Are you ready to convert your blood, sweat, and tears into cold, hard cash by selling your business? Have you recently received an inheritance? Or maybe your tax refund is unexpectedly large.

Suppose you are about to experience a liquidity event—selling a business or partnership, downsizing your home, receiving a new contract or large bonus at work, winning the lottery, or even collecting a tax refund—good for you! Now you need a plan for managing it.

What steps should you take to ensure you're prudent with this new wealth? Here’s a five-step guide to help.

5 steps for managing an influx of cash

- Address your highest money needs. Do you have high-interest debt—like credit cards with a revolving balance? It could be best to consider paying those off immediately to avoid wasting money on interest payments. You may also consider paying down other debt—like a mortgage, car, or school loan. But if that debt has good terms, like low interest, or reduces your taxable income (mortgages), you may not want to use this windfall to pay those off.

- Create a rainy-day fund. Depending on your life stage and the size of this newly acquired wealth, you should consider setting aside some portion for emergencies. For example, some people suggest having roughly three to six months’ worth of expenses socked away to lessen worries about a job loss or inability to work. But if you cannot reserve that right now, putting at least $1,000 in a separate bucket for an unexpected expense is a good practice.

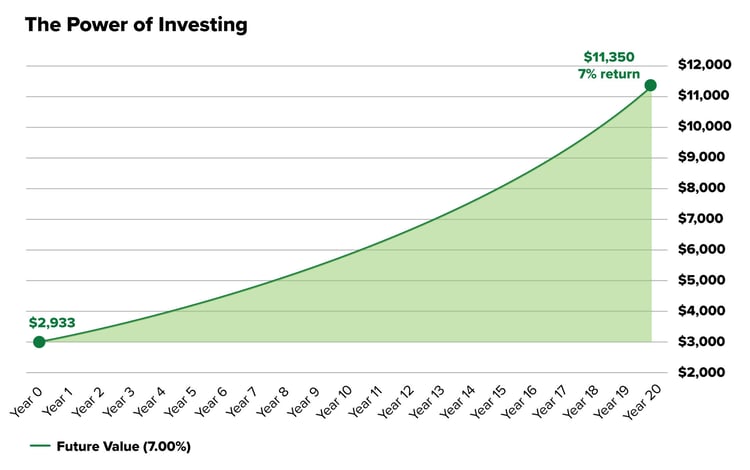

- Invest for the future. Here’s the thing about savings. The more you save, the more you'll have in the future…well, sort of! So if you put your money in a savings account at a bank, you may have less “real” money in the future. Huh? Yup, because interest paid on savings accounts, despite the increase in rates, is still quite low and significantly less than inflation. As inflation increases the prices of goods and services (even by the average rate of 2%–3%, let alone by today's higher rates), your money sitting in a bank will likely buy you less. So, weirdly, regular savings accounts may be reducing your future spending power. But if you invest that money, you have the potential to take advantage of compounding growth. Here are some stats to noodle on:

The S&P 500 has returned a historic annualized average return of around 10.5% since its 1957 inception through 2021.1

And over the last decade, a classic “60/40” portfolio—meaning a portfolio of 60% stocks and 40% bonds—delivered an average annualized real return (after inflation) of 9.1%.2

The average tax refund for 2022 is $2,933.3 So if you invested that total amount and received a 7% annual return, for example, it could potentially grow to $11,350 over 20 years. That's the power of compounding growth. Source: IRS.gov, Motley Fool Wealth Management. Data through Apr. 17, 2023

Source: IRS.gov, Motley Fool Wealth Management. Data through Apr. 17, 2023 - Celebrate your good fortune. Splurge and treat yourself (and your family). After all, you’ve worked hard in your life, or maybe you've just been lucky. But if the last two years of the pandemic taught us anything, life is fleeting, and experiences matter, especially with your loved ones. So take a family trip, enjoy a spa or golf day, or even hit up that new trendy restaurant!

- Establish your team. A large lump sum can dramatically affect your trajectory towards your life goals. So, anytime you come into sudden wealth is a good time to examine your supporting wealth team. For example, if you don’t have one, this could be the opportunity to establish advisors and professionals—including a wealth advisor, tax professional, and estate planner—to help navigate and manage your current and future wealth.

Tax strategies in high-earnings years

In addition to the above steps, you'll also want to consider how this lump sum may affect your taxable income. While a tax refund won't increase your taxable earnings, other liquidity events likely will.

Don't wait for the end of the year; start planning for ways to lower your tax burden now. Check out our report, 8 Wealth Planning Strategies to Consider Before Year-End.

Like what you're reading?

Join the thousands of readers getting stories like this delivered straight to their inbox every Thursday — for free. Give it a spin, enter your email to sign up.

Sources:

1 investopedia.com. Data through Dec. 31, 2021.

2 Goldman Sachs Asset Management. The 60/40 portfolio returns reflect a blend of 60% S&P 500/40% Bloomberg US Aggregate Bond Index. Past performance does not guarantee future results. Data Sept. 1, 2011 through Aug. 31, 2021.

3 IRS.gov. Data through Mar. 17, 2023.

Related Articles

.jpg)

Do Elections Matter to Your Portfolio? 3 Reasons We Don't Think You Should Worry

Are you worried about how the upcoming midterm election will impact your investment portfolio? This...

Timing the Market Can Often Mean Missing the Best Days

Watching your portfolio decline is never fun. And when it happens day after day… the pain is...

3 U.S. Market Trends That May Help Build Wealth

Did the 2022 market decline sour you to investing in stocks? That’s understandable. Being trigger...