Many investors confuse stock price and company value. The stock price should reflect a company's fundamentals—such as sales growth, margin expansion, increasing cash flows, or earnings growth. But it also can mirror sentiment—which usually shows itself in the valuation multiple assigned to a stock. More optimistic investors may bestow a higher valuation multiple because they believe future growth will be robust. But pessimistic investors give companies lower multiples. This pessimism or optimism can mirror the individual company's prospects or the entire market's expected growth.

Does a company’s value diminish in tandem with its stock price?

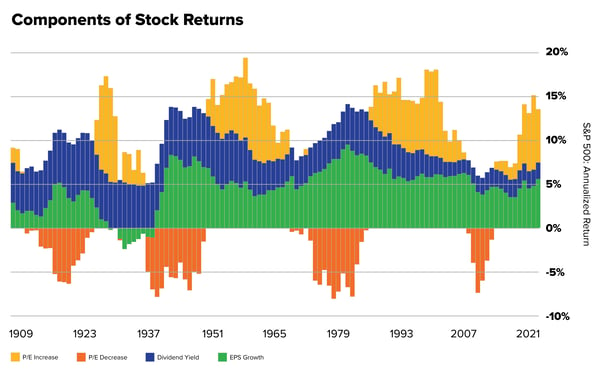

Understanding how sentiment and fundamentals influence a stock’s price vs. a company’s value is essential. The chart below shows the breakdown of shareholder returns on an annualized basis for the S&P 500.

It depicts three main components that comprise shareholder returns. Two parts are financial fundamentals—earnings (EPS) growth (green bars) and dividends (blue bars)—and one part is sentiment—valuation multiples (orange and yellow bars).

You can see that dividends have been relatively stable since the mid-90s, averaging roughly 2% per year. In contrast, earnings growth and valuation multiples have significantly varied over time, although valuation multiples are the most volatile.

Source: Crestmont Research. 10-Year stock market return components from 1900-2022. The total return is before transaction costs. Y-axis shows the annualized return of the S&P 500 Index.

Source: Crestmont Research. 10-Year stock market return components from 1900-2022. The total return is before transaction costs. Y-axis shows the annualized return of the S&P 500 Index.

So what does this mean for investors?

When the market multiple contracts/expands, we believe it is generally a function of sentiment rather than fundamentals. That is what has happened in 2022. At the high of the market on Jan. 3, 2022, the forward P/E for the S&P 500 hit 21.4x.1 Then, in early June 2022, it had fallen to 17.7x.2

That’s not to say that sometimes this contraction isn’t warranted. Of course, some companies never deserved their elevated multiples because they did not have sustainable business models. But even strong companies may experience multiple contractions. Some may have gotten caught in a euphoric fray, and their multiples may have grown ahead of their fundamentals. Others may have deteriorated along with economic conditions that could impact a company’s short-term prospects and result in lower earnings. So sometimes, contracting multiples may make sense for that short period.

But as long-term investors, we don’t get caught in the web of near-term sentiment. Instead, we believe that Quality companies with solid fundamentals should continue along a growth trajectory in the long term, even if they hit a temporary speed bump due to the economy. That’s because we think these companies' products and services create value for their customers.

That's why stock prices do not always reflect a company's value.

Just because consumers or businesses feel low doesn't mean a company has necessarily lost its value. It just may mean its stock price has taken a temporary hit. And while it may be painful to take those blows, they also could provide an opportunity to buy Quality companies at fire-sale prices.

So what do we do? We buy what we believe to be long-term winners through these types of sentiment storms and fight back against those pesky emotions!

Like what you're reading?

Join the thousands of readers getting stories like this delivered straight to their inbox every Thursday — for free. Give it a spin, enter your email to sign up.

Footnotes

1Factset, May 16, 2022

2Birinyi Associates, data from Jun. 10, 2022

Related Articles

The Surprising Truth About the S&P 500 and the “Magnificent 7” in 2024

The S&P 500 is a market cap weighted index. In fact, most major benchmark indices — with the...

How Do Investors Decide Which Stocks to Sell?

In the vast world of investing, there’s so much emphasis placed on buying stocks: Which...

Should You Have Bonds in Your Investment Portfolio?

88%. That’s the percentage of return that comes from asset allocation for most investors.1 So it’s...