Note: This is part one of the two-part Investing for Women series, where we explore how money and investing impact women’s lives.

Replacing the old-time notions of who controls the purse strings will take time. Women have confidently run their households for generations, performing tasks such as balancing the checkbook or managing the everyday budget. But when it comes to investing, they’re less sure, especially about long-term financial planning. So, why do only one-third of women see themselves as investors, and even fewer, as “confident” investors, when they’ve been the long-standing CFOs of their households?

Noodle on this stat for a minute: A mere 9% of women think they are better investors than men.1 Let’s flip that around and say it this way: 91% of females think they are worse investors than men. Yet, evidence shows the opposite is true. So where’s the disconnect?

Apparently, it’s not desire. 64% of women would like to be more active in their finances, including investment decisions.2 So what holds many of them back? They aren’t clear on the next steps they should take to invest.

Source: Fidelity Investments, 2021 Women and Investing Study

There’s a knowledge gap based on income. Nearly one-half of women with income over $100,000 report that they know what steps they need to take to invest in the stock market, whereas only one-third of women with income under $100,000 say the same.2

A generational difference also exists. While most married millennial women tend to take the lead on all financial decisions, less than 30% of married baby boomer females hold the financial reins in their households.2

It’s important to uncover and correct this disconnect because women need to be more confident and active investors, for one simple reason—longevity.

Women need more retirement savings.

Women live longer than men—by five years, on average—so they need more money to live. They're also the primary caregivers for their families. So their resources go towards caring for others, and their own care since their spouse often dies earlier than they do.

Their longer lives and caretaking roles often leave women with more worries than men—from healthcare and outliving their assets to paying day-to-day expenses. Sadly, those concerns keep many women up at night.

But they also make them more likely to anticipate and plan for critical events and life stages. And that leads to one thing women seem to be getting right about investing: A goals-based approach.

How women invest: A goals-based approach

Women tend to invest for specific goals–whether they aim to support a post-retirement lifestyle, endow a family business, leave a legacy, or make a social impact in their community or the world—rather than just focus on the numbers. We say they are getting this right because a goals-based approach is one of our core tenets. We believe wealth planning should start with an individual’s unique goals, and those objectives inform their investments.

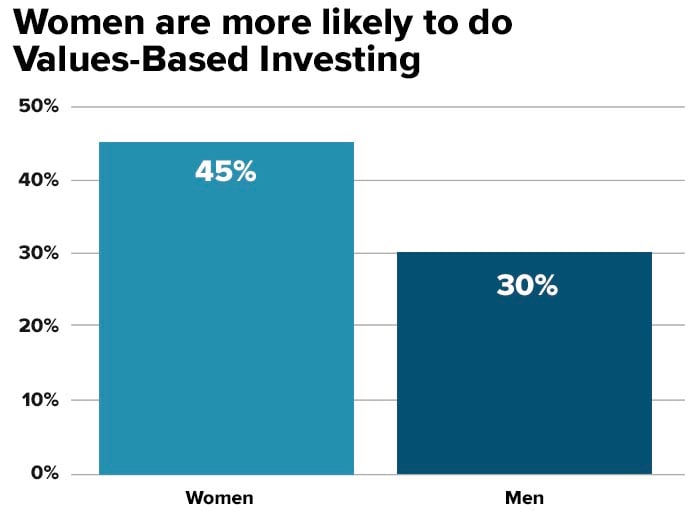

For example, women are also more likely than men to invest on the basis of their values as opposed to investing solely for performance. Specifically, 64% of women3 said that they factor environmental, social, and governance (ESG) concerns into their investment decisions.3 However, in younger generations, both men and women possess similar views on investing, including a shared purpose-driven preference.

Source: BCG Survey. "Thematic topics" include such things as the environment, sustainability, new technology, and social justice. Survey comprised individuals with $250,000 to $1 million in bankable assets.

With that said, like men, women also value performance.

The difference is that women are more likely to dig in deep, push back, and ask questions to better understand how an investment impacts their short-term and long-term goals. What about risk?

Although both men and women are willing to embrace risk, women tend to be more hesitant because of uncertainty.

So do women think differently about wealth and investing?

Perhaps, to a degree. But that doesn’t mean they need different investment products or services. Instead, they just need wealth tailored for their objectives and personal goals. And that’s where a wealth advisor can help.

We mentioned that women are less confident in their knowledge to make informed investment decisions. That doesn’t necessarily mean they are more risk averse than men. What it can mean is that they just want more guidance and help modeling the impact of different priorities to focus on goals-based investing.

Wealth Advisors, like those at Motley Fool Wealth Management, design a customized wealth plan that accounts for each individual’s circumstances and risk factors. Importantly, this personalized plan is centered around the individual’s unique goals.* The strategy considers both long-term objectives and near-term spending needs to help instill confidence that women can live comfortably today but also strive toward tomorrow’s wealth aspirations.

In part 2, we examine the one investment change most women should consider to boost their confidence that they’ll meet their wealth goals. Hint: Think stocks.

Like what you're reading?

Join the thousands of readers getting stories like this delivered straight to their inbox every Thursday — for free. Give it a spin, enter your email to sign up.

Related Articles

Investing for Women: One Key to NOT Outliving Your Assets

Note: This is part two of the two-part Investing for Women series, where we explore how money and...

The Market Explained in Two Charts

Over the last several months, we’ve talked about two themes that, in part, drove the market higher...

Quality vs. Growth: Is One Better For Your Long-Term Wealth?

Since the early 2000s, high-growth and quality stocks often seemed like one and the same. What...