The S&P 500 fell over 19% in 2022. Unfortunately, those investors tied to the S&P 500's performance through passive index strategies, like ETFs and some mutual funds, fell in lock-step. That's because these types of passive funds aim to mimic an index but not beat it.

This market decline has prompted some investors to rethink their investment strategy. These questions are at the heart of their reflection: Are you satisfied with getting market-like returns with market-like risk? Or do you desire the possibility of achieving a more substantial return?

The answers could point investors toward a market-like strategy — like a passive index mutual fund or ETF — or an active manager who hand-picks securities aiming to achieve a return greater than the market. Below we discuss some key differences.

Humans Lead Active Management

A primary distinction between active and passive management is decision-making. Passive strategies usually construct a portfolio that mimics a selected benchmark. As a result, the level of human judgment can be minimal regardless of what is going on in the market. Contrastingly, a team of investment professionals focused on choosing securities, constructing an optimal portfolio, and rebalancing to maintain appropriate risk and return targets manages active portfolios.

In other words, in actively managed portfolios, the team of research analysts and portfolio managers first assesses the market environment and the competitive landscape. Then they pick securities that they believe could generate strong returns over the life of the holding.

But picking winners is not their only objective. Active managers also need to walk a tightrope between risk and return to deliver the highest risk-adjusted return possible. That means constructing a portfolio of securities that should work together to provide their intended investment objectives.

Adding Risk to the Equation

Walking that tightrope between risk and return can be critical for investors.

In general, to achieve a higher return, an investor likely needs to take more risk. But sometimes, the risk is too high for the return earned. Part of an active portfolio manager’s job is to do their best to pick the “right” stocks. But it’s also about putting the securities together in the optimal combination to achieve proper diversification potentially. In addition, active managers monitor sector, industry, and geographic exposures to decrease the chances they’re caught off-guard by unintended risk.

Of course, no fund can remove all risk. Even passive strategies have some level of risk. But because they often hold a hundred or more securities, index-like funds are viewed as less risky than more concentrated, active portfolios.

But holding a large number of securities cannot diversify market risk. In addition, data show that owning at least 10 securities diversifies roughly 80% of stock-specific risk.2 That means high-conviction strategies may not be riskier than ones that hold hundreds of names.

Potential Benefits of Active Management: A High-Conviction Approach

Many passive strategies make little to no effort to differentiate winners from losers among the hundreds of stocks they hold. On the other hand, active managers often attempt to whittle down the universe and pick the companies they feel are best. And while some active investment managers may invest in upwards of a hundred names, others are more discerning—holding a more concentrated basket of stocks.

Although these stocks may hit a few speed bumps along the way, they may also have competitive advantages that could translate into more robust returns. And because there are only a small number of stocks, the individual performance of each company can result in a big difference, opening the door to potentially generating outsized returns.

Potential Drawbacks of an Active Investing Approach

Like all investing approaches, active is not without its flaws. First, there's usually a higher cost, generally to pay for the team of professional researchers and analysts.

Second, some active strategies may have a high turnover of securities, which may hurt after-tax returns. However, not all actively managed funds have high turnover—some may have long average holding periods. These are often referred to as long-term or buy-and-hold.

A Look at How Performance Compares

At the end of the day, investors want to know how their money is doing regardless of the type of strategy employed. So how does the performance of actively managed portfolios compare to passive ones?

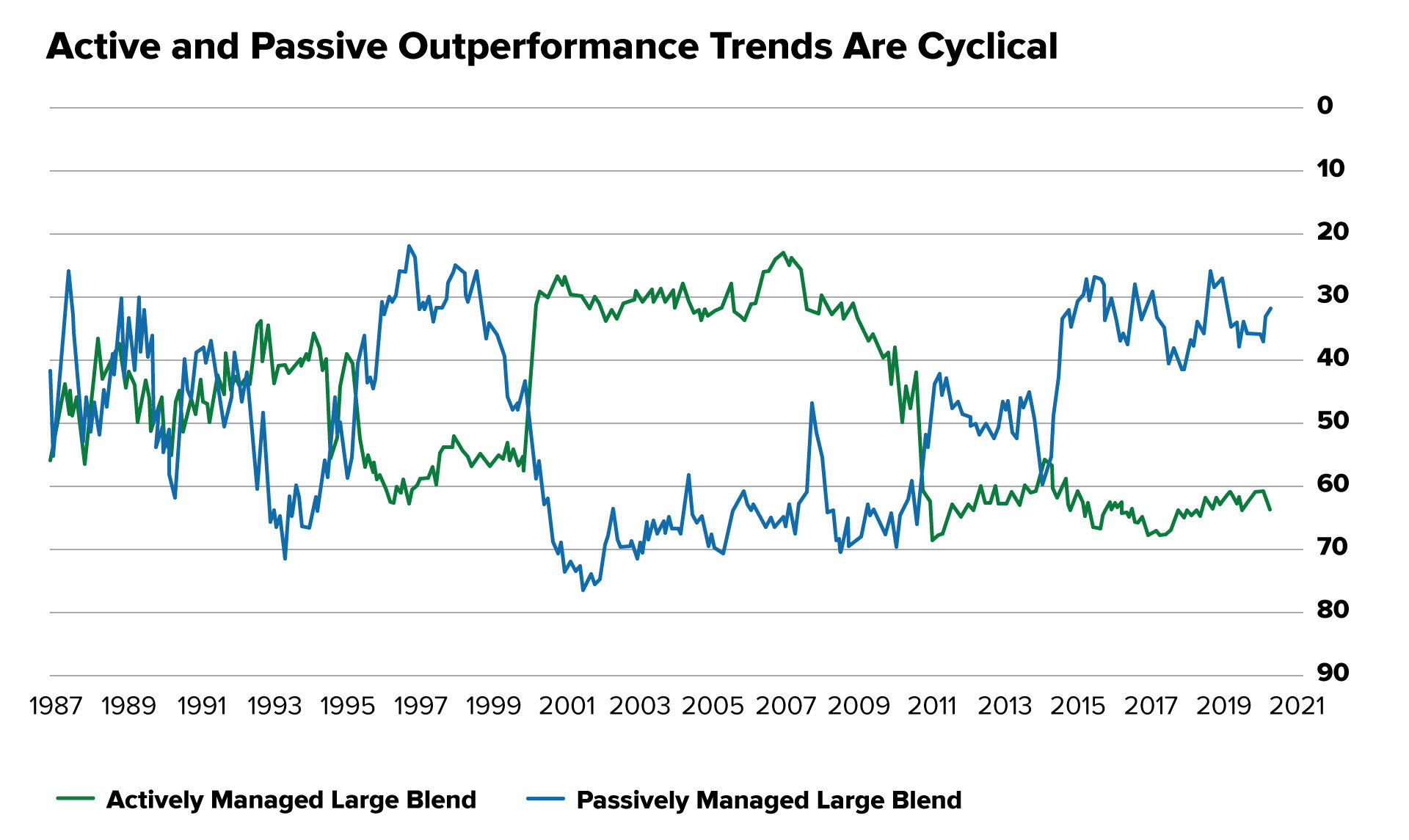

Interestingly, it depends. The ability to “beat the benchmark” is influenced by economic and market conditions during a given period. And because the economy and markets tend to be cyclical, one approach never works best all the time.

Source: Morningstar and Hartford Funds, 2/22. Chart shows rolling monthly 3-Year periods (1987–2021).

For example, disruption and the failure of many tech companies, higher dispersion between winners and losers, and greater volatility characterized the decade following the dotcom crash in 2000. As a result, active managers beat the index in eight out of the next 10 years.

Similarly, the recession of the early 1990s was an outgrowth of the Savings & Loan Crisis and rising interest rates in the late 1980s, followed by Iraq's invasion of Kuwait, which drove up the price of oil, decreased consumer confidence, and exacerbated the downturn that was already underway. In that period, active managers outperformed in three out of the four years.

Conversely, passive managers tend to perform better in periods of low volatility and an upward-moving market, like in the late 1990s and the decade following the GFC.

Why does the economic and market environment influence active vs. passive management?

In an environment of low inflation and interest rates, many companies—regardless of quality—can perform well. Borrowing money is nearly free, and financing a business on debt can allow it to grow, even if that model is unsustainable in the long run. The period following the GFC illustrates this: "Free" money supported the economic recovery, which helped drive the stock market higher. When most stocks perform well, investors do not necessarily need to discriminate between strong and weak companies, and passive investing often outperforms. But that period ended in 2022. As a result, active funds performed better in 2022—with 34% more beating the benchmark than they did in 2021.3

Further research demonstrates that the number of stock “home runs”—that is, a stock that outperforms the benchmark by 25% or more—indicates whether active or passive does better. The reason? A large percentage of home runs signals dispersion in stock returns. “High dispersion should benefit active managers who can single out the winners, whereas a low number of home runs indicates stocks are moving together, which typically benefits passive management.”4

For example, the dotcom crash saw the highest number of home runs from 1986 through 2020. As a result, upwards of 80% of active managers beat the market during that time. But in 1998, when the number of home runs was the lowest of those 35 years, only 20% of active managers outperformed.5

A Turning Tide?

Many things in life move in cycles. For example, 1990s fashion is back in full force. Singer/songwriters are tearing up the charts while pop stars, known more for their coordinated dancing than singing, are on the back burner. The economy also moves in a cycle. But just like no one knows when mom jeans will be out of fashion again, it's hard to predict with certainty when the economy will shift course. That's why investors need to weigh the costs and benefits of their investment strategy—because no one approach performs best all the time.

Today, the economic environment is shifting. In response to persistently high inflation, the Federal Reserve began hiking rates in 2022 and has moved the target rate from 0.08% in January 2022 to 4.57% in February 2023.6 The magnitude and speed of these hikes are changing the landscape for many businesses.

When rates rise, the cost of capital will become more expensive. Therefore, not every business can finance its future operations through debt alone. And when inflation rises, everything from raw materials used to manufacture goods to finished products becomes more expensive, resulting in lower consumer purchasing power and ultimately, the possible reduction of company profits.

As a result, there will likely be a broader disparity between quality businesses that will probably be the winners in the next business cycle and companies that fail to survive. It’s the job of active managers to weed out the losers.

The question you should ask yourself now: Is my portfolio managed to navigate, and potentially capitalize on, shifts in the market?

Like what you're reading?

Join the thousands of readers getting stories like this delivered straight to their inbox every Thursday — for free. Give it a spin, enter your email to sign up.

Footnotes

1cnbc.com, Jan. 31, 2022

2jstor.org, Nov. 2006

3bloomberg.com, March 7, 2023

4selectfunds.com, Jun. 2019

5Factset, Morningstar, and Hartford Funds, Feb.2021

6FRED, March 13, 2023

*We tailor our asset allocation recommendations for each client. However, our selection of individual securities is not personally tailored to client accounts. Rather, the individual securities purchased and sold for client accounts are based upon and track the holdings in our Model Portfolios which correspond to each strategy.

Related Articles

Recession: A Stock Picker’s Paradise?

Some people compare investing to the game of darts. During strong up markets, it can appear easier...

Market Declines Are Expected, and Planned For

Watching the market fall is tough, especially if you are near or in retirement—no ifs, ands, or...

The Market Explained in Two Charts

Over the last several months, we’ve talked about two themes that, in part, drove the market higher...