Chances are you’ve heard of ETFs before. Or maybe not. You may have even discussed them with a financial advisor and feel you have a decent grasp on them.

But how are you on the details? If a friend chirps on about them at a cocktail party, could you discuss how their taxes and fees differ from mutual funds, if they are only passively managed, or if they are the same as index funds? If not, we’d understand why. The details can be as elusive to grasp as a garden snake.

Here’s a quick primer on ETFs. We’ve included just enough details to make you confident to respond, “Let’s grab a drink, and I’ll explain the "deets" on ETFs to you.”

What is an ETF?

An ETF is short for exchange-traded fund. First introduced in 1993, this type of investment has grown steadily over the years and now comprises $9.6 trillion in investor assets globally.1 In the U.S., the ETF market is $6.4 trillion, just over one-quarter the size of the U.S. mutual fund market.2

ETFs are popular because they combine features of mutual funds and stocks, often at a low cost compared to similar mutual funds. Like a mutual fund, an ETF is a bundle of many securities that can be bought in one purchase. This usually provides the investor with the benefit of diversification, although the degree of diversification varies depending on how narrow or diverse its holdings are.

Like a stock, they are traded all day on an exchange and can be bought anytime during the day for their trading price at that moment. This distinguishes them from mutual funds, which can only be bought after the trading day ends, when their price for the day—the Net Asset Value, or NAV—is calculated. (You can place an order for a mutual fund during the day, but it won’t be executed until the end of trading.)

While many ETFs are designed to mimic an index, such as the S&P 500, they should not be confused with Index Funds. Index Funds are mutual funds that track an Index.

What types of ETFs are there?

Like stocks and mutual funds, ETFs come in all shapes and colors. Some track indexes, some don’t. Many are passively managed, but some are not. Some are highly diversified, but some aren’t. Many have relatively lower fees, but some don’t.

There are stock ETFs, bond ETFs, and ETFs for sectors, regions of the world, commodities, and various styles of investing.3 The most widely held ETFs are those that track an Index such as the S&P, the Dow, or the Russell 3000. (For example, the largest ETF is the SPDR S&P 500 ETF.)4 One reason these index-tracking ETFs are popular is that they are easy to follow for investors. If you hear that the S&P is up 2%, you can expect your S&P-tracking ETF to be up roughly the same amount.

Further, when ETFs track an index, they don’t require managers that make buy or sell decisions. This approach, called passive management, requires less human power, so they can be cheaper to operate, resulting in relatively lower fees to investors. Voila. Easy to understand, easy to manage, and relatively cheap…a triple attraction!

Other ETFs don’t track indices. Those non-tracking ETFs are actively managed, so the managers buy and sell holdings. They tend to have higher fees than passively managed ones. But the benefits of actively managed strategies potentially may make up for those higher fees. For example, passive strategies are designed to match—but not beat—the market performance, while active strategies strive to provide alpha—returns greater than the market. And research shows that funds don’t need hundreds of holdings to be diversified; holding just 20 securities could potentially provide the diversification benefits that help reduce non-market risk.5

On the other hand, ETFs that track an index provide diversification, generally at a lower cost relative to actively managed mutual funds. But you can also find ETFs for a narrow (non-diverse) sector, such as commodity ETFs or small-cap technology ETFs. While these may hold 100 or more different stocks, these stocks might all move up and down together (aka, be highly correlated), providing little diversification.

How are they bought and sold?

When you place an order through a broker to buy or sell a mutual fund while the market is trading, the broker must wait until the market closes at the end of the day when the price is fixed to complete the trade directly with the mutual fund company.

In contrast, ETFs are traded on the exchange all day, and the market price can at times vary to a small degree from the NAV of the underlying assets. For example, if you decide you want to buy ABC S&P 500 ETF (ABC), you go to your brokerage account and type in the symbol—ABC. Then you select how many shares and the price you want to pay. Hit submit and wait for your order to be filled! It’s no different from buying an individual stock.

How are they created, priced, and taxed?

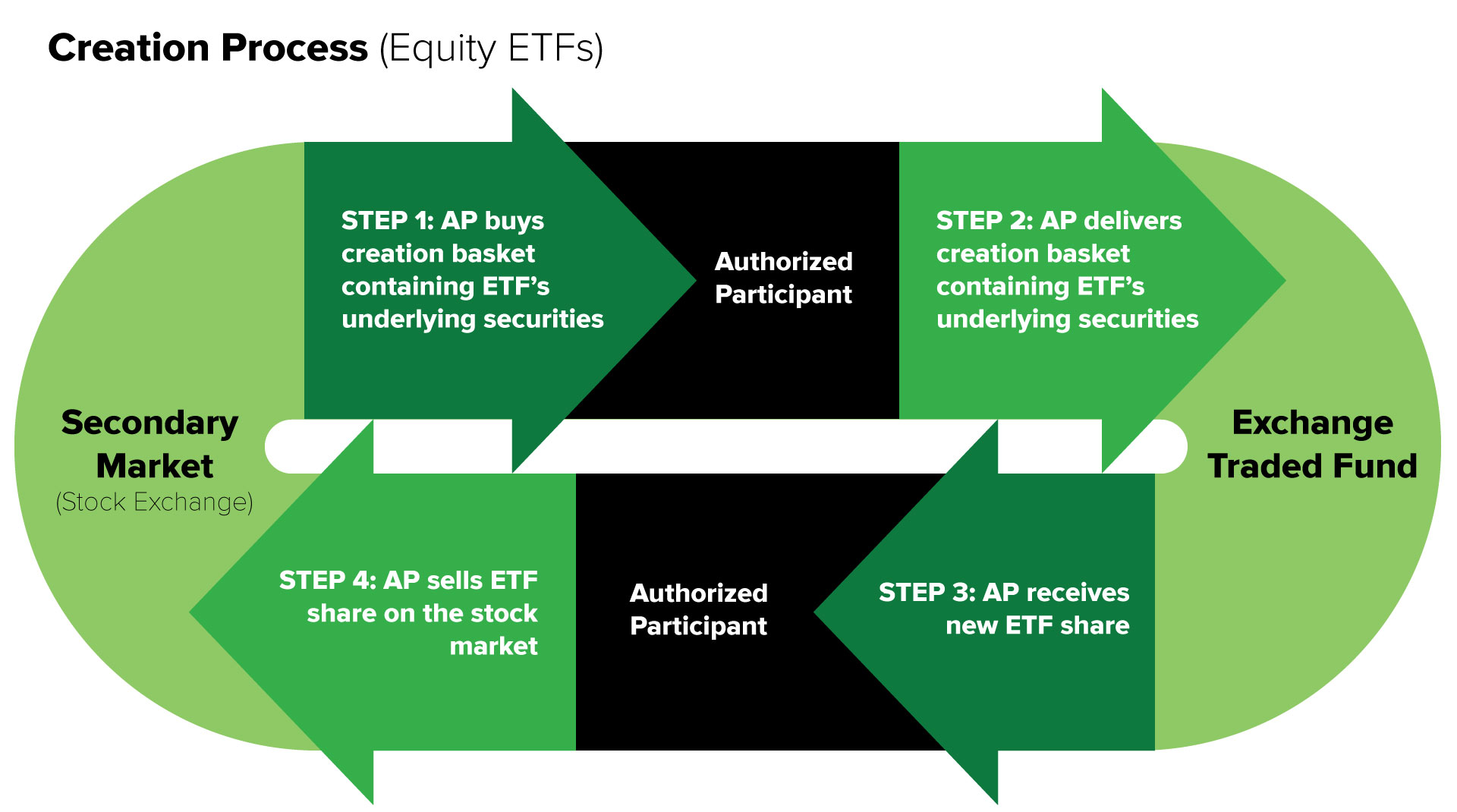

The ETF creation process begins when a sponsor, after filing with the Securities and Exchange Commission (SEC), forms an agreement with an authorized participant (AP). The full process is a bit complex, as you can see in the creation process below.

Source: ETF.com

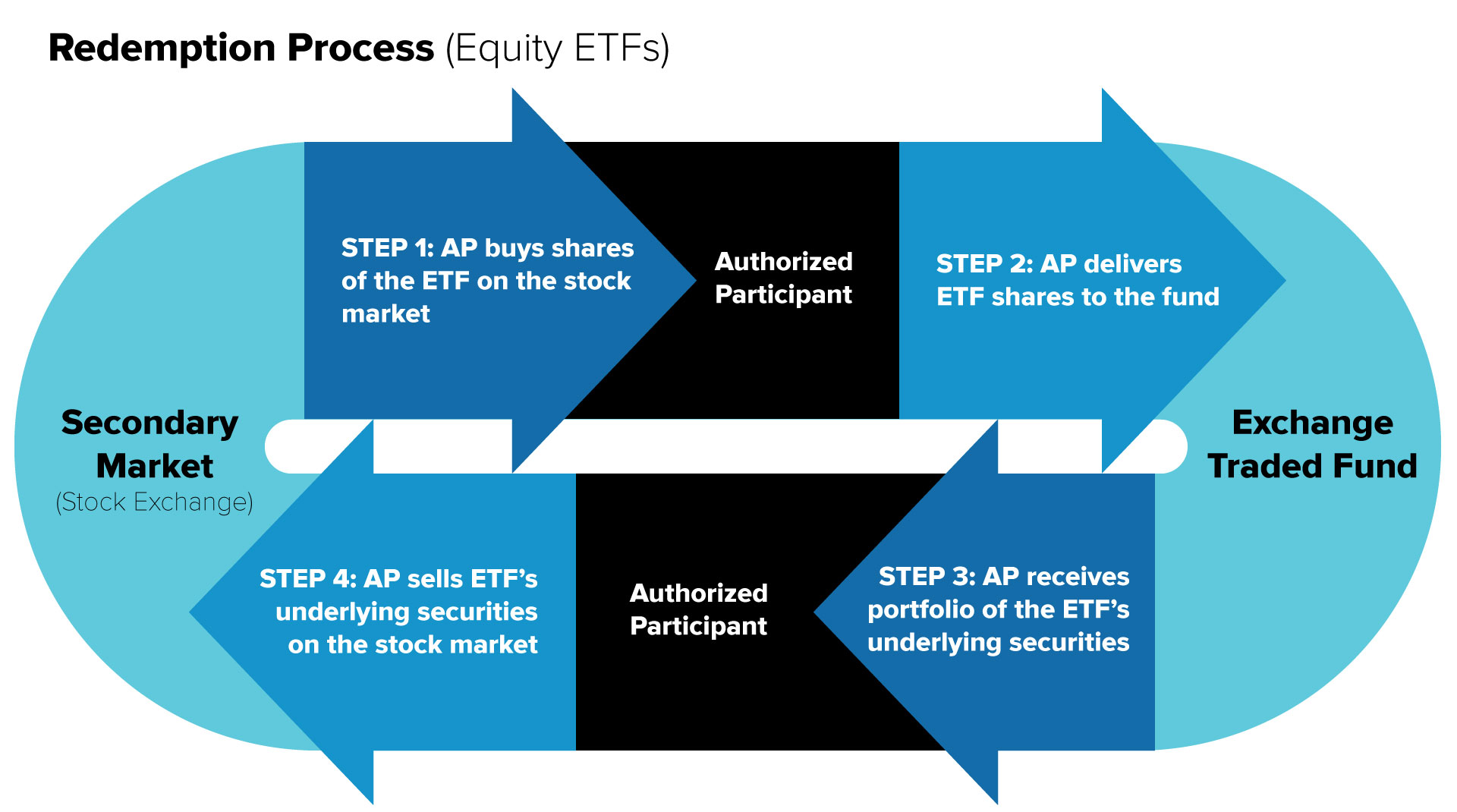

If, due to supply and demand, the price starts to vary from the actual price of the underlying securities, the AP increases or decreases the supply of ETFs in the market, thus raising or lowering the price back to its correct level. This can be done through the above creation process or the following redemption process.

Source: ETF.com

Generally, when you sell an ETF, another investor buys it on the secondary market, and it triggers a taxable capital gain, the same as a mutual fund. But sometimes, if investors sell a lot of ETFs, the AP “redeems” a large quantity. This means they unpackage the ETFs into individual stocks. This is an “in-kind” transaction—meaning ETFs are exchanged for individual securities rather than sold on the market—which is not considered a taxable capital gain event. This mechanism makes ETFs more tax efficient than mutual funds.

Do ETFs always have lower fees?

Because ETFs are more likely to be index-focused, they generally are more likely to be passively managed and have lower fees. Mutual funds are more commonly actively managed and thus are more likely to have higher fees. But bear in mind there are exceptions on both sides.

Another factor contributing to ETFs’ generally lower fees is that they do not have marketing fees (12b-1 fees), which mutual funds typically do. On the other hand, you may pay a transaction fee to your broker to buy one.6

What other unique features do ETFs have?

If transparency is important to you, you’ll probably favor ETFs—as they tend to reveal their holdings daily. Some, however, don’t offer full transparency—they’re known as semi-transparent. Conversely, mutual funds are not required to do this. In fact, most funds only reveal their holdings quarterly.7

Another difference from mutual funds is that you can buy ETFs on margin and sell them short. Neither is allowed with mutual funds.8 This, along with intraday pricing, are reasons why active traders favor ETFs over mutual funds.

Five characteristics make ETFs appealing

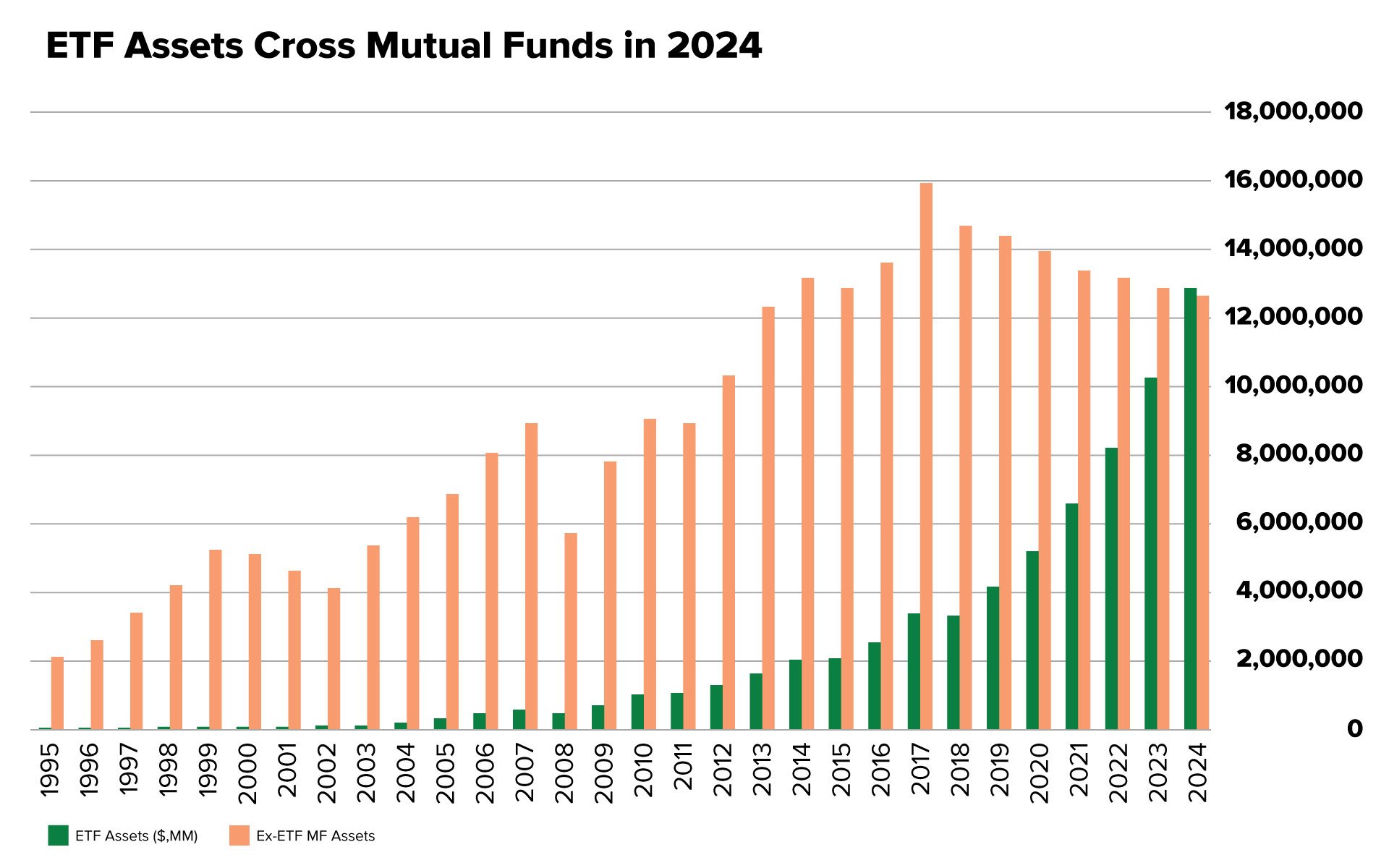

Mutual funds have been around much longer and still comprise a larger market share than ETFs. But the ETF market is growing fast. In fact, mutual fund growth peaked in 2017 and has been declining while ETFs have been growing. The reasons for ETFs’ popularity are simple: Five characteristics—relatively lower fees, intraday trading, tax efficiency, simplicity, and transparency—are increasing their appeal.

Source: ETF.com, Investment Company Institute, Factset, Dec. 10, 2019

Like what you're reading?

Join the thousands of readers getting stories like this delivered straight to their inbox every Thursday — for free. Give it a spin, enter your email to sign up.

Footnotes

1Statista.com, as of the end of 2022, accessed July 28, 2023

2Statista.com, as of the end of 2022, accessed July 28, 2023

3Blackrock.com, July 17, 2022

4Statista.com, June 7, 2022

5Elton, Edwin. Gruber, Martin. “Risk reduction and portfolio size: An analytical approach.” The Journal of Business, Oct. 1977.

6Finra.org, July 20, 2022

7Investopedia, Apr 5, 2022

8Finra.org, July 20, 2022

Related Articles

3 U.S. Market Trends That May Help Build Wealth

Did the 2022 market decline sour you to investing in stocks? That’s understandable. Being trigger...

How Can You Comfortably Invest in a Falling Market?

Sometimes too much of a good thing can be harmful. Take the health craze of apple cider vinegar....

Recession: A Stock Picker’s Paradise?

Some people compare investing to the game of darts. During strong up markets, it can appear easier...