Social Security is at the core of most retirees’ cash flow, with the average individual receiving 40% of their pre-tax income from this benefit.1 Because it’s a significant portion of retirement income, strategies to maximize it should be the top priority for retirees. Unfortunately, understanding Social Security is not cut and dry. So to help, we answer four key questions below.

When should I take Social Security?

Individuals are eligible to receive Social Security benefits at age 62. But that doesn’t mean they should take them right away — they can wait until age 70. It’s an important decision.

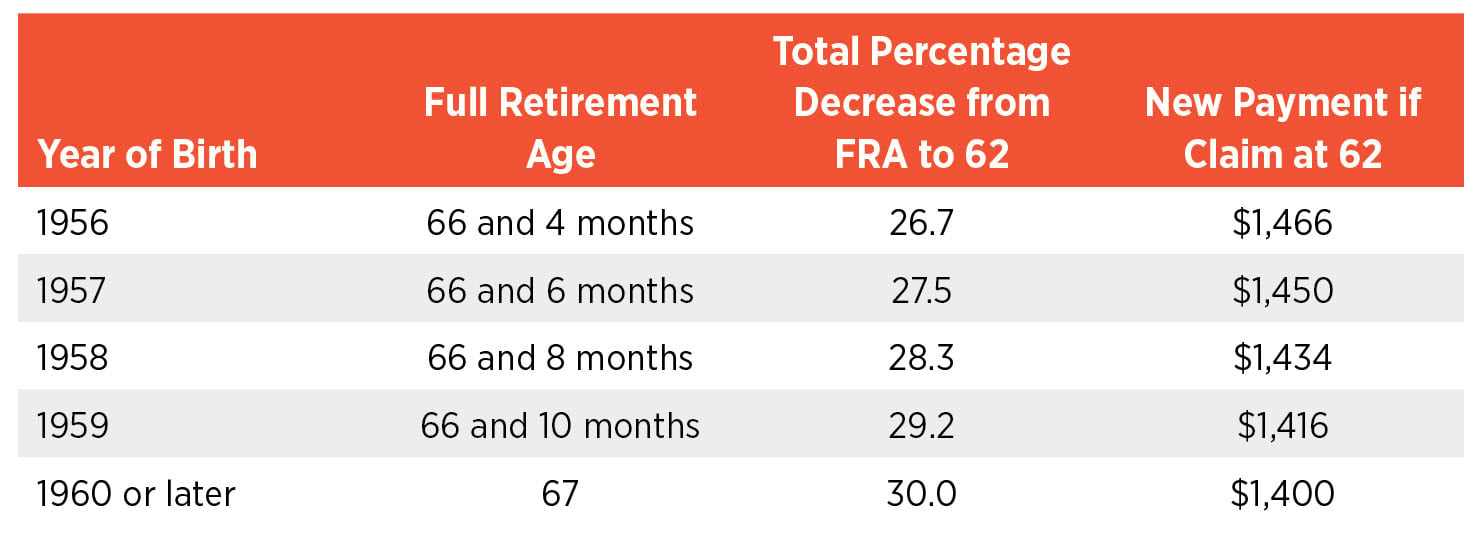

Here’s why: Taking benefits before the full retirement age (FRA) reduces overall payouts. The decrease depends on the individual’s year of birth and the age at which distributions start.

Source: Social Security Administration, Office of the Chief Actuary, Benefit Reduction for Early Retirement (SSA 2008). Notes: Starting from a $2,000 monthly payment. The percentages are based on calculating the reductions to the full monthly benefit amount at the FRA and expressing those amounts based on claiming age. All percentages are rounded.

Many retirees want to maximize every dollar available. Not a bad strategy! But often, maximizing the benefit means waiting to claim it (or knowing the exact date of your death with precision!).

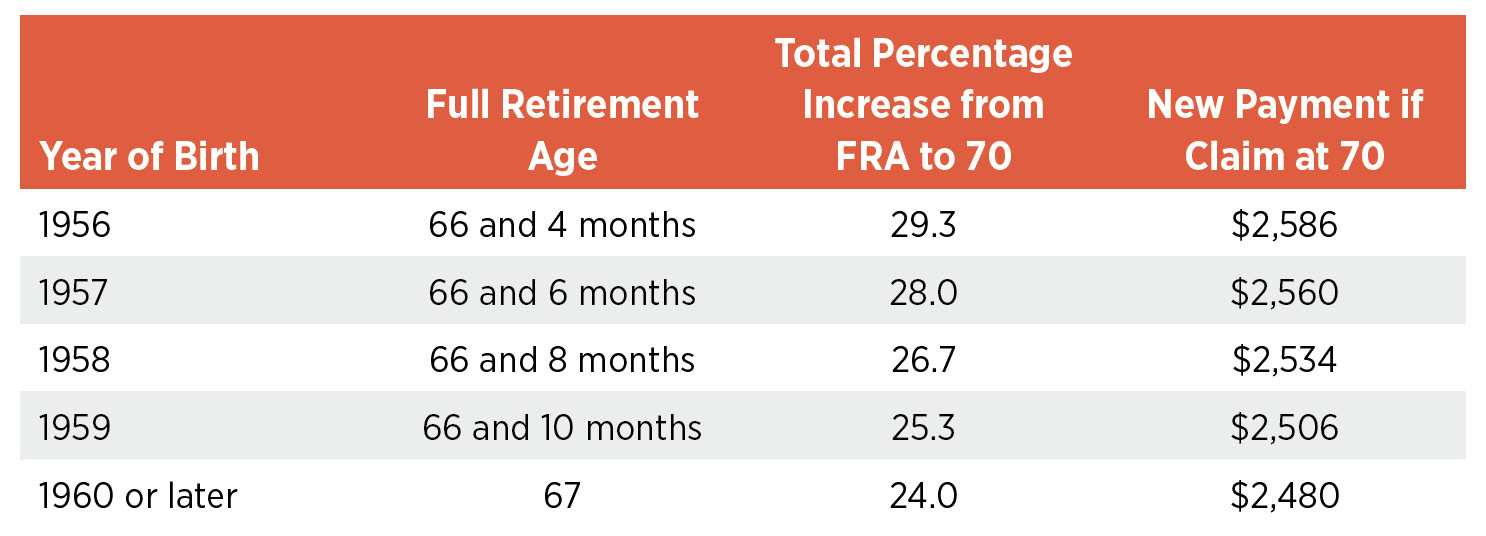

For Social Security payments that start after reaching the FRA, the monthly disbursement increases. Individuals can earn these delayed retirement credits each month up to age 70. Like the decrease, the amount of credits depends on the year of birth and the age benefits start.

Source: Social Security Administration, Office of the Chief Actuary, Effect of Delayed Retirement on Retirement Benefits (SSA 2010). Notes: Starting from a $2,000 monthly payment. The percentages are based on calculating the increases to the full monthly benefit amount at the FRA and expressing those amounts based on claiming age. All percentages are rounded.

So why do roughly one-third of people start claiming at age 62? Did they miss the memo about the “raise” you get for waiting longer?

What’s the tradeoff between taking vs. waiting?

Social Security is both an income stream and a risk mitigation tool. A lot can happen in the eight years between age 62 and age 70, and if you receive a payment every month, it means there’s less stress on your portfolio. This is essential in the early retirement years when the stock market’s returns can make or break a retirement withdrawal strategy.

So, if the tradeoff of waiting is over-stressing other assets or income streams, those extra dollars in the future might not be worth it. That’s why we believe it’s more important to optimize Social Security for your situation rather than reaching for a maximized benefit at any cost.

How can the timing affect my heirs?

The timing of when to collect Social Security is a critical decision for individuals who:

- Currently or have been married, particularly if the spouse:

- has a significant age difference — of at least three years — or

- there’s a substantial difference in earnings history

- Have minor children when they are eligible to claim

- Have a family history or actual health factors that may suggest a shorter or longer than average life expectancy

An important fact to know is that your surviving spouse and heirs are eligible to receive your Social Security benefits after you pass away. And again, there are a handful of calculations that factor into how it works:

Spouses can claim benefits at age 62 but receive only about half. The amount depends on when they are collected. Unfortunately, spouses do not get credits if they wait until age 70.

Surviving heirs can claim benefits slightly earlier, at age 60; those payouts are also reduced by at least 28.5%.2 They, however, are entitled to credits.

What are the tax implications?

Tax implications of collecting Social Security depend on your overall income. Most recipients will have 85% of their benefit included in taxable earnings at the Federal level. Each state also decides how it will tax Social Security, with 38 states not taxing any benefits.

So with all this information in mind, let’s walk through a hypothetical case.

A hypothetical case study*: How much you receive depends partly on what age you take benefits

Monica just turned 62. She is trying to determine the change in her Social Security benefits if she starts them today. According to the Social Security Administration, Monica is at her full retirement age (FRA) when she turns 66 and 10 months. At her FRA, she could expect to receive $2,000 each month.

If Monica chooses to take her benefits at age 62, they will decrease each year, declining 29.2% in total by the time she reaches the full retirement age of 66 and 10 months (Table 1 above). So instead of receiving $2,000, she would receive $1,416 at her full retirement age.

However, if Monica waits until age 70, she would receive delayed retirement credits starting at her full retirement age of 66 and 10 months. Those credits would increase her benefits by 25.3%, giving her $2,506 each month (Table 2 above).

Crucial to retirement income longevity

Understanding your Social Security benefits—especially the pros and cons of starting earlier vs. later—may perhaps be the single most important retirement income decision you make. As such, a Wealth Advisor can help you understand your choices and how these benefits impact your overall wealth plan.

It’s also helpful to understand your expected retirement benefits throughout your working life. So don’t wait for the annual Social Security letter to see your estimated cash flow. Establish a “My Social Security” account at ssa.gov to understand and keep up-to-date with your retirement benefits.

Like what you're reading?

Join the thousands of readers getting stories like this delivered straight to their inbox every Thursday — for free. Give it a spin, enter your email to sign up.

Footnotes

1Social Security Administration, reviewed Mar. 9, 2023

2Social Security Administrations. Surviving heirs can receive no more than the retired worker would have received. Reviewed Mar. 9, 2023

*This hypothetical case study does not represent any specific client’s experience with services provided by Motley Fool Wealth Management. This example is provided solely for illustrative purpose.

Related Articles

Social Security: Spousal Benefits and More

Social Security is best known for retirement benefits, and for good reason. After all, it is the...

.jpg)

Social Security: 3 Penalties to Avoid

Social Security is the largest retirement benefit program in the U.S., and the most common source...

Can I Work While Receiving Social Security?

The short answer is: Yes, you can work while receiving Social Security benefits. The long answer...