In her song “jealousy, jealousy,” pop singer Olivia Rodrigo croons: “Their win is not my loss. I know it's true, but I can't help getting caught up in it all. Comparison is killing me slowly.”

While Rodrigo is singing about being under the microscope and living up to external expectations, we believe the parallel with measuring portfolio performance is striking. Because investors often compare their portfolio's performance to others. But that may not be the right way to assess their returns. So how do you know if your portfolio is performing well?

Common portfolio performance measures

There are two customary ways to evaluate portfolio performance. The first, known as relative performance, looks at how well a strategy performs compared to a similar portfolio or benchmark.

Regularly referred to as “beating the benchmark,” relative performance is often used to tout portfolio manager skill. If a strategy can produce better returns than a similar one, it most likely is a result of superior management. This claim isn't necessarily wrong. But there is an important consideration: Is the comparison appropriate? For example, suppose a U.S. large-cap strategy strives to outperform the U.S. stock market by 2% per year (after fees and expenses). In that case, comparing itself to the S&P 500 could be valid. On the other hand, measuring a portfolio composed 70% of stocks and 30% of bonds to the S&P might not make sense.

Some funds don't try to match up to a particular index. Instead, they may endeavor to deliver a specific return objective regardless of how the market or other funds perform. This type of performance is called absolute performance. So instead of measuring returns relative to another fund, these funds aspire to return a particular amount over a specified period of time. For example, a private equity fund may target a 10% return over the fund's life.

Both of these portfolio performance measures have a purpose. But do they truly answer the question of how well a portfolio is performing? The unfortunate answer is: Not always. For example, is your portfolio doing better when the absolute performance is high or relative performance is strong? It depends.

Relative vs. absolute performance: Which is best?

In strong markets, absolute performance tends to be high, and in weak markets, it tends to be low or negative. But on a relative basis compared to a benchmark, you may outperform or underperform in that comparison regardless of the market environment. So how do you assess whether your portfolio is doing well?

Let's walk through an example:

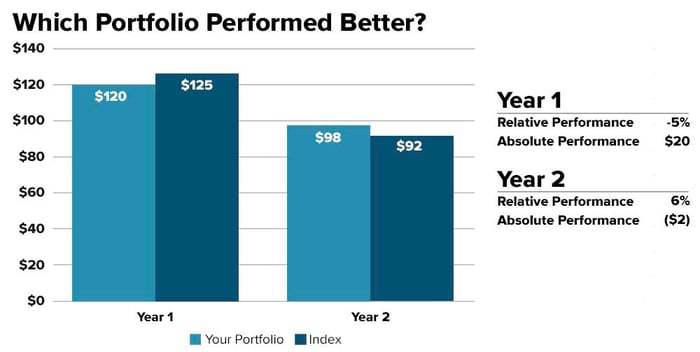

You invested $100 in a retirement portfolio. In Year 1, the benchmark index was up 25%, while your portfolio returned 20%. So you made money in Year 1, but not as much as if you invested in the benchmark index. But in Year 2, the benchmark index was down 8%, while your portfolio fell by 2%. So you lost money, but not as much as those invested in the benchmark index.1 Which year did your portfolio perform better?

This is for illustrative purposes only. Initial asset value equals $100. Example ignores fees, taxes and other costs, and compounding. Example also assumes investors can directly invest in an index, which in reality, is not the case.

Relative performance says that Year 2 was better. Your portfolio outperformed the benchmark index by 6%. But, it lost money. Conversely, absolute performance says that Year 1 was better. So, even though your portfolio underperformed the benchmark index, it increased your wealth! But more relevant to most long-term investors is that your portfolio did better than the benchmark index over the aggregate 2-year period on both a relative and absolute basis.

Proponents of relative performance argue that this method effectively neutralizes factors outside of all managers’ control and focuses on the managers' skills. In other words, even if performance is negative, if your portfolio was down less than the benchmark index, then some believe the manager did a good job. But relative performance doesn't tell you about the impact on your wealth.

On the other hand, absolute performance measures performance in terms of real money—by assessing how much money you made or lost. That absolute return number translates into real money for the investor. But measuring portfolio performance in absolute terms in isolation still doesn't tell individuals if they are on track to meet their wealth goals in the long term. Because wealth planning is more than just investment returns.

Are you on track?

In our opinion, a comprehensive wealth strategy starts with discovering who you are, how you want to live, and what level of assets are needed to meet your goals.

Once you define your goals and objectives, we believe understanding risk tolerance and capacity is the next step. Risk tolerance refers to how much potential downside you can take before constant worry keeps you up at night. On the other hand, risk capacity refers to your ability to afford potential losses.

From there, develop an appropriate asset allocation. In simple terms, asset allocation is the percentage of each asset class in your portfolio. It allows investors to “balance out” their portfolios' potential risks and returns. We believe there are six steps to finding your optimal asset allocation.

Wealth strategy should shift as life circumstances evolve—life is not static, so your wealth strategy shouldn't be either. For example:

- Has your or a family member’s health changed?

- Has your wealth significantly increased or decreased?

- Have you experienced a life change? Examples include employment status, marital status, living arrangements, births or deaths, or legacy aspirations.

It's vital to assess your wealth plan at least annually. Understanding whether your investment strategy is generating the returns necessary to hit your plan's financial targets is part of that assessment. But unfortunately, neither relative nor absolute performance metrics fully answer that question.

Portfolio performance should be about you

Assessing performance for a comprehensive wealth plan that combines several strategies is not straightforward. In place of an appropriate index, some firms may use a broad market index or blend several benchmarks to mimic the characteristics of a personal portfolio.

We believe an even more direct approach may be to compare expected to actual asset growth. For example, how much did your wealth change over the period? If your asset growth is in line with your plan and there are no changes to your life circumstances, no investment changes may be needed. But if life changes or asset growth differs significantly from expected—either by more or less than anticipated—then changes may be warranted.

In our view, by measuring portfolio performance relative to your wealth plan, you will know if you are on track. In this way, your portfolio performance measures less about the fund managers and more about you.

Like what you're reading?

Join the thousands of readers getting stories like this delivered straight to their inbox every Thursday — for free. Give it a spin, enter your email to sign up.

Footnotes

1For this example, we are ignoring fees, taxes and other costs, and compounding, and we assume investors could invest directly in an index, which in actuality, is not available.

Related Articles

Wondering When You May Recover Your Market Losses?

2022 has been a strange year so far. It almost feels like the lethargy that follows an endorphin...

Should You Have Bonds in Your Investment Portfolio?

88%. That’s the percentage of return that comes from asset allocation for most investors.1 So it’s...

When is it Time for a Portfolio Tune-Up?

Buying a new car is a big expense, and it takes time and effort to find the perfect one. Once...