Meme stocks. Non-fungible tokens (NFTs). Robinhood. It seems that there's a new way to invest or an asset to buy wherever we turn. In 2021, these investment trends moved the markets more than once. For example, in January 2021, investors witnessed GameStop’s (GME) stock price gain over 800% in less than a week following social media chatter on Reddit. Similarly, in June 2021, AMC Theatres (AMC) gained more than 500%. Similar excessive moves have occurred this year as well. Why? There appears to be a shifting investor base, recognition of value, and influence from social media.

Perceived value is also behind the growth of NFTs. For example, would you pay nearly $3 million to own the rights to the very first Tweet on Twitter? Or over $69 million for a digital artwork that is a picture of all the artist’s 5,000 other works? For two buyers, the answer was a resounding yes.

What do these examples highlight? In a nutshell, many investors are vying for old and new asset types and banding together to follow the momentum of social media hype. So are they changing the rules of investing?

Past markets have embraced change

The New York Stock Exchange started in 1792. But market participation wasn't widespread until the Securities Act of 1933 and the Securities and Exchange Act of 1934 established securities registration, and rules for fair disclosure and a secondary trading market.

Since then, there have been substantial modifications. In the early 1970s, index mutual funds came to the market, and two decades later, the first ETF was traded. After computers survived Y2K, decimalization of stock quotes (instead of fractions) narrowed trading spreads. Then eight years later, high-frequency trading hit new highs as computer algorithms exploited millisecond differences in the timing of trade settlements. These are just a few examples. So, to say that changes to the way markets operate are nothing new is an understatement!

But is this time different? In the words of Sir John Templeton, “The four most dangerous words in investing are ‘This time it’s different.’” But maybe, this time, it is.

Some things are different…for now

Three trends appear to be at the forefront of recent stock market shifts.

Trend #1: Changed work model. The worldwide pandemic changed the way all people live and conduct business. Whether it's remote work and learning, curbside pick-up and home delivery, or access to newly released movies at home, the way we live has fundamentally changed.

Some of the aftereffects of the pandemic seem to be remaining. Not all workers have returned to the office, and those that have are probably in a hybrid model. In fact, a recent study estimates that "lower tenant demand because of remote work may cut 28%, or $456 billion, off the value of offices across the U.S."2 At the same time, normalcy has returned to concert-going, restaurant-eating, sporting event-attending, and leisure-traveling.

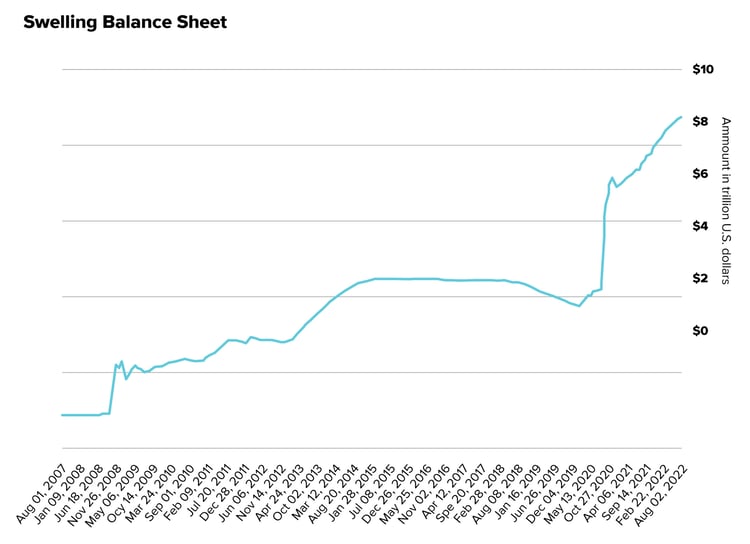

Trend #2: Government largesse. The U.S.’ balance sheet was already large. Then the pandemic hit, and it has grown by leaps and bounds. Expanded unemployment insurance, stimulus checks, and the Paycheck Protection Program, among others, provided much-needed funds to individuals, families, and small businesses. Between March 2020 and August 2021, the Federal Reserve’s balance sheet has nearly doubled—from $4.3 to $8.3 trillion.3And even compared to the $1.8 trillion assistance levied in response to the 2008 Global Financial Crisis, the $5.9 trillion COVID relief enacted-to-date is significantly greater.4

Starting in June 2022, the government has embarked on quantitative tightening to reduce its balance sheet. Sales of bonds are expected to continue into 2023.

Source: Statista, accessed Oct. 6, 2022. Chart shows the value of assets on the Federal Reserve balance sheet (Aug. 2007 to Sept. 2022.)

Source: Statista, accessed Oct. 6, 2022. Chart shows the value of assets on the Federal Reserve balance sheet (Aug. 2007 to Sept. 2022.)

Trend #3: Investing open to all. The trading platform Robinhood launched in 2013 with a mission to “democratize finance for all… to make investing friendly, approachable, and understandable for newcomers and experts alike.” How? Primarily by offering zero trading fees. And it's worked. Robinhood has amassed 18 million users in eight short years, roughly half the size of behemoth Charles Schwab.5 Robinhood is not alone—many other brokerages, including Schwab, have zero or low trading fees. Moreover, in 2020, the number of brokerage accounts and the trades per account saw a massive uptick. So it appears technology has unlocked investing, giving more people access to trading stocks and other assets.

But regulators have taken notice. Special Purpose Acquisition Companies (SPACs) are garnering regulatory scrutiny. At the same time, cryptocurrencies are the focus of SEC chair Gary Gensler. Governments around the world are also taking a closer look. For example, China has all but banned Bitcoin mining in its fight against the use of cryptos.

What’s it mean for your portfolio?

We believe these trends can impact investing in two ways. First, a broader investor base engaged in do-it-yourself investing and meme stock trading may cause security prices to overshoot on both the up and downside. In other words, stock prices may be bid higher or sold more readily as investors follow each other’s moves. This overshooting can potentially create opportunities for active managers to take advantage of mispricings. Our takeaway: Be opportunistically aggressive.

Second, it is our view that more investors and those flush with capital are a recipe for rising asset prices. Here’s why. More money chasing few assets typically drives up prices. In turn, higher-priced investments generally lead to lower returns. Our takeaway: Investors should be adaptable in valuing stocks by adjusting how much they’re willing to pay for a company’s future cash flows. They should scrutinize a business’ quality of growth, unit economics, competitive advantages, and management team when making long-term investment decisions.

So has investing changed?

Market manias are nothing new. They may provide increased volatility and portfolio turnover but also more inefficiencies and opportunities. However, we believe there has been a fundamental shift in the cost of capital; therefore, expected returns going forward may be lower as interest rates rise. This requires more company-specific scrutiny by active managers—to differentiate the long-term winners from the short-term spikers.

In other words, we adhere to a formula for value creation that is grounded in owning quality companies that generate value for customers and convert their competitive advantage into durable cash flow streams. So, while some things may have shifted—as they tend to do in a dynamic marketplace—a sound philosophy grounded in quality companies, we believe, stands the test of time, regardless of the latest investment trends.

Like what you're reading?

Join the thousands of readers getting stories like this delivered straight to their inbox every Thursday — for free. Give it a spin, enter your email to sign up.

Footnotes

1Statista

2Arpit Gupta, Vrinda Mittal, Stijn Van Nieuwerburgh, "Work From Home and the Office Real Estate Apocalypse, Sep. 26, 2022

3Statista

4Statista

Related Articles

3 U.S. Market Trends That May Help Build Wealth

Did the 2022 market decline sour you to investing in stocks? That’s understandable. Being trigger...

How Can You Comfortably Invest in a Falling Market?

Sometimes too much of a good thing can be harmful. Take the health craze of apple cider vinegar....

Value? Growth? How About Quality

Difficult market environments often cause investors to rethink their investment strategy....