Americans love the feeling of exclusivity. E-commerce giant ETSY* understands that all too well and has made a business of matching unique, handmade crafts with buyers who seek one-of-a-kind products.

In the world of investing, some investors also desire one-of-a-kind portfolios designed for their unique goals and objectives. But, most are invested in pooled investments, like mutual funds, exchange-traded funds (ETFs), or even real estate investment trusts (REITs).

So instead of getting a one-of-a-kind portfolio, they’re just one in a million…literally

Pooled investment vehicles work like this: They aggregate investment dollars from many individual investors with a specific investment purpose in mind. Mutual funds, hedge funds, exchange-traded funds, pension funds, and unit investment trusts are all examples of professionally managed pooled funds. If you are an investor in a pooled fund (401(k), anyone?) you get the benefit of economies of scale—which allows for lower trading costs per dollar of investment—and diversification.

That’s great, but as just one in a million, you may be not getting what you truly need. But with a separately managed account (SMA), your investments are designed specifically for you.

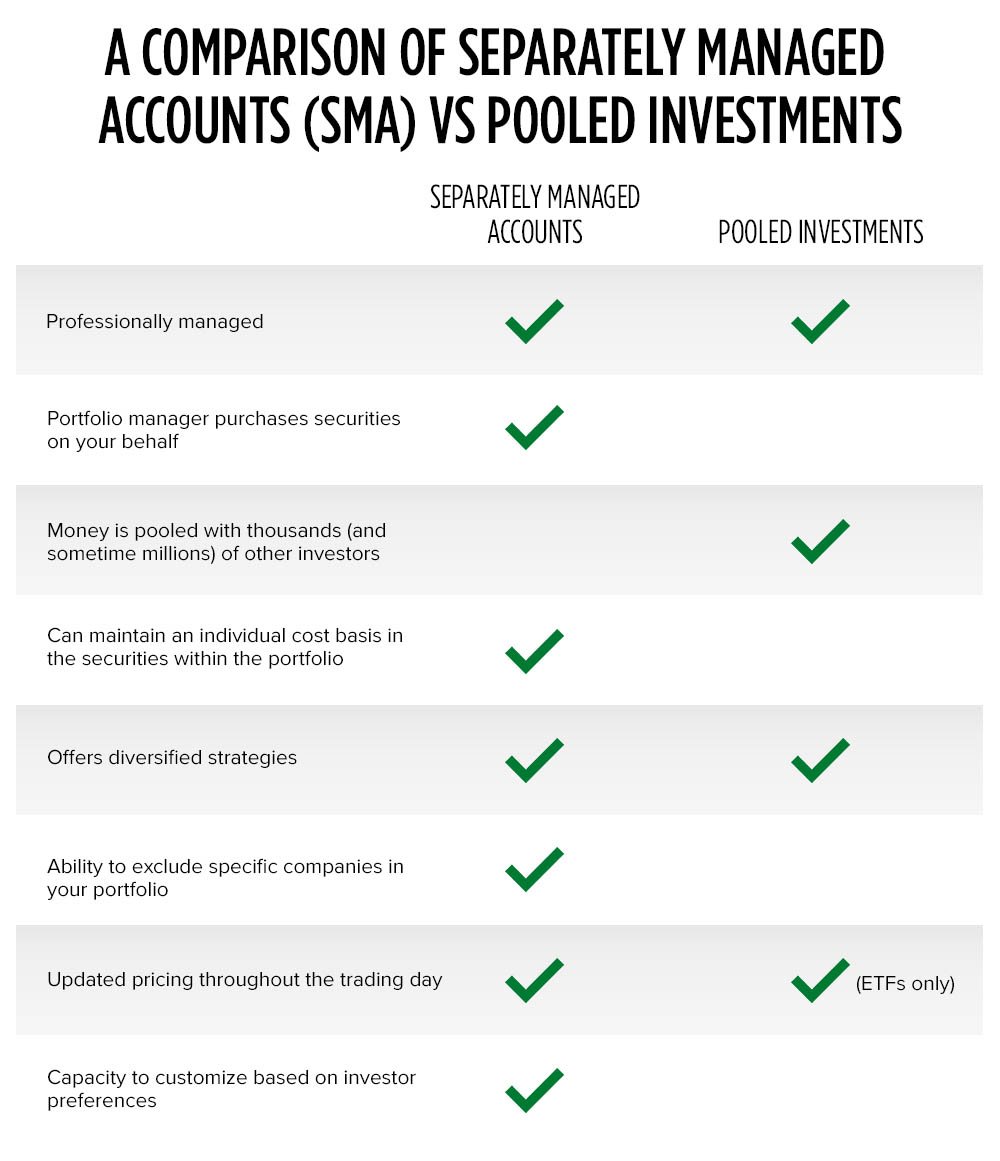

Let’s take a look at pooled vehicles vs. SMAs and see how they differ.

The popularity of mutual funds

The most common pooled investment vehicle is a mutual fund, first launched in 1924. In the U.S., over 45% of households have money in at least one of the over 7,600 mutual funds, totaling trillions of dollars.1

How they work: Professional fund managers raise capital from many individuals and institutions and aggregate this capital into a single large fund. That fund then invests in stocks or other assets.

One of the broadest appeals of mutual funds for many investors is convenience. If you don’t like following the markets or reading quarterly earnings reports, it can be a way to own a fairly diversified portfolio without doing all the work.

But they also have downsides.

Investment risks. Although over 60 million Americans have 401(k)s, some of which invest in mutual funds, they don’t come without risks. For example, some mutual funds are invested in bonds or other types of debt, which makes those investments sensitive to changes in interest rates. They can also be subjected to currency risks (when a portion of the fund’s investment is tied to a foreign currency, and that currency fluctuates). There’s also liquidity risk to keep in mind—how easily an asset or security can be bought or sold in the market and converted to cash.

What are the fees? One of the potential downsides to investments—pooled or otherwise—is that the investors may incur fees no matter how the strategies perform. It’s a fact of life—the professionals who manage the funds need to be paid. The key is to understand the full slate of expenses being charged.

In the case of mutual funds, it’s true that fees can be lower on passively managed funds than actively managed funds and can differ by the share class of a mutual fund (institutional vs. retail investor). Regardless, they can add up over time.

A fund is required to disclose its shareholder fees and operating expenses in its prospectus. Here are two types of fees that can lower a fundholder’s return:

Shareholder Fees

- Sales Loads—similar to the commission you pay to a broker

- Redemption Fee—imposed when you redeem your shares in the fund

- Exchange Fee—imposed when exchanging fund shares for the shares of another fund within the same fund group

- Account Fee—imposed if an account falls below a certain level

- Purchase Fee—some funds charge this fee when you purchase their shares

Annual Fund Operating Expenses

- Management Fees—paid out of fund assets to the fund’s investment advisor

- Distribution (12b-1) Fees—paid out of fund assets to cover distribution expenses

- Other Expenses—examples include legal and accounting costs

- Total Annual Fund Operating Expenses—expressed as a percentage of the fund’s average net assets

Source: SEC

Lack of control. Fundholders may not know the exact makeup of the fund’s portfolio and have no say over its purchases. The SEC requires mutual funds to report their holdings on a quarterly basis. That’s a good thing! However, the fund is given up to 60 days after the end of a quarter to do so. In effect, this can mean that the reported holdings may not be the current ones. Rather, it could be an outdated list that doesn’t reflect what’s in the fund today. The only direct impact a mutual fund shareholder may have is to vote for the proposed slate of Board of Directors.

A look at exchange-traded funds (ETFs)

An ETF is very similar to a mutual fund—with one main distinction: ETFs trade throughout the day just like individual stocks, so investors always know the value of their investment. Conversely, mutual funds get priced once a day—at market close (4 p.m. ET). That’s possibly one of the reasons why ETFs have grown in popularity, with an estimated $5.4 trillion currently invested.2

SMAs: Reaching for a truly personalized portfolio

SMAs differ from a pooled fund in that a professional investment manager purchases securities in an account in your name—on behalf of you, the investor, not on behalf of the fund. This important distinction opens the window for five possible advantages of SMAs over pooled vehicles.

Professional management

Like actively managed mutual funds and some ETFs, SMAs are managed by professional asset managers who focus on specific asset classes, such as stocks or bonds. But unlike mutual funds and ETFs, SMAs hold individual securities that the account holder owns directly.

For example, you can buy a share of an S&P 500 Index ETF and gain exposure to 500 of the largest U.S. companies. Some of these companies you may be excited to have in the fund, while others you’d rather not. But because you do not directly own shares in any of those companies, you have no say in what is held and what isn’t. Perhaps a more desirable approach? You can directly own shares of the individual companies you desire.

That’s one of the possible appeals of an SMA—the ability to create a personalized actively managed portfolio tailored to your personal situation and tax status. There's a team of people behind the scenes making trading decisions—not for millions of fundholders—but just for you.

Tax management

A major advantage of the SMA is that account holders maintain an individual cost basis in the securities within the portfolio. In other words, when a security is bought in your account, the price you paid (your cost basis) is locked in on that day. The benefit? Prudent income tax management, where you could potentially manage your gains and losses to take advantage of tax benefits. Mutual fund shareholders, who own only a percentage of the total pooled assets, do not have this option.

Furthermore, a mutual fund must pay out a portion of its gains to shareholders each year. This means that regardless of if you want or need the distributed income, you will receive it and pay taxes on it.

On the other hand, with a separately managed account, you control when you take a distribution from your account.

Diversification

This is one of the most important principles of investing. Think of it this way: When you own one stock, and the price of the stock triples, so does your money. But if that stock's price falls 70%, you also lose 70% of your money.

So, one holding is the most concentrated—least diversified—portfolio available. Compared to an index—which tends to have hundreds or thousands of holdings—the potential level of risk with a single stock is undeniable.

Pooled vehicles usually tend to hold significantly more securities than SMAs. Does that mean they have better diversification? Not necessarily.

Overwhelmingly, the data show that just like one stock offers no diversification, the opposite end of the spectrum—holding hundreds or thousands—does not provide additional benefits.3 In fact, it may even hurt returns because too many stocks have the potential to diffuse returns to the point of non-impact. Instead, the data show that owning roughly 10-20 stocks has the potential to lower portfolio risk through diversification by 81%-90%.4

Customization

A key component of an SMA is that your portfolio manager can tweak the holdings to suit your personal preferences.

For example, some investors are applying an ESG (environmental, social, governance) lens to investing decisions. Maybe you don’t want to invest in a company that makes tobacco products or gambling stocks because you don’t support those businesses and don’t want them in your portfolio. You are able to exclude them from your portfolio with an SMA—but not necessarily with a pooled vehicle.

While restricting certain companies helps align values with investments, doing so with too many names—say more than 10%—can impact performance. Often, restricted tickers are held in cash, which can mean your portfolio is not fully invested.

Performance

Every strategy’s performance can be predicated on the managers’ abilities to select investments that deliver positive returns. But there’s one characteristic of pooled vehicles outside of investment selection that impacts a fund’s return—money flows.

Individuals tend to follow the crowd. It’s no different in investing, which means investors often buy or sell at the same time.

In a mutual fund, this phenomenon is magnified because of the sheer number of fund shareholders. Data show that these bad timing decisions can reduce a fund’s returns by 1%-2% on average each year.5 And in some cases, poor timing can wipe out all the outperformance offered by good-performing funds.6 Unfortunately, every investor’s return in a pooled vehicle can be impacted by this behavior as investors tend to pull money out when the market is falling, exacerbating the decline.

But SMA holders are not subjected to the whims and misguided timing of other investors. That’s because SMA holders are the only investor! SMAs can also be subjected to losses from poor timing—but those decisions come from the single account holder and not from other fundholders.

Your money, your account

A separately managed account has one main purpose—to fulfill your investing wants and needs. It’s not about what other people want. It’s not about how other people move their money. And it’s not about what other people believe. It’s about you—your taxes, your beliefs, your objectives. Another advantage? Transparency. You are the owner of the securities. You can see your holdings whenever you want and in real-time.**

At Motley Fool Wealth Management, our clients can view their account holdings at any point in time. Our investment team also provides a written “Trade Rationale” for every buy and sell transaction we make, so our clients know the “why” behind every portfolio move.

If you like owning individual stocks or bonds and benefiting from a customized portfolio that considers your tax situation and could align your money with your values, a SMA may be right for you.

Like what you're reading?

Join the thousands of readers getting stories like this delivered straight to their inbox every Thursday — for free. Give it a spin, enter your email to sign up.

Footnotes

1Statista, Data 1980 through 2020

2Statista, Data through 12/31/20

3S&P Dow Jones Indices

4JSTOR.org, Oct. 1977

5Friesen, G., Sapp, T. Mutual Fund Flows and Investor Returns: An Empirical Examination of Fund Investor Timing Ability. Journal of Banking and Finance

6Published in Journal of Banking & Finance 31:9 (September 2007), pp. 2796–2816

Related Articles

The Role of Asset Location in Managing Retirement Taxes

Location, location, location. It’s not just for real estate.

The Market’s Down and You’re Set to Retire, Now What?

What’s that saying…oh yeah: The best-laid plans of mice and men often go awry. So true it is....

Want to Hedge Inflation?

Worried about inflation and wondering if you should put your money in Treasury Inflation-Protected...