The U.S. dollar has been flexing its muscles. Since August 2021, it's been on a tremendous uphill climb. And even after declining towards the end of 2022, it's still relatively strong.1 So, is a strengthening dollar a good thing for your wealth?

The concept of a strong dollar is hard to understand. One reason is that it’s not an individual currency phenomenon. Instead, it’s more like a tug-of-war: If the dollar strengthens, another currency—like the euro or Yen—must weaken.

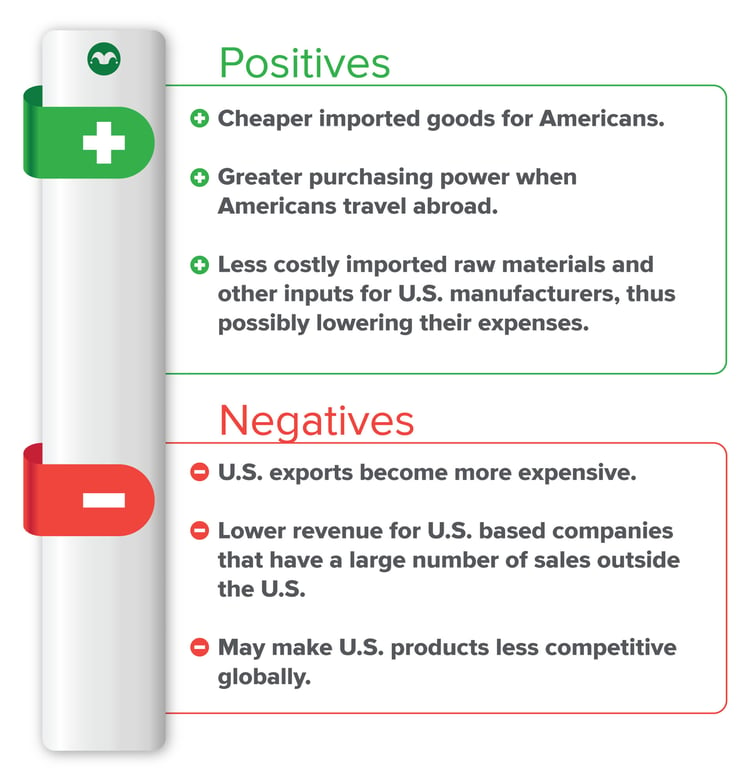

Another reason is that a strengthening dollar is not good or bad. It depends on your perspective. What does that mean? Of course, the answer is not straightforward (shocking—what part of economics is?). But all else being equal, this chart can help explain some of the potential positives and negatives.

So, a strengthening dollar is a double-edged sword—it may give you access to cheaper foreign goods and the ability to buy more for less when you travel overseas. But, it could hurt America’s competitiveness, which may ultimately decrease U.S. economic growth.

How could rising rates impact the dollar strength?

How could rising rates impact the dollar strength?

Investors, especially foreign governments, need to put their money somewhere. So, they usually invest in the safest, highest-yielding instruments available. Often, that has been U.S. government bonds.

Rising rates in the U.S. usually mean treasury bonds offer higher yields. So, foreigners may buy U.S. bonds (in dollars) which may continue to strengthen the U.S. dollar.

Like what you're reading?

Join the thousands of readers getting stories like this delivered straight to their inbox every Thursday — for free. Give it a spin, enter your email to sign up.

Footnotes

1U.S. Dollar Index (DXY), accessed July 28, 2023

Related Articles

Emerging Market Equities – An Undervalued Opportunity?

Many investors are underweight or not invested at all in emerging markets (EM) equities.1 This is...

Investments in a Down Market Still Tend to Outperform Savings Accounts Historically

What happens when a doctor recommends that you eat healthier? The reaction varies by individual....

What’s the Difference Between After-Tax and Roth Account Contributions?

Whether you’ve recently started contributing to a 401(k) or you’re a seasoned saver, you’ve...