Since the early 2000s, high-growth and quality stocks often seemed like one and the same. What kinds of companies did this pairing represent? Ones that we use every day—like Amazon, Apple, Microsoft, Facebook, and Google,1 among many others. So while these technology companies delivered high-flying growth, they also created and frequently led new markets, had pricing power, and moved from luxuries to necessities—the exact definition of quality.

Their dominance was pronounced through the bull market that followed the 2008 Global Financial Crisis. And because bull markets tend to have a “rising tide lifts all boats” atmosphere, other technology companies rode their coattails. But many of these other businesses did not represent quality—because they failed to operate profitably, did not have strong management teams, and lacked robust competitive dynamics. Yet they did exhibit high growth!

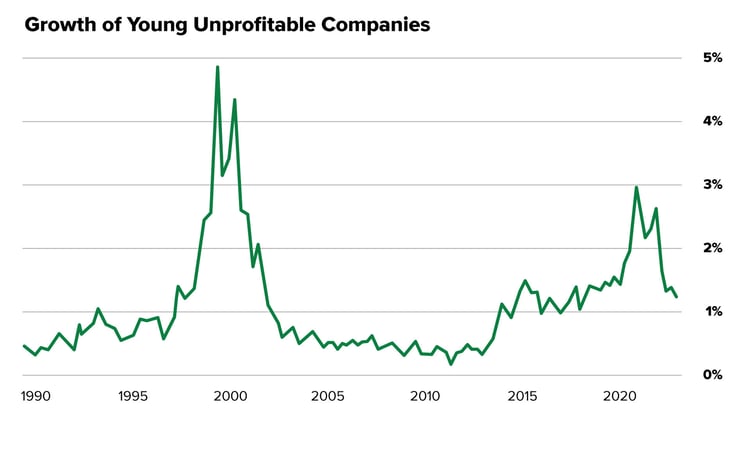

In 2021, the performance separated and growth pulled ahead of quality. Some of the biggest gainers were unprofitable tech companies that exhibited high growth, but low quality.2

Source: Factset, JPMAM.. As of Dec. 27, 2022. Young unprofitable companies defined as having negative net income two out of three years, less than five years since IPT, and annual revenues growing >15%. Chart shows % of equity market capitalization.

Source: Factset, JPMAM.. As of Dec. 27, 2022. Young unprofitable companies defined as having negative net income two out of three years, less than five years since IPT, and annual revenues growing >15%. Chart shows % of equity market capitalization.

In 2022, the market slaughtered these unprofitable companies. But since investors were running scared, it also killed the profitable, quality companies. However, we liken investing to the Indianapolis 500. And this period was just one lap in the race.

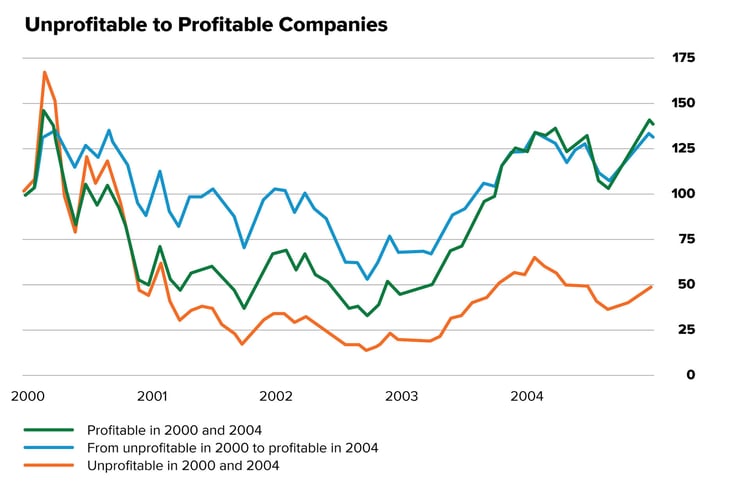

Companies with short-term growth—especially those propelled by a single factor, like the reopening of the economy, or who purchased growth through the use of cheap debt—without an underlying profitable business will probably hit the skids over the long term. This is especially true in today's environment, where interest rates went from almost zero to nearly 5% over the course of one year. Surprisingly, we believe not all unprofitable companies are of low quality. Lessons from the dot-com bust of 2000 show that if an unprofitable company becomes profitable in a few years, its returns could mimic other profitable companies.

Source: Factset, JPMAM. Profitability measured as positive or negative net income in Q1 2000 and Q4 2004. Stocks with market cap>$400M. Index of equal-weighted large-cap tech stock returns (100+Jan. 2000).

Source: Factset, JPMAM. Profitability measured as positive or negative net income in Q1 2000 and Q4 2004. Stocks with market cap>$400M. Index of equal-weighted large-cap tech stock returns (100+Jan. 2000).

But sustainable growth businesses should thrive. And that can be the difference between pulling ahead for a lap and winning the race.

Some “quality” investors only look at return on equity (ROE), earnings growth rate, or margins at a single point in time. But to better analyze future growth, other factors—like how a company positions itself versus the competition or if its product or service represents a shift in consumer behavior—must also be considered.

Unfortunately, this style of investing doesn’t get rewarded immediately. It can take a while to play out and requires a long-term focus.

That’s because high-quality companies don’t lap others all the time when especially short-term disruptions or near-term macroeconomic forces are thrown in their path. But they have the potential to maneuver around these roadblocks and speed ahead over the long haul. In that way, truly high-quality companies often leave the competition in the dust when the race flag switches from yellow back to green.

Like what you're reading?

Join the thousands of readers getting stories like this delivered straight to their inbox every Thursday — for free. Give it a spin, enter your email to sign up.

Footnote

1Certain of our Personal Portfolio strategies may hold Amazon, Apple, Microsoft, Facebook, or Google. This message is not a recommendation to buy or sell any security (including, without limitation, Amazon, Apple, Microsoft, Facebook, or Google) by Motley Fool Wealth Management. The security identified and described in this article does not necessarily represent the securities purchased or sold for our portfolios. You should not assume that an investment in this security was or will be profitable, and there is no assurance, as of the date of this message, that the security has been or will be in any model portfolio. Rather, the discussion is solely intended to describe the up and down movement of stock prices over time.

2FT.com, Jan. 20, 2021

Related Articles

Periodic Underperformance is Common…and Expected

Being good at what you do doesn’t mean you win all the time. Even the greatest quarterback of all...

In Active vs. Passive, the Economy May Deliver the Knockout Punch

The S&P 500 fell over 19% in 2022. Unfortunately, those investors tied to the S&P 500's performance...

ETF vs. SMA: Which is Right for You?

The financial industry never stops evolving. In the ‘70s, mutual funds boomed. In the ‘90s,...