"I want to avoid paying taxes, so I'm going to move all my IRA money into a Roth IRA.” Does this sound familiar?

We’ve heard this from many clients over the years. And for some, this may make perfect sense. But for others, it may not. The crux of the issue is tax optimization: Which is better—small tax payments over time (via traditional periodic distributions) or one large tax payment immediately (Roth conversion)?

What’s the breakeven?

Taxpayers can convert a traditional IRA into a Roth, even if they’ve started taking their required minimum distributions (RMDs). However, a taxpayer cannot switch just the annual RMD into a Roth.

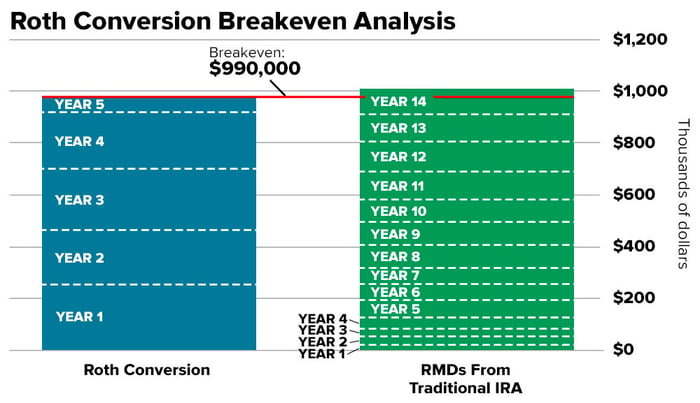

One way to assess whether a Roth or traditional IRA could be best suited for an individual’s situation is to look at a break-even analysis, which examines the point at which profit and loss are equal.

Consider the following hypothetical example:

David and Janice, both in their mid-70s, were contemplating moving their traditional IRA assets into a Roth. The reason was simple: Their RMDs from a traditional IRA exceed their living expenses. In addition, by having a higher income, they may be subjected to increased Medicare premiums or a higher hurdle for deducting medical expenses on their tax returns. But by moving their assets to a Roth, they would not be required to take—or pay taxes on—distributions they did not need.

In this scenario, a Fool Wealth planner can assist with performing a breakeven analysis. Notably, this example assumes that leaving a legacy was not a priority for the clients. The results from this analysis are as follows:

The analysis shows that David and Janice's breakeven for a Roth conversion would be 14 years. So each would be well into their 80s before the switch made tax sense.

The analysis shows that David and Janice's breakeven for a Roth conversion would be 14 years. So each would be well into their 80s before the switch made tax sense.

Roth or traditional? How about both

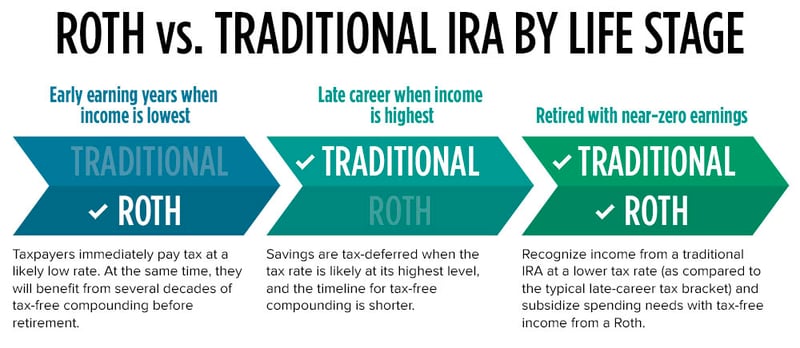

Interestingly, many taxpayers think of this decision as an all-or-nothing shift. However, for some, the optimal solution may be a mix of both. That way, individuals could take deductions at the highest tax bracket while working and recognize income in the lowest tax bracket in retirement. This tax-arbitrage strategy is lost if 100% of assets are in only one approach.

The chart below may help distinguish between the choices depending on an individual’s life stage.

A muddy decision

A muddy decision

While converting to a Roth appears to be the financial move du jour, the decision should be highly individualized based on income level and resultant tax status. For some, the choice is straightforward: Roths make sense earlier in careers while traditional IRAs are better-suited for the late-career stage and into retirement.

But for many individuals in between, there’s no one “right” solution. That's why it's essential to look at it from all angles and perform a breakeven analysis. This is especially critical if there’s a desire to leave a legacy, concerns about estate taxes, or other factors that may muddy the decision.

Fortunately, a financial planner can consider the situation from a holistic wealth plan perspective and make an informed recommendation. Because at the end of the day, a Roth vs. traditional IRA is just one spoke on the wealth planning wheel.

Like what you're reading?

Join the thousands of readers getting stories like this delivered straight to their inbox every Thursday — for free. Give it a spin, enter your email to sign up.

Related Articles

Finding Retirement Income in a Down Market

.jpg)

Planning Your Retirement Income? 3 Things to Know

Will I have enough retirement income? This is one of the most common concerns people have. And so,...

2 Layers of a Sustainable Retirement Investment Strategy

What does your pie-in-the-sky retirement look like? For some, it’s buying an RV and traveling the...