Sometimes too much of a good thing can be harmful.

Take the health craze of apple cider vinegar. It’s proven to contain proteins, enzymes, and friendly bacteria that help to kill harmful bacteria and may aid in weight loss, lower blood sugar, and improve heart and skin health. But if you take too much, it may cause unpleasant digestive side effects, lower potassium levels, increase bone loss, and erode tooth enamel. So this seems to be a case where taking a little at a time makes more sense than gulping down copious amounts.

Similarly, investing small amounts at a time may make sense for some investors.

When dipping your toes in slowly is for you

Market drawdowns are disconcerting, and some investors may fear that the market will drop as soon as they invest their money. That’s an understandable concern.

One way to overcome that worry is to slowly dip your toe into the market by dollar-cost averaging (DCA).

In dollar-cost averaging, you invest a specific amount at regular intervals over time. How does it work? It’s all about the “averaging” part of dollar-cost averaging; as stock prices fall, you can buy shares at lower prices. And vice versa if prices rise. Over time, the average price will likely be somewhere in the middle of the high and low you paid. So, the benefit of gradually investing is that it removes the emotional and timing elements of putting your money to work in the market.

But like most things in life, investing this way has costs and benefits.

Cost/benefit tradeoff

Historically, returns are affected when an investor dollar-cost averages instead of invests all at once. Data show that two-thirds of the time, all-in investing produces better long-term results than a staged entry.1 That’s partly because a portion of cash sits idle on the sidelines, so it’s not potentially working to build net worth. But also because the market tends to move up over time.

However, at specific times, it may be beneficial to invest slowly. Let’s walk through an example:

Let’s say you have $1,000 available to invest and, for simplicity’s sake, you want a one-stock portfolio—Stock Z. (This is a bad idea for diversification purposes but makes illustrating our point easy!) Today’s market price of Stock Z is $100. You’re ready to buy it with your $1,000, but your friend thinks you should purchase it gradually over the next few months. Which makes more sense?

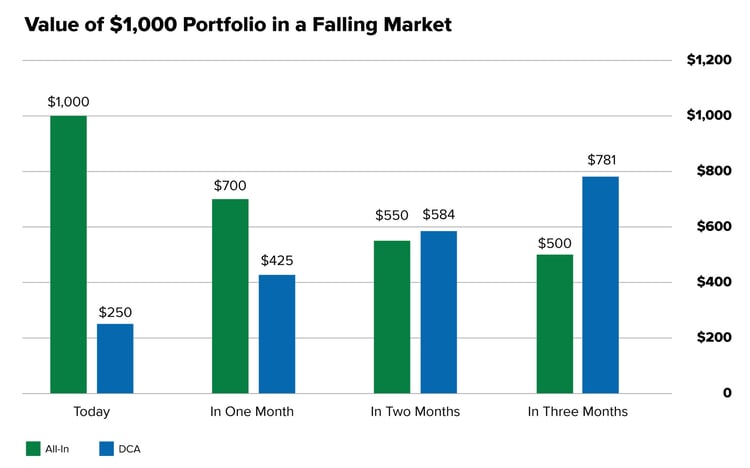

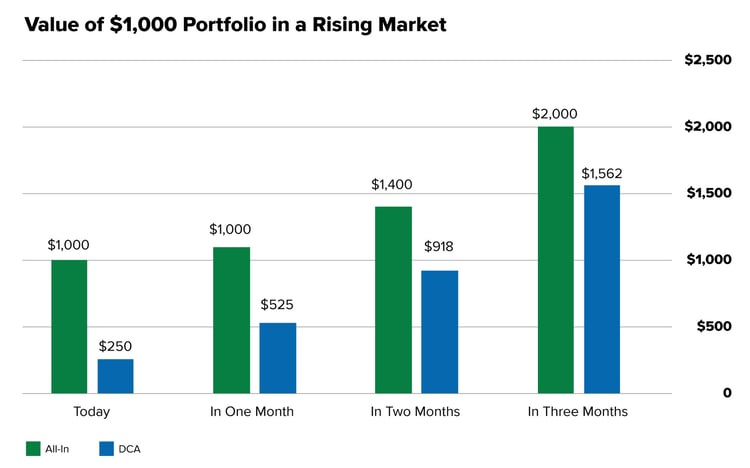

We looked at these two scenarios in a falling and rising market. In a falling market, we set the price of Stock Z at $10 today and moved it lower over the three months to $7, $5.50, and $5. In the rising market, the price moved in the reverse sequence, from $5 today to $10 in three months.

This chart shows the hypothetical value of a portfolio if you buy it all at once (green bars) compared to dollar-cost averaging (blue bars) your purchases with equal buys of $250 over four months.

In a falling market, DCA offers a higher portfolio ending value because you are buying more and more shares at cheaper prices. So instead of owning 100 shares (all-in scenario), you own 156 shares (DCA scenario).

Note: This illustration does not include any transaction costs or dividends.

Source: Motley Fool Wealth Management

In a rising market, the opposite is true. Buying all at once provides a higher ending value. In the DCA example, you buy fewer shares as the price of Stock Z rises. So at the end of the period, you only own 156 shares compared to 200 if you went all-in today.

Note: This illustration does not include any transaction costs or dividends.

Source: Motley Fool Wealth Management

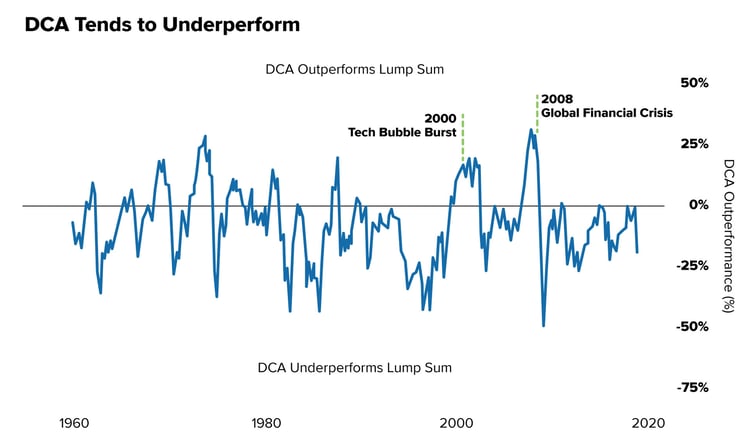

This example has held throughout history because, as we said earlier, the market tends to go up over time. The following chart shows the 2-year rolling performance of DCA vs. Lump Sum (an all-in approach). You can see that nearly 75% of the time, dollar-cost averaging underperforms an all-in strategy (below the 0% line). Moreover, the magnitude of this underperformance is high—an average lost return of 7.5%.

But ~25% of the time, DCA is better. When does this happen? Usually during a prolonged market drawdown, like in 1974, or during market crashes, such as the tech bubble and the Global Financial Crisis.

Source: https://www.econ.yale.edu/-shiller/data.htm, 1960-2018 (OfDollarsAndData.com) On average, DCA (over 24 months) underperforms Lump Sum (an all-in approach) by 7.5% and underperforms Lump Sum in 74.2% of the months shown.

Here’s the thing about investing—one size does not fit all. So it may be all well and good that you might make more money in the long run if you go all-in rather than take a staged entry. That’s a cost that fearful investors may be willing to pay because peace of mind is more important.

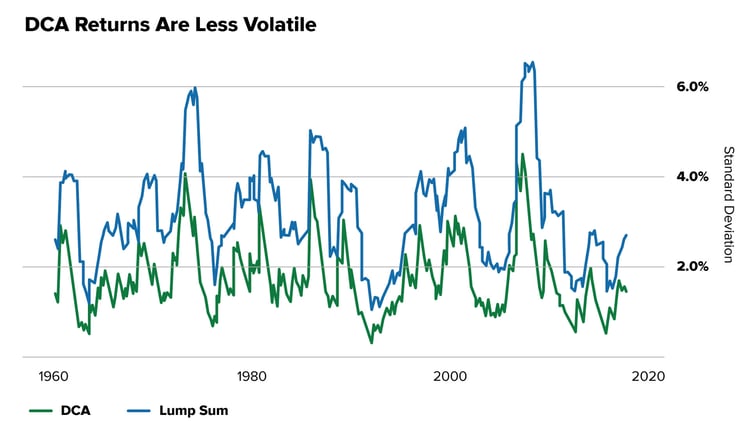

But is this peace of mind warranted? Yes, because DCA tends to be less risky than an all-in approach. Volatility—as defined by standard deviation, which measures the level of variability of returns—is lower for DCA. That makes sense: Because, as we also mentioned earlier, you’re sitting with some idle cash in DCA. Not being invested reduces volatility.

Source: https://www.econ.yale.edu/-shiller/data.htm, 1960-2018 (OfDollarsAndData.com) On average, the DCA strategy has a standard deviation of 2% while Lump Sum (an all-in approach) has a standard deviation of 3.3% over the time period shown.

The takeaway

We believe that time in the market is one of the key determinants of building wealth over time. But if fully invested isn’t feasible, a gradual entry is better than not investing at all. And with a gradual entry, you can have more peace of mind that you don’t have to pick the “right” time to invest.

Like what you're reading?

Join the thousands of readers getting stories like this delivered straight to their inbox every Thursday — for free. Give it a spin, enter your email to sign up.

Footnotes

1finra.org, May 24, 2022

Related Articles

Is the Market Oversold? Overbought?

When the market falls from its high, does it mean it's oversold? What about if it keeps making a...

3 U.S. Market Trends That May Help Build Wealth

Did the 2022 market decline sour you to investing in stocks? That’s understandable. Being trigger...

Investments in a Down Market Still Tend to Outperform Savings Accounts Historically

What happens when a doctor recommends that you eat healthier? The reaction varies by individual....