You've probably heard about the importance of diversification for your portfolio. But when the market is rising, it's not top of mind. Conversely, when the market is falling—especially if it's in a prolonged downturn—the urgency is paramount.

There are several ways to diversify—you can invest in securities with dissimilar businesses or that operate in unlike industries. Or you could spread your investments among various asset classes whose performance should be unrelated. There are also “alternative” strategies (e.g., equity long/short) that are designed to mitigate certain portfolio risks and seek “absolute return” (i.e., a positive return over time—regardless of whether markets are going up, down, or sideways).

You can also hold lots of stocks in your portfolio. But how many do you need to get an adequate level of diversification? Two? Two hundred? Or two thousand? The answer is important, because some investment managers believe you need hundreds or thousands to mitigate concentration risk, while others postulate that holding just a few is adequate.

We believe the key to success is not only how many stocks you own but whether those stocks offer high-conviction diversification. Let’s take a look at why.

Why diversify?

Diversification is important because it is directly related to portfolio risk.

Think of it this way: When you own one stock, and the price of the stock triples, so does your money. But if that stock's price falls 70%, you also lose 70% of your money.

One holding is the most concentrated—least diversified—portfolio available. Compared to an index—which tends to have hundreds or thousands of holdings—the level of risk with a single stock is undeniable.

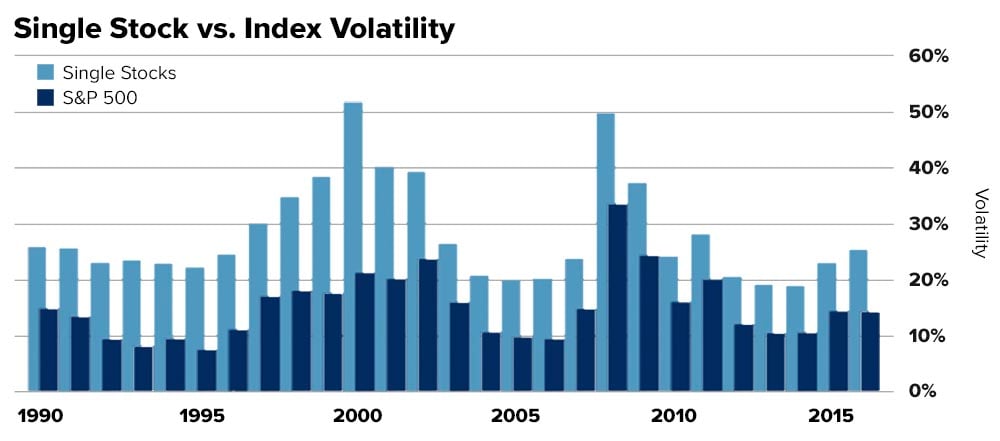

You’ll notice in the graph below that over the course of the 26 years this data covers, the volatility of owning a single stock was up to 40% higher than holding an index of 500 stocks.

Source: S&P Dow Jones Indicies, LLC. Data as of June 2016. Volatility is measured by the standard deviations of total return for the index and constituents. Past performance is no guarantee of future results. Chart is provided for illustrative purposes.

What happens if you own two stocks? Held in equal amounts (and assuming different industries), if one rises (falls) 50% while the other stays flat, then your money goes up (down) 25%—the risk is halved.1 Why does this happen?

Two types of risk

Risk falls into two main categories—market risk and specific risk.

Market risk affects most companies simultaneously and is nearly impossible to diversify. COVID-19, politics, or macroeconomic issues are examples of market risk. The impact from these types of events and drivers—things like unemployment, interest rates, or a trade war—is so widespread, they have a tendency to affect many companies or many industries all at once. That’s why it’s called systematic risk. It cannot be eliminated through diversification. Therefore, it was not the reason why the risk was halved in the two-stock example.

Instead, the risk was halved because it was specific risk. Also known as unsystematic or diversifiable, this type of risk is exclusive to a particular company's operations or an industry's environment, but not to the whole market. This means it is “diversifiable”—the risk can be mitigated since investors can spread out specific hazards by investing in more than one company, industry, or sector.

So, how many stocks offer adequate portfolio diversification?

Overwhelmingly, the data show that just like one stock offers no diversification, the opposite end of the spectrum—holding hundreds or thousands—does not provide additional benefits and may even hurt returns. Let us explain.

Recall our example of how two stocks cut the risk in half.1

One could reason, then, that the more stocks held, the lower the risk. But the benefits of risk reduction diminish as the number of stocks increases.

One study shows that investing in 20 stocks can lower a portfolio's risk by 81%.2 And, holding more than that does not diversify much more.

In fact, a separate study concluded that owning 12 to 18 stocks delivered more than 90% of the benefits of diversification.3

But it's not good enough to hold any 20 stocks. We believe the select few should be the best ideas of the portfolio managers—the names in which they have the highest conviction. That's where manager skill comes into play.

Closet indexing vs. active conviction

Passive funds have one purpose—to replicate an underlying index.

To accomplish this, they tend to hold hundreds of stocks. This flies in the face of the above diversification research.

So instead, some active managers track closely to the index to get similar returns, even if they don't hold all of the stocks. These managers are referred to as closet indexers. As a result, their performance does not measure up.

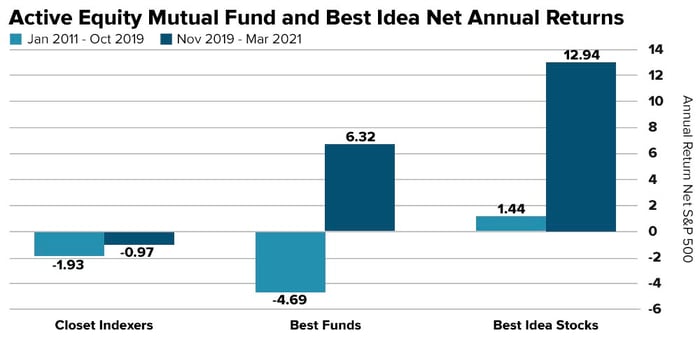

Since 2011, closet index funds* have delivered lower returns (on average) than the best active funds or portfolios of the best ideas.** You’ll see in the chart below, that this was true during the sustained bull run from 2011-2019 but even more glaring during the market turmoil caused by COVID-19.

Source: Morningstar and AthenaInvest. The reported annual returns are derived from a simple average of the 200 or so best-fund subsequent-month net returns for each time period. Closet index returns are calculated in a similar manner. Best idea stocks are those most held by the best funds. Each month features between 250 and 300 best-idea stocks.

Quality over quantity

We believe that the key to diversification is manager skill. Does the portfolio team have a repeatable process that has the potential to deliver consistent returns? Otherwise, trying to whittle down the universe from thousands to a select few is nearly impossible.

We believe that the best ideas come from diligent research that analyzes a company's business, leaders, industry, and competitors.

Managers should, in our opinion, assess whether the companies can grow and last for the long haul through pricing power, customer loyalty, and competitive advantages. Those are the keys, we believe, to finding high-conviction names that will lead to outperformance.

Because, while we agree that diversification is about spreading risk among various companies, industries, and asset classes, we also think it’s about owning the optimal number of stocks. But not just any stocks—ones with quality businesses.

Like what you're reading?

Join the thousands of readers getting stories like this delivered straight to their inbox every Thursday — for free. Give it a spin, enter your email to sign up.

Footnotes

1This is a simplistic view that ignores other factors. Research shows a two-stock portfolio has 46% less risk.

2jstor.org, Oct. 1997

Related Articles

The Role of Asset Location in Managing Retirement Taxes

Location, location, location. It’s not just for real estate.

.jpg)

Too Much of a Good Thing? Ways to Reduce a Large Stock Position

Were you lucky enough to buy Apple stock (AAPL*) on April 8, 1983, for $0.18 and, more...

.jpg)

Do Elections Matter to Your Portfolio? 3 Reasons We Don't Think You Should Worry

Are you worried about how the upcoming midterm election will impact your investment portfolio? This...