Transitioning to a new employer can be stressful. And for most people, their retirement account is usually not top of their mind. It may only have a few hundred dollars, or it may be worth a million. Regardless of how much money is held in it, each person needs to decide what to do with the funds. Unfortunately, many people don’t know their options. Here’s a guide to potentially help you wade through the choices.

What to do with an old 401(k)

We’ve identified several potential solutions for managing 401(k) assets that remain in a former employer’s retirement plan. Several factors may impact which choice can be individually fitting, including the investment line-up (what investments can you invest in), fees (administrative and other), and ease of keeping track of the assets (knowing where all your retirement assets are and how much they are worth).

- Keep it with a former employer. If you are comfortable with the investment options and pleased with the performance and fees, then it might make sense to keep your retirement account invested in your previous employer’s plan.

- Roll over into an IRA. Many people choose to roll over their old 401(k) into an IRA. A primary reason is to consolidate accounts into one investment account. Additionally, IRAs may offer greater investment choice or lower costs.

- Roll over into a new employer's plan. Depending on your retirement plan’s rules, you may be able to roll over your old 401(k) into your current employer’s plan. This will consolidate the assets and invest them in a manner that is consistent with your current asset allocation.

- Cash out. Some individuals decide to withdraw their retirement savings altogether. But if you cash out before age 59 ½, you will have to pay taxes on your entire withdrawal. In addition, the IRS takes out 20% withholding for taxes along with a 10% early withdrawal penalty when you file your tax return. These fees and penalties can drastically reduce your savings. For these reasons, the cash-out strategy is generally the least favorable option.

Which solution is best for you? Although individual circumstances differ, the benefits of rolling over a 401(k) to an IRA often typically outweigh the other options for many people. Here’s why.

Benefits of rolling over your 401(k)

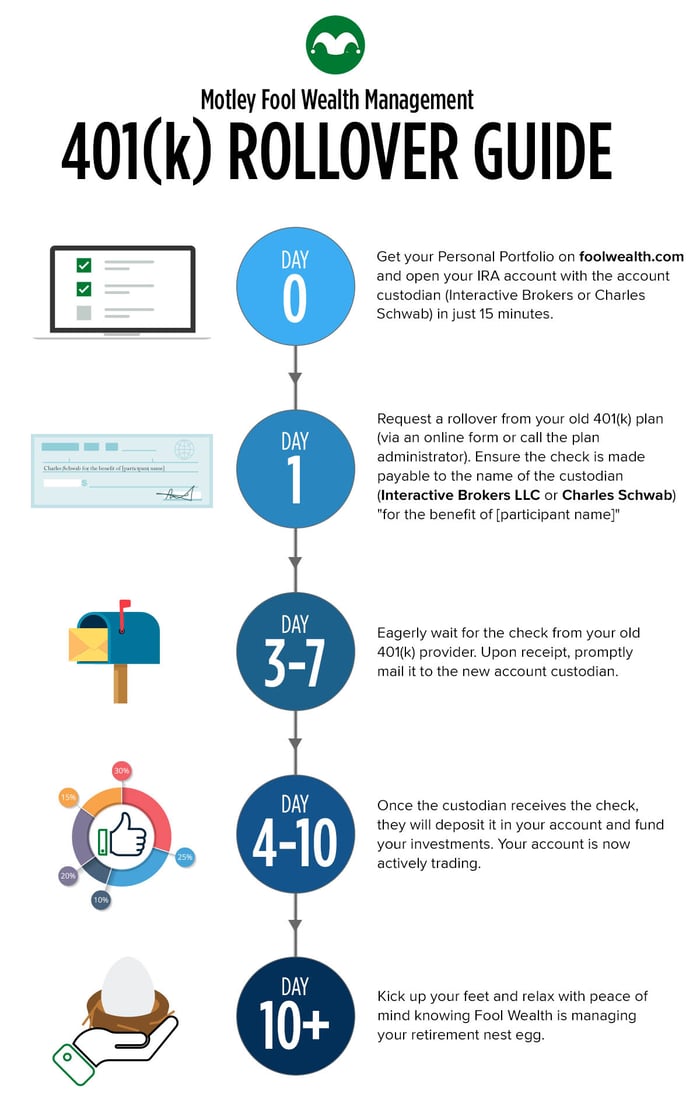

Today, the rollover process has become more streamlined and simplified. While this simplicity is a bonus, there are five other advantages to an IRA rollover.

Greater investment choice and account mobility

Depending on your former employer’s retirement plan, your old 401(k) asset allocation may not have kept up with the times. For example, many older plans had limited investment options. Others may have locked you into so-called low-risk “stable value” options as defaults.

Now is your opportunity to hit the reset button and create an investment portfolio that is more in line with your current financial objectives. It’s your chance to customize your own retirement plan. And because your IRA won’t be connected to your employer, you may have more flexibility, privacy, and control so you can change jobs with less worry.

Lower costs

High fees also weigh down some older plans. These fees—to invest, withdraw money, take a loan, and for recordkeeping and printed statements—are often passed on to retirement plan participants like you.

Some of these account fees may still exist today. But many have vanished, in part because there’s more transparency and it’s much easier to see charged fees.

Consolidation

Keeping track of various isolated accounts is not easy—especially as individuals age and life gets busier and more complex. Consolidating retirement accounts can make tracking assets more convenient. But it’s more than that. Bringing together retirement assets in one place also can help you visualize where you are in your retirement plan, and how far you need to go. It can paint a more complete investment picture of your total asset allocation, risk exposure, and overall return.

No taxes or penalties with a direct 401(k) rollover

Participants can move money from one retirement account to another without penalty. This is known as a direct rollover. But don’t make the mistake of having your old company cut a check payable to you. This is considered a distribution and means your 401(k) plan is required to withhold 20% for taxes.

More options for early withdrawals

IRAs allow early distributions without penalty—although taxes will be owed—for certain expenses, like higher education and first-time home purchases. Conversely, the 10% tax on early withdrawals from a 401(k) is waived in only a few severe circumstances, like total disability or medical bills that exceed 10% of adjusted gross income. But unlike with a 401(k), you can’t borrow against an IRA.

When should retirement assets stay put?

Despite the benefits, a rollover may not be the right decision for your situation. There are several reasons why keeping assets in a current 401(k) may make more sense.

|

Creditor protection |

401(k)s generally provide better protection against bankruptcy and claims from creditors. |

|

Loans |

Loans from IRAs are not allowed, which can decrease financial flexibility in times of need. |

|

Working longer |

If you work past age 73, then you do not have to take required minimum distributions (RMDs) from your 401(k). But an IRA would still mandate annual distributions.1 |

|

Early retirement |

Want to retire early and need income? Individuals can start taking qualified distributions from a 401(k) at age 55, slightly earlier than allowed with an IRA.2 |

|

Company stock |

Does your 401(k) hold company stock? Transferring it to an IRA may not offer the most favorable tax treatment. A possibly more tax-friendly option? One could be to move the company stock to a taxable brokerage account. That way the gains are only subject to capital gains tax, which is usually lower than income tax. (Yes, please always check with your qualified tax advisor on this option and all other tax advice.) |

|

Roth strategies |

Completing annual “backdoor” Roth conversions may not be tax efficient if you have IRA assets. However, if you plan to convert pretax balances to a Roth (and pay taxes on the converted amount), then having an IRA balance creates Roth conversion opportunities. (This is another great topic for you to discuss with your qualified tax advisor!) |

Refine your retirement strategy under one roof

Saving for retirement seems like a simple concept. But managing a retirement strategy is complex. It’s made even harder when assets are spread among various accounts that are managed independently—with differing, and sometimes competing objectives, or goals that made sense 30 years ago, but may no longer seem appropriate near retirement or in an evolved investment environment.

A non-centralized approach can make selecting an appropriate asset allocation and risk level overwhelming, even for the most financially astute. Case in point: Harry Markowitz, the 1990 Nobel Prize in Economics recipient. Known as the father of Modern Portfolio Theory, Markowitz’s research on the efficient trade-off between risk and return underpins most asset allocation models. Still, he famously chose to split his portfolio evenly between stocks and bonds in the 1950s. But Markowitz recognized that what worked in 1952 may not work today, explaining he now splits his money “among asset classes, like efficient portfolios…”3

This example illustrates the importance of refining investment strategy and asset allocation. Because what worked in the past may not work now. But it’s hard to know where you stand when retirement assets are all over the place. Fortunately, rolling over an old 401(k) can be simple and easy. Here’s how to get started.

Like what you're reading?

Join the thousands of readers getting stories like this delivered straight to their inbox every Thursday — for free. Give it a spin, enter your email to sign up.

Related Articles

What’s the Difference Between a 401(k) and an IRA?

If you recently decided to start saving for retirement or you’re fine-tuning your approach, pat...

Retiring Early? How Can You Bridge the Income Gap

Retiring early is a dream for many. For others, it may be a necessity or an unexpected development....

Solo 401(k)s for the Self-Employed

Self-employment is an exciting option for many of us. Whether you work for yourself full time or as...