Are you preparing for retirement and expecting to spend a certain amount each month from your investments to supplement your Social Security benefits?

Or are you already retired and worried that a market downturn would reduce your ability to cover your living expenses or cause you to run out of money?

Regardless of your retirement situation, you need to be confident that your plan could successfully meet your needs.

So how can you know?

Measuring your return against a market benchmark like the S&P 500 won’t tell you. Neither will comparing your plan’s performance to an arbitrary return assumption, like 8%. What about if you generate enough to stay ahead of inflation? It still may not explain if you’re on track to meet your needs.

Unfortunately, there’s no way to know with 100% certainty. But there is a way to measure your probability of success. Luckily, you don’t need to be a fortune teller to figure this out!

(Fortunately, you don't need to be a statistician, either!) Instead, you can use a statistical model to estimate how likely your plan will meet your goals.

Here’s the "inside baseball" on how it works

Based on a Monte Carlo simulation, the model predicts the likelihood of the desired outcome given the impact of different variables. Monte Carlo simulates thousands of possible scenarios to understand the implications of risk and uncertainty on the outcome. It helps you determine the probability of success of a specific set of inputs.*

For example, suppose you're planning for retirement and expecting to spend a certain amount each year. In that case, you might test your ability to meet that spending using a historical return expectation. Or, if you are worried about a downturn, you might test various lower return assumptions to see if your portfolio is at risk of running out of money. On the other hand, maybe you'll live longer than expected (a good problem). You can test the longevity of your plan to ensure your portfolio will last over more years.

Let’s walk through a hypothetical example.

Dan and Joann both just turned 65 years old and are concerned about having enough income to supplement their Social Security benefits. They have $600K in their IRAs and estimate their house is worth $300K. Luckily, they have no loans or other outstanding debt. Dan estimates his life span to be about 85 years old—another 20 years from today—since Dan’s relatives lived to 83 years old, on average, while Joann expects to live to 87.

They are invested in a portfolio that is 66% stocks and 34% bonds, which historically has generated a 5.64% average annual return. They are interested in knowing if their current portfolio will provide the retirement income they need for healthcare and basic living expenses.

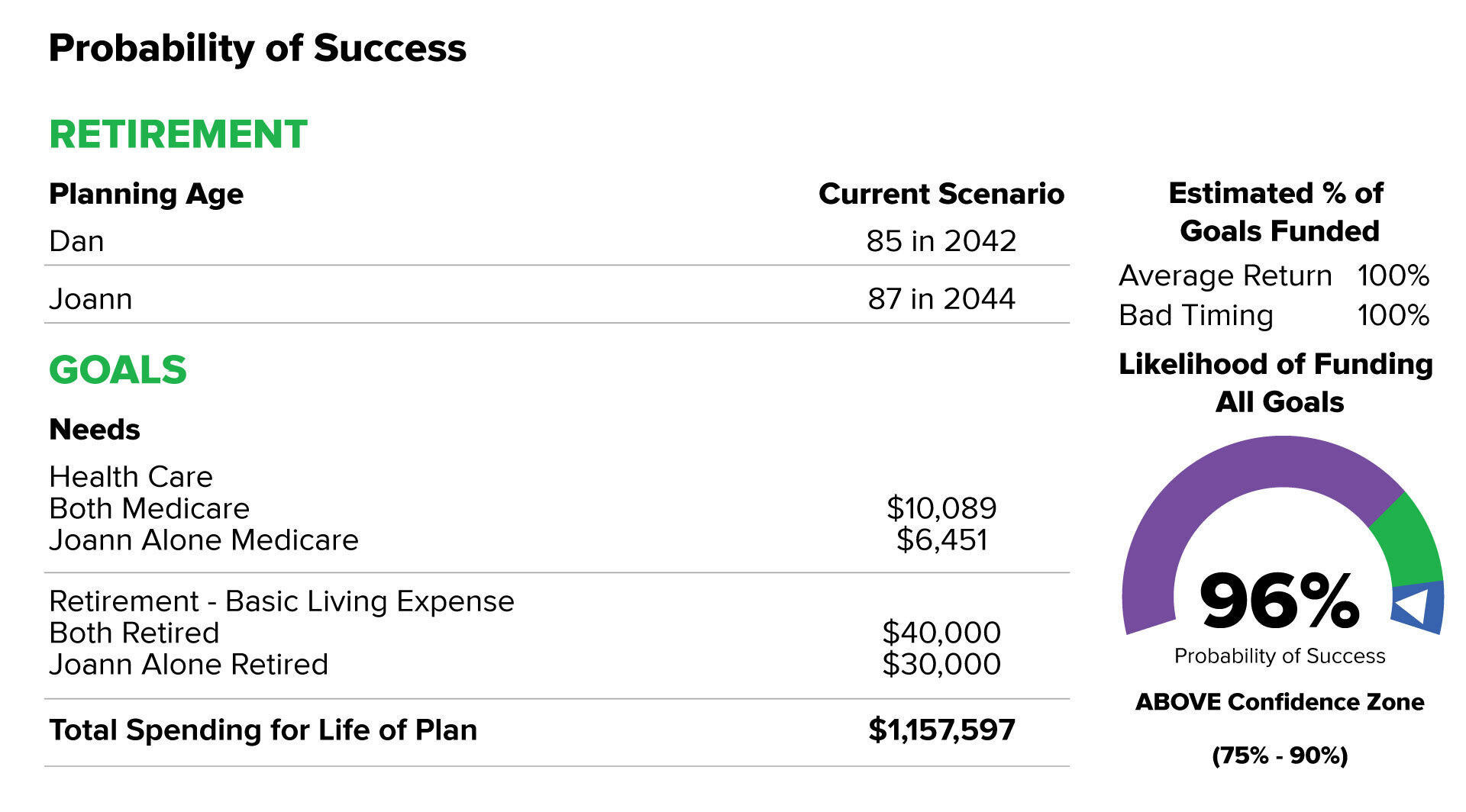

Our model generated the following probability of success for their current plan. Notably, the model factors in an annual inflation rate of 2.25% per year.

The Probability of Success meter displays the percentage of trials from 1000 Monte Carlo trials that were successful in funding all the goals. We identify the Confidence Zone as the probability of Success between 75% and 90%. Source: MoneyGuidePro. See “Notes on analysis” for further disclosures.

The model shows that they have 96% probability of success, meaning there is a 96% likelihood of funding their financial goals with their current plan.

Test the "what ifs"

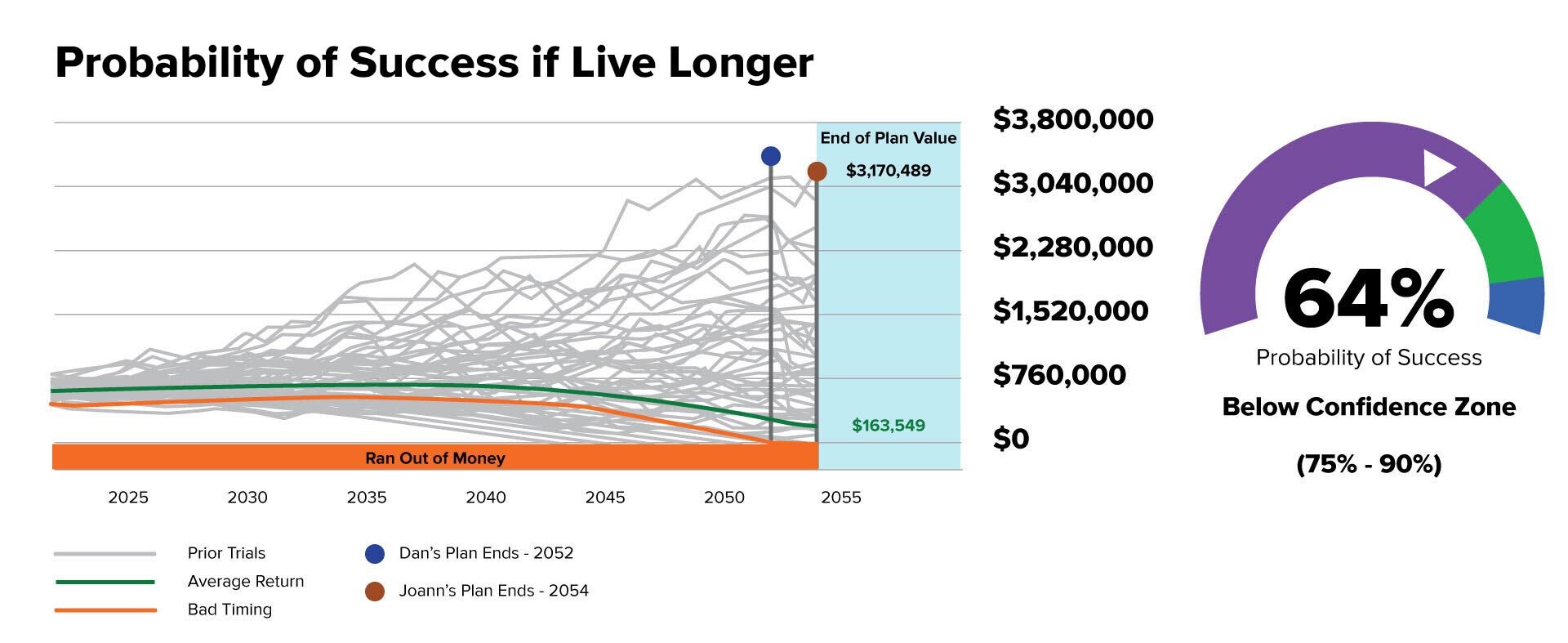

The model can also test what happens in other situations. For example, what if Dan and Joann live longer. Say, for example, they live 10 years longer than they projected (Dan to age 95 and Joann to age 97). In that case, their current plan’s probability of success is 64%.

The graph shows the results for 1000 Monte Carlo trials. The Probability of Success meter displays the percentage of trials that were successful in funding all the goals. We identify the Confidence Zone as the probability of success between 75% and 90%. Source: MoneyGuidePro. See Notes on analysis for further disclosures.

Adding confidence to your retirement plan

This type of testing is, we believe, the best way to confidently assess whether your current plan can meet your retirement goals. Measuring your return against a benchmark certainly won't. Neither will a preconceived return notion or the performance of your brother, sister, or neighbors' portfolios tell you if your retirement is on track.

Like what you're reading?

Join the thousands of readers getting stories like this delivered straight to their inbox every Thursday — for free. Give it a spin, enter your email to sign up.

Footnotes

*The return assumptions in MoneyGuidePro are not reflective of any specific product and do not include any fees or expenses that may be incurred by investing in specific products. The actual returns of a specific product may be more or less than the returns used in MoneyGuidePro. It is not possible to directly invest in an index. Financial forecasts, rates of return, risk, inflation, and other assumptions may be used as the basis for illustrations. They should not be considered a guarantee of future performance or a guarantee of achieving overall financial objectives. Past performance is not a guarantee or a predictor of future results of either the indices or any particular investment. IMPORTANT: The projections or other information generated by MoneyGuidePro regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. MoneyGuidePro results may vary with each use and over time. Other disclosures and a glossary are available at moneyguidepro.com.

Related Articles

Investments in a Down Market Still Tend to Outperform Savings Accounts Historically

What happens when a doctor recommends that you eat healthier? The reaction varies by individual....

.jpg)

Too Much of a Good Thing? Ways to Reduce a Large Stock Position

Were you lucky enough to buy Apple stock (AAPL*) on April 8, 1983, for $0.18 and, more...

3 Strategies to Avoid Emotional Investing

Life can be an emotional roller coaster. There are significant moments, like the joy of watching...