It’s that time of year when people begin thinking about taxes and investments. How should you minimize the inevitable tax burden? How should you build up savings for that future day when you’re no longer working and need a substantial nest egg to supplement Social Security and provide a steady income stream? These are important questions to consider—whether you’re 28, 42, or 55.

Of course, any type of savings represents potential retirement savings. But traditional IRAs and Roth IRAs are time-tested investment accounts that almost anyone can use to help build savings in order to enjoy a comfortable—and maybe even an early—retirement. While anyone with earned income can open an IRA account, there are IRS rules and important tax advantages with each.

When you get started early—and make yearly contributions (up to the allowable IRA income limits)—you’ll likely be in a far better position down the road. Because your money will have the chance to compound and grow for as long as possible before you will need it.

There are two main types of IRAs—traditional and Roth—and each has different eligibility rules and tax advantages. Below we discuss the similarities and differences.

What is a traditional IRA?

The traditional IRA is a tax-deferred investment account for individuals with earned income that allows you to invest pre-tax money toward your retirement. When you contribute to a Traditional IRA, you’ll get a valuable tax break because contributions reduce your taxable income, and you’ll pay less in tax during the years when you make contributions. Contributions may be fully, partially, or non-tax-deductible, depending on your tax-filing status and household income. (Consult with a professional advisor to determine your status.)

You will, however, have to pay taxes on the money when you withdraw it. And even if you don’t need the money, the IRS requires holders of traditional IRAs to take required minimum distributions (RMDs) starting at age 73. That can be a potential drawback of a traditional IRA. How? Because since you are required to withdraw a certain amount each year—even if you don’t need those funds—you have to pay taxes on that withdrawal.

The traditional IRA contribution limit is $6,500 ($7,500 if you are 50 or older).1

Call to Action! You have until the tax-filing deadline to open and make an initial contribution to a new IRA—or to complete your annual contribution to an existing IRA.

Who should consider a traditional IRA?

- You have earned income without access to an employer's 401(k) plan, or you want to supplement an existing workplace retirement plan.

- You are seeking a tax deduction and tax-deferred growth.

- You think your tax rate will be lower in retirement.

What is a Roth IRA?

The Roth IRA is a tax-deferred investment account for individuals who have earned income and who meet certain income-qualification limits. Contributions are made with money that has already been taxed. Therefore, all future qualified withdrawals (after age 59 ½) are tax-free. Another benefit? Required minimum distributions during your lifetime are not mandatory. So, if you don’t need to withdraw funds throughout retirement, you can potentially leave your beneficiaries a sizable, tax-free inheritance.

Not everyone is eligible to make contributions to a Roth IRA. To qualify, an individual’s modified adjusted gross income (MAGI) must be below certain thresholds. (Consult with a professional advisor to determine your eligibility.)

Just as with the traditional IRA, the Roth IRA contribution limit is $6,500 ($7,500 if you are 50 or older).1

Call to Action! You have until the tax-filing deadline to open and make an initial contribution to a new Roth IRA—or to complete your annual contribution to an existing Roth IRA.

Who should consider a Roth IRA?

- You have earned income and want to accumulate tax-free retirement funds.

- You are in a lower tax bracket now than you expect to be later in your career or in retirement. For millennials and other young investors, that can mean decades of tax-free growth and tax-free income during retirement.

- You want to leave your beneficiaries a potentially tax-free inheritance.

Traditional IRA vs. Roth IRA

The distinctions between traditional and Roth IRAs are often hard to understand. For example, while the annual contribution limits are the same, the Roth IRA withdrawal rules differ from those for a traditional IRA. This table shows several of the main differences.

| Traditional IRA | Roth IRA | |

|---|---|---|

| Mandatory Withdrawals | By April of the year after reaching age 73 | None |

| Taxes on Withdrawn Funds | Individuals may incur a tax and penalty by withdrawing money before age 59½ | Contributions (not the growth) can be withdrawn tax- and penalty-free*** |

| Estate Planning | Similiar rules apply to heirs that applied to original owner* | Provides tax-efficient inheritance* |

| Distribution Period | Spouse**: Can stretch over lifetime Non-spouse: Most are required to take all distributions within 10 years of original owner's death |

None |

| Taxes on Inherited Assets | Taxes at beneficiary's tax rate | Not taxed |

*For specific rules on inherited traditional and Roth IRAs, see https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-beneficiary

** In addition to spoouses, minor children, beneficiaries less than 10 years younger than original owner, and disabled beneficiarites can also stretch distributions over their lifetime. Source: IRS

*** Growth is subject to a penalty depending on your age and how long the account has been held. Other criteria may allow browth to be withdrawn pelanty-free. Contact your tax advisor for details.

Other key considerations

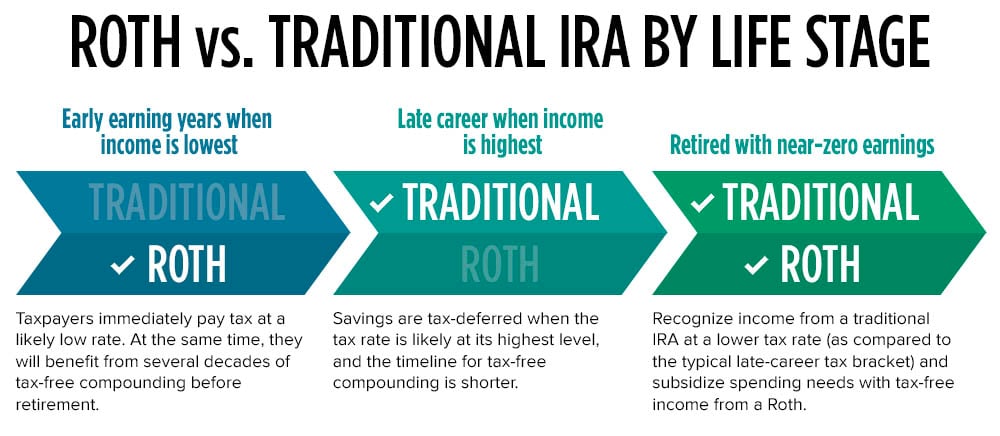

The choice between a traditional IRA or a Roth IRA depends on your age, income level and expectations, and “life stage.” Do you think your retirement income and tax bracket will be lower or higher? Your answer will help determine which IRA you should choose.

Investors don’t always have to choose between the two types of IRAs. Some can contribute to both a traditional and a Roth IRA, so long as the combined contribution does not exceed $6,500 ($7,500 if you are over 50).

In addition to contributing new money, there are several other ways to start a new one or add to an existing IRA:

- 401(k) rollover: You can roll over employer-sponsored retirement accounts—like a 401(k)—from former employers into a traditional IRA or Roth IRA when you leave or change employers. With a rollover, you can consolidate accounts and gain the opportunity for more customized investment choices and possibly lower costs.

- Partial conversion: You can convert all or part of an existing retirement account, such as a 401(k) or a traditional IRA, into a Roth IRA.

- Backdoor Roth: This type of conversion transfers money from a traditional to a Roth. There are many reasons why this may—or may not—be a good strategy for you. For example, do you need RMDs to support your lifestyle? If yes, then sticking with a traditional IRA may make sense. Or if you have after-tax money to add to an IRA but exceed the income limits for a Roth, then this conversion may be a way to accumulate tax-free earnings. A financial advisor can assess your situation and provide appropriate recommendations.

An IRA gives you considerable flexibility with your investment options because you can invest in a broad variety of assets, such as mutual funds, ETFs, target-date funds, and individual stocks. A typical 401(k) plan often has a more limited selection of investment options.

The takeaway? Save for the future

Many people are curious about the spending and saving habits of the wealthy. Well, regarding retirement savings, an IRA is the most commonly used account by affluent Americans. Why do they flock to IRAs? Because they know that the most important thing you can do to live the retirement you want is to save. Both traditional and Roth IRAs offer flexible investment solutions.

Another tenet well-to-do individuals understand? The earlier you start, the more compounding can potentially grow your money. So no matter your age or how much you can squirrel away each month, the greatest advice is to save, save, save!

So, to help you determine which type of IRA may make the most sense for you, consider the following:

- Contributions to traditional IRAs make sense, even when they are not tax-deductible. Why? Because every contribution gives you the opportunity to grow your retirement savings on a tax-deferred basis.

- With the Roth IRA, your savings will grow with no tax due in the future when you make qualified withdrawals.

- Remember, when it comes to saving for retirement, time is your greatest ally. Because history has shown that investments appreciate over the long haul, despite inevitable market downturns. Case in point: The S&P 500® Index has generated an average annualized return of 10.2% from 1926 through 2022.2

Like what you're reading?

Join the thousands of readers getting stories like this delivered straight to their inbox every Thursday — for free. Give it a spin, enter your email to sign up.

Footnotes

1Contribution limits apply for 2021 and 2022 tax years.

2S&P 500 returns (dividends included) and yahoo! finance . calculated by moneychimp.com

Related Articles

What’s the Difference Between a 401(k) and an IRA?

If you recently decided to start saving for retirement or you’re fine-tuning your approach, pat...

Distribution Rules for Inherited IRAs

Once upon a time, inheriting an IRA was relatively simple. You had to pay attention to and make...

5 Strategies for Inherited IRAs

There are two main options available to all designated beneficiaries when it comes to withdrawing...