“[L]aymen and economists alike tend, in my view, to exaggerate greatly the extent to which labor unions affect the structure and level of wage rates.” – Milton Friedman, 1950†

Apple. Trader Joes. Starbucks. Amazon. BuzzFeed. The Democratic National Committee.

What do these organizations have in common?

Some of their workers recently voted to unionize. Of course, being part of a union is not a new U.S. phenomenon. But it is a reversal of a previous downtrend. For example, in 1983, 20% of U.S. employees were union members. But as of the end of 2022, that number dropped to only 11.3%.1 However, it seems to be rising with several companies’ recent elections to band together.

There are numerous reasons workers may decide to unionize, but we believe the ultimate goal is to give more power and leverage to employees. As employees, we may identify with the purposes of these efforts and the positive impacts unionizing has on workers and society through the reduction of wage inequality. But as investment managers, we must consider how unions may impact our investment companies’ operations and profitability.

So was renowned economist Milton Friedman correct in thinking unions have less impact than most believe? Or is this trend a concern for wage growth and other factors that may eat into profitability or hold back future growth?

Do unions hurt company profits?

Studies show that union workers receive roughly 20 to 30% higher wages and benefits than non-union workers.2 But do these higher benefits and wages make companies more susceptible to failure?

Probably not. Data show that there is little impact on firm survival from worker collectives.3 However, unions could affect employment growth and the productivity of labor.

While paying workers more may mean fewer resources are available to hire new workers, productivity is either improved as workers get paid more or unaffected by union efforts.4 Even more critical is the impact on the bottom line.

Unfortunately, unions’ influence on profitability is not as evident. Most studies show that collective bargains lower profits as wages and benefits increase expenses. If unions disrupt work through strikes or other demands, earnings could be even lower. But unions may also increase productivity, which could drive overall expenses lower.

Another outgrowth of unions may be slower long-term growth, as companies redeploy capital towards labor instead of business investment or they may just hire fewer workers.

But on the positive side, unions can add value to a company. They can help attract talent, reduce turnover, and increase employee commitment to business success through better wages and benefits.

One study looked at the effects on profitability over a 40-year period—from 1961 to 1999—and concluded that unions “reduce growth in assets, because of decreased growth in plant, property, and equipment, [but] profit and return on assets appear unaffected by unionization.”5

More importantly, does unionization reduce stock returns?

As investors, we strive to gain outsized returns on our investments. And the recent trend in unionizing at some of America’s biggest companies has us wondering if it may hurt expected returns.

The same study we mentioned above looked at this exact question. Its findings suggest that “the average effect of a union win at a workplace is to decrease the market value of the affected business” by 10 to 14%.6 Digging deeper, the data show that average returns are similar to those predicted before a union vote. But at the time of the election, returns diverge. The performance of firms with only a small percent of the workforce unionized does not change—it follows the predicted path. But whole firms unionizing show significant divergence of returns, with the full effect hitting up to 18 months later.

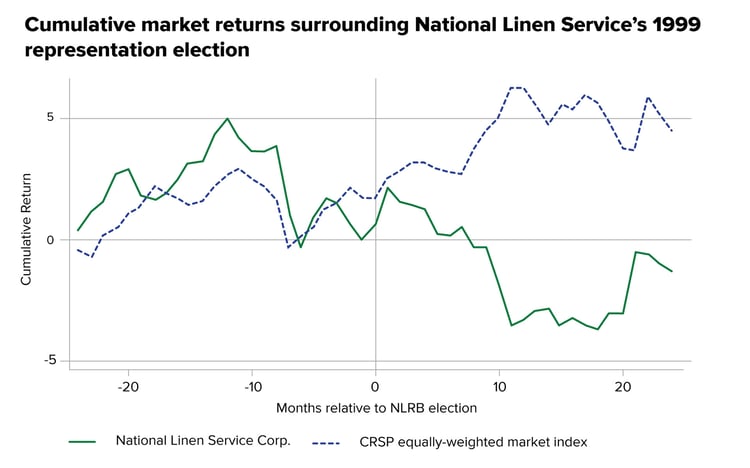

The experience of National Linen Service (NLS) is a good example. After a strong vote to unionize in March 1999, the stock market slowly punished NLS over time. The chart shows that before the election, the returns for NLS and the market tracked closely. However, after the election, NLS began to lag the market, and two years later, the price of NLS’ shares was down 25% while the index rose 50%—a 75% difference.

Source: NBER.org, Feb. 2009

Source: NBER.org, Feb. 2009

So should investors avoid companies that unionize?

In short, we don’t think so. Instead, we believe there is more to a company's story. First, in many cases, the recent elections are at particular locations rather than companywide. And if returns follow the same path uncovered by the research, then companies with only a few union workers should not see performance diverge from expectations.

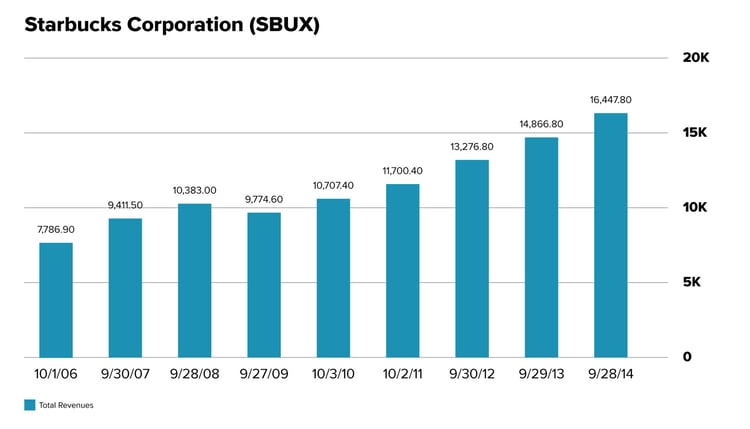

Secondly, perhaps more importantly, we recognize that each company is unique. Many factors and inputs go into our investment thesis. So we take each situation on a case-by-case basis. Let’s examine one recent example: Starbucks.7 Starbucks has historically had a strong brand, digital customer engagement, pricing power, and a progressive employee culture. We believe these attributes, if they continue, should help the company manage the effects of unionization.

Starbucks has strong customer loyalty. Even during more challenging economic times, many people are willing to pay that extra dollar or two for their Starbucks drink. Not only is it a drop in the bucket relative to other daily expenses, but it is a small bit of extravagance and normalcy many are loath to let go. We saw this happen in the aftermath of the Great Recession. In the beginning, revenue declined, but as founder Howard Schultz returned as CEO and the company launched its customer loyalty program, sales rebounded and continued to grow. The loyalty program has been a great success—it has grown to 30.8 million members (or just over 1 out of 12 Americans).8 The rewards program is easily accessible as a mobile app and helps form consumption habits, making sales more resilient in times of economic weakness.

Source: TIKR

Source: TIKR

So the central question around Starbucks’ union effects is: If the company has to increase prices to pay for higher wages and benefits, will customers remain loyal and maintain their buying habits?

Americans spend about 2% of their annual income on coffee each year, on average.9 And for many people, coffee is not just a morning drink but an all-day experience. So even though it's a luxury, it's an affordable one. And it's one many drinkers would still be willing to spend their money on, even if the cost may rise a small amount. But, again, it's because Starbucks' customers tend to be loyal—Starbucks Rewards members represented 57% of U.S. company operating revenue in the second quarter of 2023.10 In our opinion, this relative consumption inelasticity—meaning customers will still demand their coffee despite price changes—should allow for successful price increases.

What else may insulate Starbucks from the negative effects of unionization? It has a well-established reputation as an industry leader when it comes to employee compensation and benefits. Schultz founded the company with the core belief in treating employees well, so much so that employees are called partners. Although there have been many headlines about union formation at Starbucks, unionized stores make up less than 3% of the ~9,000 company-owned U.S. stores.11 Moreover, most consumers are aware that Starbucks values and treats its employees well–it is part of the company's ethos. In that sense, consumers may be more likely to understand (and perhaps not mind) when their next cup of joe is pricier, knowing they are contributing to higher earnings for their local barista.

So while we believe some companies can pass on higher costs that may arise from unionization to customers, are financial impacts a foregone conclusion?

Maybe not. We've seen in the past that unionized companies sometimes lose market share. For example, unionized automakers lost market share to non-union competitors. And in the end, competition prevented unionized companies from paying their workers higher wages anyway.

In addition, if stores become unprofitable because of the higher wages, then companies may close those locations in favor of financially strong ones. To that end, the overall company may be unaffected by single-store union votes in the long run.

Like what you're reading?

Join the thousands of readers getting stories like this delivered straight to their inbox every Thursday — for free. Give it a spin, enter your email to sign up.

Footnotes

†NBER paper, Friedman, Milton, "Some Comments on the Significance of Labor Unions for Economic Policy," in David McCord Wright, ed., The Impact of the Union: Eight Economic Theorists Evaluate the Labor Union Movement, New York: Harcourt, Brace, and Company, 1950. Institute on the Structure of the Labor Market, American University, Washington D.C.

1Bureau of Labor Statistics, Jan. 19, 2023

2Time, “American Companies Have Always Been More Anti-Union Than International Ones. Here's Why,” Apr. 21, 2022

3princeton.edu, Mar. 2003

4theconversation.com, May 8, 2019

5nber.org, Feb. 2009

6nber.org, Feb. 2009

7The mention of Starbucks Corporation (SBUX) is not a recommendation or indication of our intentions to trade the security. Some of our Personal Portfolios may hold SBUX. In this article, the reference to SBUX is to discuss a recent union example and its potential impact on the company’s financial position.

82Q23 Starbucks earnings report, May 2, 2023

9finance.yahoo.com, Oct. 26, 2020

10pymnts.com, May 2, 2023

112Q23 Starbucks earnings release, May 2, 2023 and apnews.com, Jan. 10, 2023

Related Articles

Recession Obsession: How Scared Should Investors Really Be?

Traditionally recessions are characterized by slowing economic growth, job loss, rising...

Is 2023 the Year for International Stocks?

2022 was a bad year for stocks, not just in the United States. The MSCI All Country World Index, a...

How Has the Stock Market Performed During Recessions? You Might Be Surprised

A recession is loosely defined as a decline in economic activity and employment. There isn’t one...