What can you do with your required minimum distribution (RMD) if you don’t need (all of) it?

That question was a topic of conversation we had with several clients recently. Most believed that the only solution was to convert their retirement accounts into a Roth IRA. However, we think that's not the only solution.

Does converting to a Roth IRA make sense to eliminate RMDs?

Converting to Roth IRA to avoid RMDs may make sense for some. It removes the mandate of annual distributions, but when you convert, you have to pay tax on the amount you shift. So there are situations when this may be beneficial and others where it may not.

For instance, if you want to leave a legacy to your heirs, then a Roth IRA may be an optimal account choice because the money grows tax-free forever, even after you gift it.

But a Roth IRA may not make sense if you want to donate your wealth to charity. Why? Because it contains after-tax income. Charities are tax-exempt entities. This means that because you already paid tax on the Roth IRA assets, you're essentially donating less than if you gift tax-deferred monies (like from a traditional IRA).

Converting to a Roth IRA (whether doing it via a backdoor or straight up) may be difficult because of restrictions and limitations. And, even if you do convert, you may not need to move everything. Instead, we recommend keeping the amount you need for your life's daily living expenses in a tax-deferred account and converting the rest.

Let's walk through an example. Dan and Taylor, both age 62, expect to spend $100K each year on living expenses. They receive $25K from Social Security and need $75K from RMDs. Their Wealth Advisor helps them determine how much they should keep in their traditional IRA and what they can convert.

- Using the RMD table factor for the first year (27.4), their Wealth Advisor calculates that they need $2.1 million in their traditional IRA at age 72.

- Using the rule of 72, she then shows that their traditional IRA will double by age 72 (10 years from now) and generate a rate of return of 7.2%

- Therefore, Dan and Taylor should target a balance of $1 million in their traditional IRA and convert the rest.

An Alternative Solution for Non-Needed RMDs

Converting to a Roth IRA may make sense when you intend to leave a legacy for family or friends. But for charitably minded individuals, an alternative is to keep your assets in your tax-deferred retirement accounts and make a qualified charitable distribution (QCD) instead of taking your RMD.

In other words, a QCD may be a better planning solution than a Roth IRA conversion in cases where you...

- would like to donate to charity during your life, or

- do not have heirs, or do not prioritize leaving money to heirs.

QCDs also allow more flexibility than a Roth IRA. For example, the amount of QCDs can also be adjusted on a year-to-year basis according to your charitable goals and spending needs, whereas a Roth IRA conversion cannot be undone after the fact.

What is a qualified charitable distribution?

QCDs are gifts to qualified public charities that, when done correctly, count toward your RMD amount each year. And more importantly, QCDs cancel out any tax you would have to pay on the RMD.

The key to making a legal QCD that may reduce your tax is transferring your donation directly from your tax-deferred account into a qualified charity’s account—without moving the money into any of your other personal accounts.

If you were already going to make charitable donations, then this direct transfer turns two steps into one simpler step.

Which reduces tax burden more: A QCD or cash donation?

Suppose you take your RMD as taxable income, then make a charitable cash donation equal to your RMD and itemize the gift as a tax deduction. The itemized deduction will reduce your income by the same amount as the RMD. Wouldn't making a QCD have the same outcome, so long as the amounts were the same?

Actually, no.

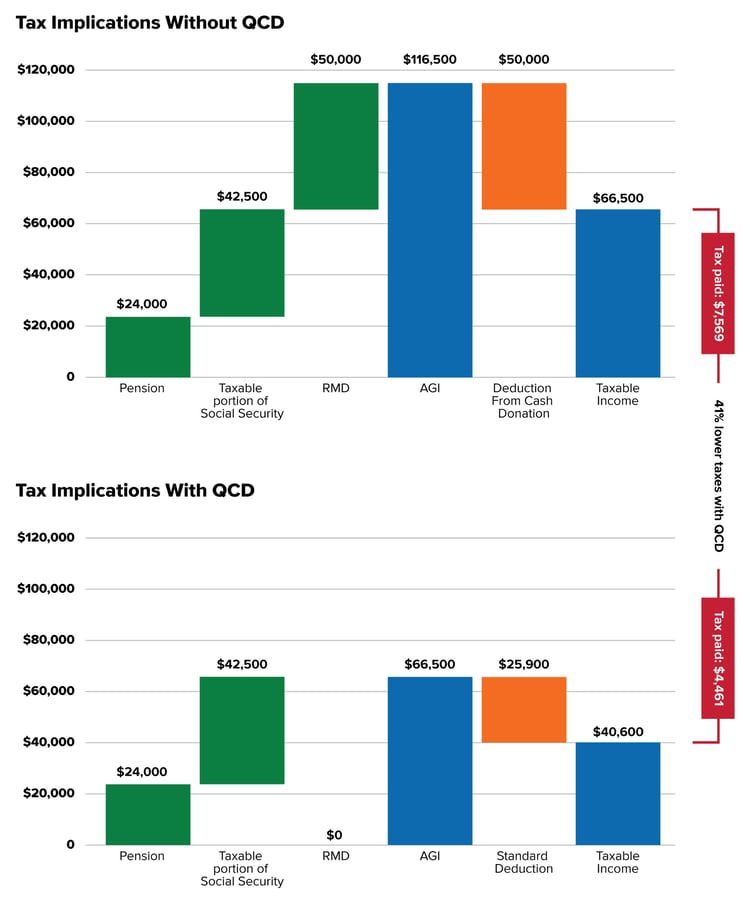

Let's take another example, Joe and Corinne, a retired couple weighing their options on making a $50K donation to their favorite charity. They planned on gifting cash, but their Wealth Advisor explained there could be a better way.

Let’s say they file their taxes jointly. They have a combined annual income of $24K from a pension, $50K in Social Security income (of which 85%, or $42,500, is taxable), and $50K of RMDs. Remember, RMDs are considered income and taxed at ordinary income rates.

Their Wealth Advisor computed two scenarios:

- Withdrawing their RMD, making a cash donation of $50K, and taking it as an itemized deduction on their tax return

- Making a QCD of $50K and taking a standard tax deduction

Here are the results of her analysis:

This analysis is hypothetical and for illustrative purposes only. For guidance and advice on taxes, consult your tax professional.

This analysis is hypothetical and for illustrative purposes only. For guidance and advice on taxes, consult your tax professional.

In both scenarios, Joe and Corinne gift $50K to their favorite charity. But by making the QCD instead of a cash donation and taking the standard deduction, Joe and Corinne lowered their taxable income by the amount of the standard deduction, $25,900, resulting in paying $3,108 less in taxes—a 41% reduction.

There’s another important consideration–your healthcare costs. Making a QCD that reduces taxable income may mitigate your exposure to Medicare Parts B and D income limits. In other words, the lower your income, the less you pay in Medicare premiums. So a benefit of making a QCD instead of taking an RMD is it may reduce the amount you pay for health care each year. For reference, the difference between the lowest and the highest Medicare Part B premium comes out to $4,898.40 annually per person. (So, double that if you’re a couple.)1

Follow These Guidelines to Make a QCD

Your situation will probably differ from our example. But you may be one of the many people for whom using a QCD method of donation could result in tax savings.

Here are a few guidelines for using QCDs to lessen your tax burden:

- Transfer your donated money directly to the charity from your IRA (Donor-advised funds and private foundations do not qualify as a charity for this purpose.).

- Donate the gift by December 31 (not April 15).

- Contributing to your IRA may reduce the amount you can gift to a charity.

- The maximum amount each person can contribute through a QCD per year is $100K.

As always, we recommend you consult your tax professional and Wealth Advisor for guidance.

Like what you're reading?

Join the thousands of readers getting stories like this delivered straight to their inbox every Thursday — for free. Give it a spin, enter your email to sign up.

Footnotes

1medicare.gov, accessed Oct. 2, 2022

Related Articles

Making Sense of Required Minimum Distributions

The government wants you to save for retirement. That’s why many people believe retirement savings...

RMDs Are Mandatory, But Here’s What You Can Control

You must start withdrawing from tax-deferred retirement accounts at a certain age, but there are a...

Could an In-Service Distribution Be a Good Idea for You?

If you have a retirement plan at work — especially if you're at least 59 ½ years old — you may have...

.jpg)