Congratulations, you’ve just graduated college or landed your first job. You may feel as though the world is your oyster as you embark upon the part of your life where you’re making “real” money. So now what should you do? Plan for retirement, of course!

We know, you’re saying to yourself, “I just started working, do I really need to be thinking about when I want to retire?” Quite literally, yes. Because building a nest egg takes time, and your first job is exactly when you should start.

Even though you may not be earning much now, there are several advantages to jumping right in—namely, you have time on your side. Your long horizon before retirement gives you years to grow your wealth through the power of compounding growth. It also allows you the opportunity to tolerate investments that may have higher volatility in the short term but may generate higher returns over the longer term.

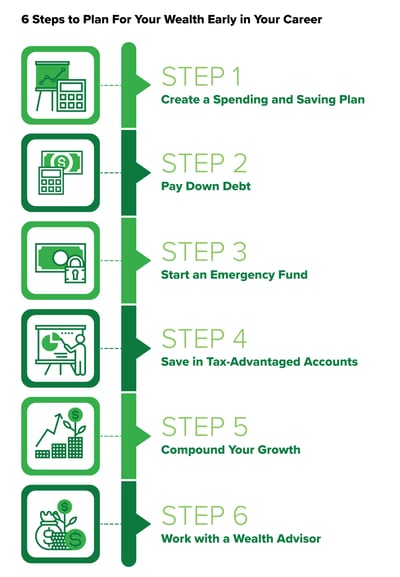

Where to start? Here are six simple steps to focus on early in your career that have the potential to make a huge impact in meeting your financial goals.

Step 1: Create a smart spending and saving plan

Step 1: Create a smart spending and saving plan

Building wealth isn’t about how much money you earn but how much you are able to save. By spending less than you earn, you can invest and build the foundation of your wealth.

The first step is creating a budget to make sure all your major financial obligations are taken care of. Included in your spending needs should be money for housing, transport, food, and other obligations like your student loans, credit cards, and other necessary expenses. One budgeting rule of thumb is to follow the 50/30/20 plan. That is: 50% of your income is set aside for essentials, 30% for wants, and 20% for savings.1 To reach that 20%, look at your variable expenses—your wants—and see where you can cut so you can save more if need be.

In studying the habits of the wealthy, those financially independent are careful with how they spend their money. They are relatively frugal and understand it isn't necessarily about how much money you make but how much you are able to save. Your goal will be to keep more of the income you’re making, pay off your debt faster, and get your hard-earned assets working for you.

Step 2: Pay down your debt

What should you do first: Pay off your student loans or other debt or start saving and investing? By paying off debt, you can reduce the interest you pay, which can save you money in the long run. But the sooner you save and invest, the more time you have to take advantage of compounding.

Start by prioritizing which debt you should pay off first. High-interest debt, like credit cards, carries interest rates up to 30%. These types of debt can grow very quickly if not paid off, and trump stock market returns even in the best years. If you have high-interest debt, you should set aside the bulk of your extra income to pay it down.

Student loans are a massive burden for many individuals. But they may offer low-interest rates and beneficial payment terms. So it may make sense not to pay these early and use your extra funds to save instead.

Step 3: Start an emergency fund

An emergency fund is money you set aside to pay for unexpected expenses and financial emergencies. Common uses for an emergency fund are job loss, medical emergencies, unexpected home or car repairs, and other unplanned expenses. The rule of thumb is to keep three to six months’ worth of expenses. The amount will depend on your job and personal circumstances. If you own a business or have a side gig or commission-based job, you may want to save six to 12 months.

This safety net can help reduce your stress level and keep you from making bad financial decisions when you're in a pinch, such as using high-interest credit cards. This money should be in a liquid account where you can easily access it when an emergency occurs. For those just starting out, it is even more essential to be able to cover unexpected expenses.

Step 4: Take advantage of tax-advantaged accounts

We get it: Saving for retirement isn’t top of mind at this stage in your life. But no matter what stage you are in, investment vehicles—such as 401(k), 403(b), or 457 plans—and IRAs are the best ways to get started. There are many reasons why this is true. First, many employer-sponsored retirement accounts offer matching contributions. So not taking advantage of these accounts mean you are literally leaving free money on the table. Second, retirement accounts also provide valuable tax benefits that not only reduce the amount of taxes you pay but also can possibly help build your wealth faster.

If your employer offers a match, you should at least aim to contribute up to the maximum of that match. But if you can contribute the maximum amount allowed by the IRS each year, you should strive to hit that mark.

If you still have available money left over, consider opening a traditional or Roth IRA. There are several differences between the two types, but the main one is that you contribute pre-tax money to a traditional and post-tax money to a Roth. Then when you take out the money, you pay tax on the traditional withdrawals but not on those from a Roth. Roth IRAs can grow tax-free forever. A generally accepted rule of thumb is that you fund a Roth at the beginning stages of your career when your income is probably at its lowest level (so your tax rate is lower than it will likely be in the future) and switch to a traditional in the middle to end of your career when your tax rate is closer to the highest bracket. There are also an annual maximum contribution limit, eligibility requirements, and withdrawal age restrictions. Your tax professional can help you understand the tax implications of these options. And if you max out these accounts, think about starting a taxable brokerage account (non-retirement account).

If you are worried you won’t be disciplined with saving, you may want to make monthly automatic contributions to your accounts. This can also help you weather tough times when the stock market is volatile. Stocks can move sharply up and down in the short run, but over the long term, the stock market has historically moved higher. So by contributing to your savings regularly and through automatic deposits, known as dollar-cost averaging, you can ease concerns over investing at the wrong time and take advantage of cheaper market prices when stocks fall.

Step 5: Compound your growth

While retirement may be a long way off, and you don’t have a sense of urgency to save for it, your long-time horizon is your best friend.

So even if you can only save small amounts, time is on your side due to the benefit of compounding. It’s like building a snowman. You start with a small snowball, then roll it in the snow to pick up more snow. The more you roll it, the larger it gets. This is how Warren Buffett, considered the world’s greatest investor, describes the effects of compounding. By starting early, the snowball will continue to get bigger over time.2

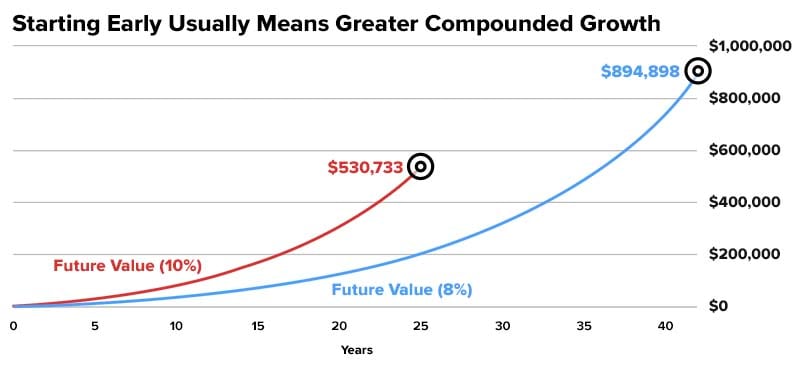

Let’s put this compounding into perspective. A 22-year-old who starts saving $200 a month and earns an annual return of 8% will have close to $894,989 by age 65. In comparison, an investor who waits until age 40 to start investing and doubles his savings to $400 per month while earning an even higher return on investment per year—10% instead of 8%—will have a little over $530,733 at 65. That’s $364,256 less—even after contributing more and earning a higher rate of return—because those 18 years of missed compounding have a greater impact on growing wealth. This example shows the importance of starting your retirement savings as soon as you can, even if you can only contribute a small amount each time.

Source: IRS.gov. The blue line represents the future value for the 22-year-old who invests $200 a month over 43 years and receives an annual return of 8%. The red line represents the future value for the 40-year-old who invests $400 a month over 25 years and receives an annual return of 10%.

Step 6: Work with a Wealth Advisor

If you are new to investing, working with an advisor can help you design an appropriate asset allocation for your investments. Every situation is different, so a Wealth Advisor can tailor your asset allocation to your goals. But often, because time is on your side now, your investment plan will likely lean towards a more aggressive investment style—if your risk tolerance affords you this option—with little regard to short-term market movements. The key at this stage is to be disciplined by regularly contributing to your investment portfolio, staying the course when times get rocky, and keeping your eye on the long-term prize.

Like what you're reading?

Join the thousands of readers getting stories like this delivered straight to their inbox every Thursday — for free. Give it a spin, enter your email to sign up.

Footnotes

1Robert Brokamp, CFP® and Dan Caplinger, The Motley Fool “The Path to a $1 Million Portfolio, accessed Jun. 1, 2022

2Nicolas Vega, “In 1999, Warren Buffett was asked what you should do to get as rich as him—his advice still applies today,” May 10, 2022.

Related Articles

How to Do a Roth Conversion

Roth IRAs can offer a number of advantages as you approach retirement. Money in a Roth IRA isn’t...

Is a Roth Conversion For You?

"I want to avoid paying taxes, so I'm going to move all my IRA money into a Roth IRA.” Does this...

What Every Retiree Should Know About Taxes

Tax planning doesn’t end with retirement. In fact, tax planning can be equally, if not more...