Has the recent pullback in the market found you wondering if your risk level is set correctly for your portfolio? This is not uncommon. Many people feel comfortable with their portfolio’s risk when the market is going up, but when the market drops, they feel uncomfortable. Or worse, they panic and sell.

Does this sound familiar? If so, then your portfolio might have been designed with too much risk. But if the same scenario happened and you realized that losing too much money could put your lifestyle at stake, then your portfolio may be too high-risk for your capacity to lose money. In other words, your portfolio needs to be designed with three components of risk in mind—your risk tolerance, capacity, and propensity. Understanding them will hopefully help you avoid feeling deep discomfort when the market undergoes its periodic corrections or chasing highs when the market is skyrocketing.

What is risk tolerance?

In simplest terms, risk tolerance is a measure of how much decline in your portfolio balance you can stomach without resorting to deep worry and selling out of fear. Someone with a higher risk tolerance can withstand greater declines without worry and fear than someone with a lower tolerance.

People with a high-risk tolerance tend to see market declines as normal fluctuations that will bounce back in time. They may not always think of declines as losses since they haven’t sold and locked in the lower prices. They might look at these moments as “temporary dips in value that will correct in time.” They may even see these moments as opportunities to buy when prices are low.

Those with low-risk tolerance tend to see market declines as actual permanent losses instead of temporary fluctuations in value. They tend to think, “this market may never bounce back. I better sell before it gets worse.” Following this thinking, they may be prone to sell out of fear when the market is low. And by selling, they might lock in losses.

By properly constructing your portfolio to your level of risk tolerance, we believe your portfolio can have the potential to perform in a way that keeps you happy when the market is good and keeps you from panicking when the market is down.

Assessing your risk tolerance, and helping you live through market ups and downs, is one of the most important services our Wealth Advisors offer. Using carefully constructed questionnaires, our Wealth Advisors assess your risk tolerance and create your portfolio according to it. Their objective from this exercise is to construct a portfolio that matches your risk tolerance to weather volatility that strives to prompt you to hold—instead of sell—during a market decline. Why is this important? Because we believe selling during a decline is not only generally a money-losing action, it also can tend to be a worse outcome for you financially. On the flip side, your portfolio must also perform well enough in good times to keep you happy.

If you answer the questionnaire by saying that you can handle a 10% drop in balance, but a 20% drop will cause you to panic, then your advisor, using their firm’s experience and knowledge, will construct a portfolio that strives to hopefully avoid a 20% decline. This portfolio construction may also limit your upside during strong bull markets. But in the long run, it may be better for your tolerance to accept a smaller average long-term gain than to sell in a low market.

Clients with high tolerance hold portfolios with more equity than fixed income, such as an 80/20 or 70/30 portfolio balance. These portfolios may experience wider market swings—higher volatility of returns. Those with low tolerance will receive portfolios with less equity versus income, such as a 50/50 balance, a 40/60 balance—or even a 20/80 balance—that greatly favors fixed income. These portfolios can experience more narrow swings in value during market declines.

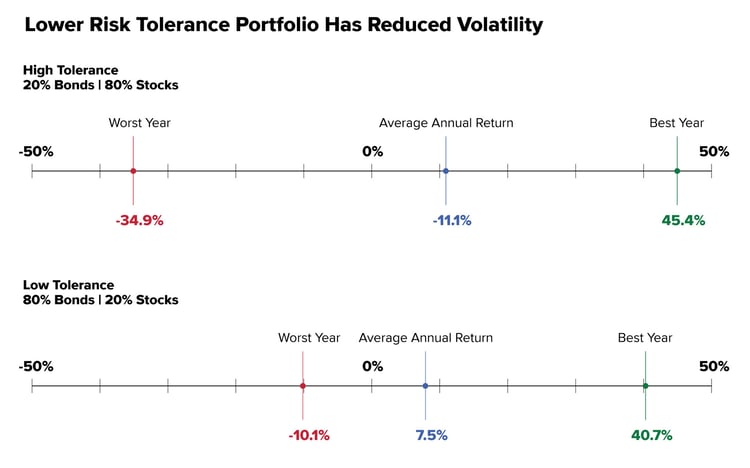

Why doesn’t everyone choose a low-tolerance portfolio to avoid big downturns? Because these portfolios often grow less over time. For example, historically, a low-tolerance portfolio comprised of 20% equity and 80% bonds has an average annual return of 7.5% with only 16 of 96 years experiencing a loss. Contrast that with a high-tolerance portfolio made up of only 20% bonds and 80% equity (the exact opposite allocation), which had an average annual return of 11.1% but 24 of 96 years having a loss. And within those portfolios, the higher-tolerance portfolio saw more extreme swings—from down 34.9% in its worst year to up 45.4% in its best year. The lower tolerance portfolio only had a 10.1% down-year and a 40.7% up-year—a more muted volatility.

Source: Vanguard. Data for the U.S. stock market returns comes from the Standard & Poor’s 90 Index from 1926 to March 3, 1957, and the Standard & Poor’s 500 Index thereafter. Data for the U.S. bond market originates from the Standard & Poor’s High Grade Corporate Index from 1926 to 1968, the Salomon High Grade Index from 1969 to 1972, and the Barclays U.S. Long Credit Aa Index thereafter. Data for U.S. short-term reserves is from the Ibbotson U.S. 30-Day Treasury Bill Index from 1926 to 1977 and the FTSE 3-Month U.S. Treasury Bill Index thereafter. Past performance is no guarantee of future returns. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

Source: Vanguard. Data for the U.S. stock market returns comes from the Standard & Poor’s 90 Index from 1926 to March 3, 1957, and the Standard & Poor’s 500 Index thereafter. Data for the U.S. bond market originates from the Standard & Poor’s High Grade Corporate Index from 1926 to 1968, the Salomon High Grade Index from 1969 to 1972, and the Barclays U.S. Long Credit Aa Index thereafter. Data for U.S. short-term reserves is from the Ibbotson U.S. 30-Day Treasury Bill Index from 1926 to 1977 and the FTSE 3-Month U.S. Treasury Bill Index thereafter. Past performance is no guarantee of future returns. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

What is risk capacity?

While risk tolerance is about your emotional state, risk capacity is about your financial state. It focuses on how much you can lose without changing your lifestyle.

For example, a person with $40,000 who needs all of it for a down payment on their house next month cannot put their money at risk today. They have zero risk capacity and should not invest with any risk. But a person with $80,000 who needs $40,000 in two years for a house down payment may have more capacity for loss, even if they don’t want it.

A Wealth Advisor can help determine your capacity for risk. One of the ways they do that is through a wealth plan simulation that tests 1,000 scenarios to provide a probability of your plan’s success, also known as a Monte Carlo simulation.

This simulation can test various portfolio allocations and market environments to determine the likelihood of successfully meeting your goals. For example, suppose you're planning for retirement and expecting to spend a certain amount each year. In that case, you might test your ability to meet that spending using a historical return expectation. Or, if you are worried about a downturn, you might test various lower-return assumptions to see if your portfolio is at risk of running out of money. On the other hand, maybe you'll live longer than expected (a good problem). You can test the longevity of your plan to ensure your portfolio will last over more years.

Determining your risk capacity is an important way to think more specifically about your real financial situation and thus better determine your risk level.

What is risk propensity?

Completing the risk trifecta is risk propensity. This one assesses personality—what is your tendency towards taking risks? It looks at your personality as a whole—not just what you answer on a questionnaire or discuss with your Wealth Advisor—to help determine what you might be likely to do in a given market situation.

Are you someone who likes risk and spontaneity in your life? Do you sometimes make big decisions quickly, using instinct—like changing jobs, selling your house, or changing relationships? Do you like doing some things spontaneously for the adrenaline rush? Do you enjoy things with some danger in them, like sky diving, rock climbing, or motor-cross racing?

People like this often may have a naturally higher propensity to take risks or to act impulsively. Regarding investments, they may say they will act according to plan with their money but then act spontaneously in the heat of the moment.

Think of risk tolerance as what you predict you will do, but risk propensity as what, from a more objective long-term perspective, you very likely could do, based on experience. In other words, if you set your risk tolerance with your Wealth Advisor three months ago, but yesterday you “overrode” it by selling your portfolio, it may have been predictable based on your propensity in life for acting spontaneously, according to new information. This should be part of your risk planning.

Assessing your risk propensity can be helpful in setting up your portfolio correctly, especially if you are new to investing and have not yet gone through deep or prolonged market corrections. Knowing your propensity for changing course may cause you to adjust your risk tolerance up or down.

For example, let’s say you answered the risk questionnaire, and it says your risk tolerance is “in the middle.” But you know two more things: You currently have a low capacity for risk and often follow your gut under pressure. Now you and your Wealth Advisor are better prepared.

People can also have a propensity to play it very safe in life. These folks may approach investing too conservatively for their true needs. This often shows up in retirement planning. For example, a couple in retirement with low-risk propensity may be inclined to take no risk at all and invest simply in CDs. But in doing so, they could fail to beat inflation over the years and risk running out of money. An astute Wealth Advisor will see this and can recommend an appropriate amount of additional risk to ensure a more secure future.

Blending these concepts into one solid approach

Understanding your risk tolerance, capacity, and propensity are important inputs to correctly building your overall portfolio risk.

You want to avoid thinking about risk differently during good and bad markets. It’s not helpful for your long-term security to say, “I can take more risk” during a bull market, and then say, “I want to take less risk” during a bear market. Most people who think they can do this wind up making adjustments too late, so they take more risk (buy) when the market is already high, and they take less risk (sell) when the market is already down. This tends to produce a lower long-term return than a long-term buy-and-hold strategy.

Getting comfortable with the risk of your portfolio is one reason to visit a Wealth Advisor regularly. They are trained to reassess your risk every year, especially during life changes, such as a marriage, divorce, and child's birth. They will likely assess your risk capacity and propensity along with your tolerance.

They do this to try to ensure that your risk level is up-to-date and accurate, reflecting any new changes in your thinking or lifestyle. They want to adjust your portfolio appropriately during normal times and avoid re-thinking it during market stresses.

If you are discussing this issue with a Wealth Advisor regularly, you will likely feel more comfortable during a pullback. If you haven’t thought about it in a while, and find that this market pullback is bothering you, then you should assess your portfolio’s risk based on these three prongs.

Like what you're reading?

Join the thousands of readers getting stories like this delivered straight to their inbox every Thursday — for free. Give it a spin, enter your email to sign up.

Related Articles

How Do Geopolitical Risks Impact Your Investments?

The pandemic taught us many lessons. But none may be more pronounced than how massively...

What Does Inflation Mean for Your Wealth?

Rising prices are scary for many people, especially for those on fixed budgets. But while the...

Will Your Retirement Plan Be Successful? How You Can Gauge the Likelihood

Are you preparing for retirement and expecting to spend a certain amount each month from your...