When individuals consciously think about wealth, they realize it goes beyond the amount in a bank account or the number of possessions they own. Instead, many discover that the intention behind having wealth is about fulfilling a mission—achieving a goal or objective. It's the "why" behind their wealth.

It’s human nature to want to know “why.” Why do we have to clean up? Why do we have to learn chemistry? Why should we wear sunscreen? You'll likely follow through if the "why" resonates with you. But if it's not something you identify with, you'll probably ignore it or simply forget about it.

The same can be true about saving and building wealth. So to answer the why and keep it at the forefront, some families create a mission statement.

What is a mission statement?

Most companies and organizations have a mission statement to describe their purpose and overall intention. It also supports their vision—the organization's ideal state. While the mission statement communicates meaning and direction, the vision should be aspirational.

Part of the mission and vision is identifying the core principles that guide and direct the organization and its culture. These values create a moral compass that underpins decision-making and establishes a standard for assessing actions. Companies that align their efforts, resources, and energy behind their mission, vision, and values tend to make stronger, faster, and more impactful progress toward their goals. It's a powerful tool that we believe individuals can benefit from as well.

Creating YOUR family mission statement

Like companies, your mission statement should be “a formal summary of your aims and values…."1 It should get to the heart of your family's "why." Getting started is not easy for many, which seems weird because it's about your values and goals. But taking an introspective view is not something many people do.

How do you get started?

Identifying your mission may be overwhelming. So instead of trying to think “big picture,” start small. We recommend reflecting on past experiences that felt fulfilling—whether it was a vacation, starting a business, or raising money for charity. Then find the common threads in those experiences.

For example, if you received satisfaction from raising money for charity and acting as a tutor at a low-income school, helping the disadvantaged might be your mission. Or, if going on a vacation with your extended family gratifies you, your purpose may be to organize annual family gatherings to grow family cohesion. Perhaps starting a business that promotes the performing arts is your heart’s desire. In that case, your mission could focus on supporting the arts in your community. Your mission can be whatever fills your life with joy.

But no mission stands alone. Your values are its pillars.

How do you identify your values?

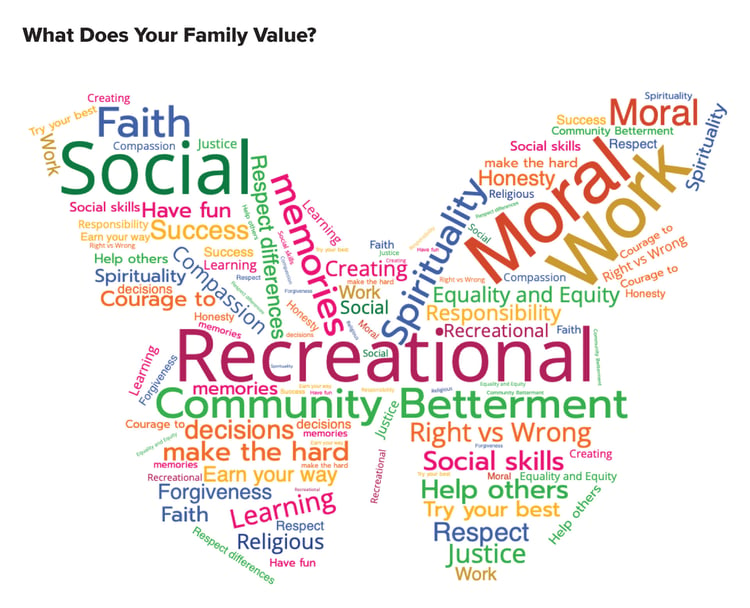

Family principles and beliefs are the core ideals upon which each member conducts their life. But, of course, there are many different values, and no one belief is better or more right than another. It's about what is inherently part of your being and your aspirations.

Unfortunately, no one can tell you what your philosophies are or should be. Identifying your core ideals requires a profound internal discovery and discussions with your loved ones. Here are some categories to help guide your introspection.

This real-life example may help put this into practice: Bill and Melinda Gates and Warren Buffett conceived the Giving Pledge on this notion of purposeful prosperity. Created in August 2010, 40 of America's wealthiest people joined together in a commitment to give the majority of their wealth to address some of society’s most pressing problems. "It is inspired by the example set by millions of people at all income levels who give generously—and often at a great personal sacrifice—to make the world better.”2

So while you may not be a billionaire or a millionaire, the concept still can apply to you. So, if you value community betterment, your mission may be philanthropic—giving away your wealth after accounting for living expenses to help improve the world.

Identified your "why?" Now it's time to figure out the “how”

A part of your mission may only require your time or voice. Volunteerism is one of the best ways to get the whole family involved and to learn valuable lessons about commitment, giving back, teamwork, compassion, and empathy, among others. Or standing up for those who can’t fight for themselves by speaking out or starting a petition. Encourage your children to stand up to bullies or run for student government so they can positively impact the lives of their peers.

These are all great endeavors, but most elements of your mission may require some good, old-fashioned moolah to bring them to fruition.

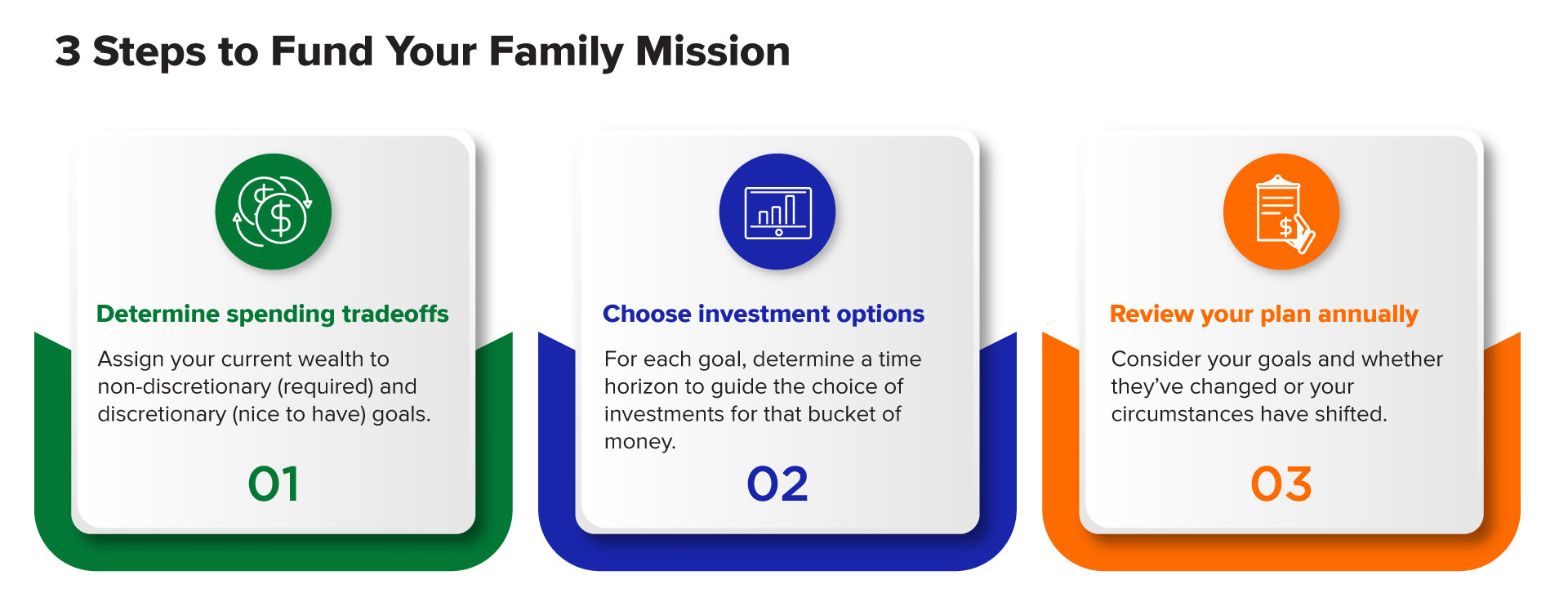

And for that, you’ll need a solid financial plan. We look at a three-step process to fund your family mission:

But above all else, and regardless of how you devise your financial strategy to fund your mission, knowing what you’re setting out to accomplish—your mission—should be your guidepost to finding prosperity with a purpose.

But above all else, and regardless of how you devise your financial strategy to fund your mission, knowing what you’re setting out to accomplish—your mission—should be your guidepost to finding prosperity with a purpose.

Like what you're reading?

Join the thousands of readers getting stories like this delivered straight to their inbox every Thursday — for free. Give it a spin, enter your email to sign up.

Related Articles

5 Money Tips For 2023 And Beyond

You might be surprised at how few New Year's resolutions are actually achieved (or maybe you know...

The MEGA Backdoor Roth: How to Save An Extra $43,500 Each Year

Roth IRAs are a favorite among retirement savers who want predictable retirement income. While...

Retirement Planning for Public Employees

Are you eligible to retire from serving as a public employee, but wondering if you can afford to...