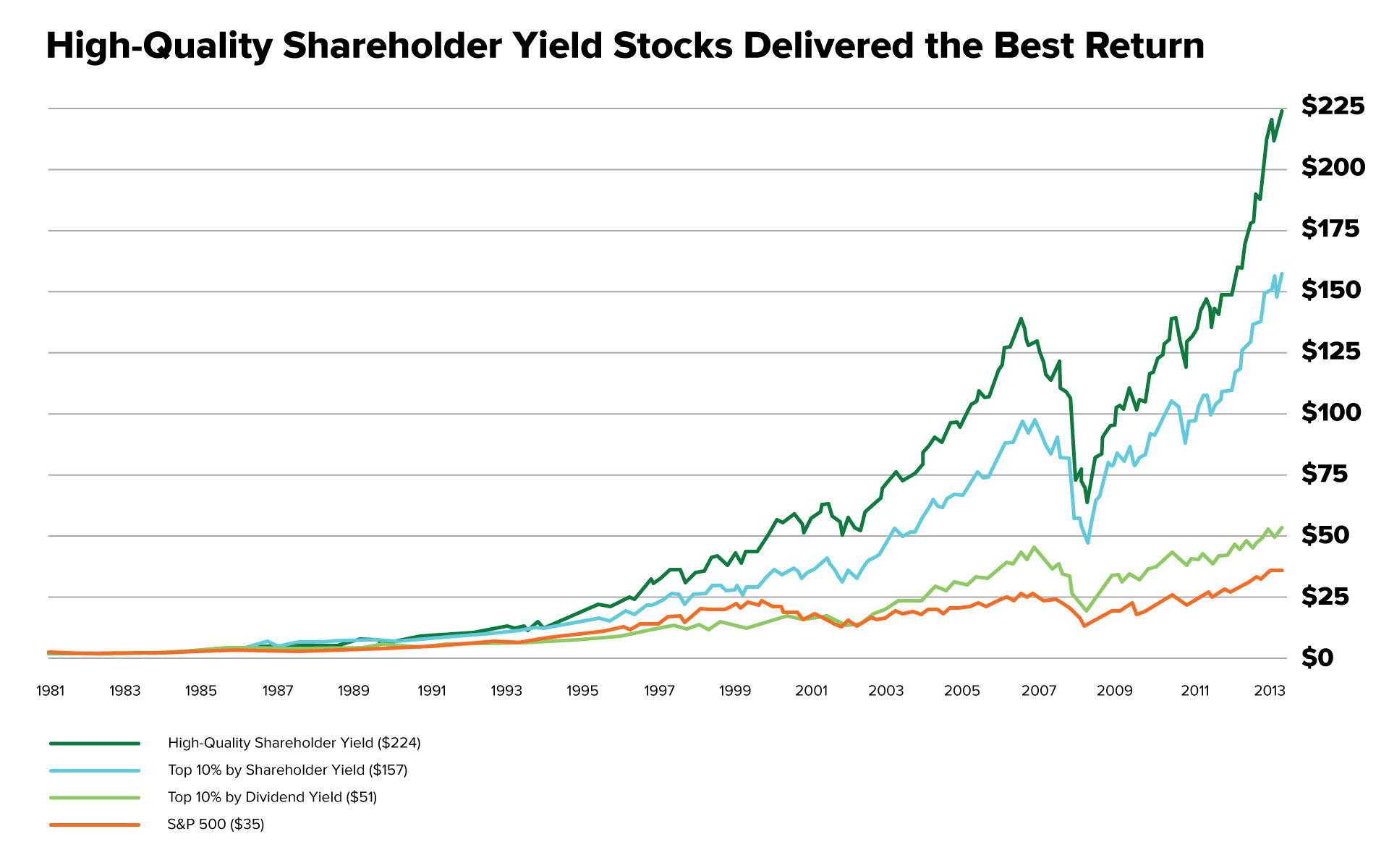

For example, this chart follows the growth of $1 over 32 years between 1982 and 2013. The results show that the top 10% of large stocks by shareholder yield delivered the highest returns, led by high-quality, appropriately valued ones.3

Source: O’Shaughnessy Asset Management, September 2019. Shareholder Yield: A Differentiated Approach to an ‘Efficient’ Market – US Large Cap Value. The chart shows the growth of $1 invested in 1982 through 2013 in four different strategies: S&P 500, the top 10% of large stocks by dividend yield, the top 10% of large stocks by shareholder yield (dividends and buybacks), and the top large stocks by shareholder yield after eliminating half of those with the lowest valuation and poorest quality.

A similar study tested shareholder yield vs. the S&P 500 over 17 years from 1999 to 2016. Again, the results were comparable, where the shareholder yield cohort had an annualized return of 16.44% vs. the 5.12% from the S&P 500.4

Shareholder yield speaks to management quality

One of our 4 Pillars of Quality framework is Management, Culture, & Incentives. In addition to potentially delivering higher returns, we believe that shareholder yield can provide a more holistic view of a company’s capital allocation and balance sheet management than focusing on dividend yield alone.

We also believe that in many cases, especially with a mature business, returning capital to shareholders is preferable to spending on acquisitions or other “empire-building” activities that often destroy shareholder value. So companies that score highly on this quality metric, in our minds, have a greater potential to be winners over the long term.

Like what you're reading?

Join the thousands of readers getting stories like this delivered straight to their inbox every Thursday — for free. Give it a spin, enter your email to sign up.

Footnotes

1Bloomberg, L.P., Dec. 2021

2Capital Group, MSCI, Datastream. As of Dec. 31, 2021

3Shareholder Yield: A Differentiated Approach to an ‘Efficient’ Market – US Large Cap Value, Sept. 2019

4Quant investing: improving the value of shareholder yield, Nov. 4, 2015

Related Articles

Investing in Mid-Cap Stocks During Turbulent Times

Do you have mid-cap stocks in your portfolio? Maybe you don’t know because there isn’t a uniform...

3 U.S. Market Trends That May Help Build Wealth

Did the 2022 market decline sour you to investing in stocks? That’s understandable. Being trigger...

Reevaluate? Reallocate? Or Hold Fast? How to Approach Investing in a Recession

Recessions are an economic—not a stock market—phenomenon. Yet, since the economy and the market,...