Even if you’re not working in retirement, you probably generate income and pay tax on it. How, you ask? It comes from income sources like Social Security and distributions from your retirement accounts, like your 401(k) or traditional individual retirement account (IRA). And if you have income coming from other sources, like rental properties or an employer, then your tax bill may be substantial. But there are ways you could potentially lower how much you pay. We highlight three below.

How much are you taxed in retirement?

Before we unveil how you could potentially lower your income tax in retirement, let’s first walk through which retirement income is taxed. The answer is simple: almost all of it. There’s one exception, which we’ll discuss in our strategies.

Social Security

The federal government taxes up to 85% of your Social Security benefit each year. The taxable amount depends on your combined income, which you can determine by taking your adjusted gross income (AGI) plus nontaxable interest and 1/2 your Social Security benefits.

The taxable amount of Social Security based on your combined income is:

| Up to 50% | Up to 85% | |

|---|---|---|

| Individual | $25,000-$34,000 | $34,000+ |

| Married filing jointly | $32,000-$44,000 | $44,000+ |

Source: Social Security Administration, accessed Mar. 17, 2023

That’s just taxes from the federal government. Some states also tax Social Security. Find out if your state does.

Other retirement accounts

The most common types of retirement accounts are pensions, 401(k)s or 403(b)s, and traditional IRAs. Since these accounts are considered tax-deferred savings vehicles, you must pay tax when you receive distributions.

Again, the federal government taxes income from tax-deferred accounts at the same rate as income from an employer—at your ordinary income tax rate. The breakdown is of ordinary income tax rates is as follows:

| Tax Status | Single | Married Filing Jointly |

|---|---|---|

| 10% | $0-$11,000 | $0-$22,000 |

| 12% | $11,001-$44,725 | $22,001-$89,450 |

| 22% | $44,726-$93,375 | $89,451-$190,750 |

| 24% | $95,376-$182,100 | $190,751-$364,200 |

| 32% | $182,101-$231,250 | $364,201-$462,500 |

| 35% | $231,251-$578,125 | $462,501-$693,750 |

| 37% | $578,126 or more | $693,751 or more |

Source: irs.gov, Oct. 18, 2022

And like Social Security, some states tax income from retirement accounts too. Almost every state imposes a tax on retirement account distributions. The exceptions are Washington, Nevada, Texas, Wyoming, South Dakota, Illinois, Tennessee, Mississippi, Florida, Pennsylvania, Alaska, and New Hampshire. Two other states—Hawaii and Arkansas—do not tax pension income but tax distributions from 401(k)s and IRAs.

3 strategies to reduce income tax in retirement

Many retirees plan their retirement income needs around their spending level. Some may have just enough saved to live comfortably, while others have plans to leave a legacy. Regardless of which bucket you may fall into, paying taxes is likely not high on your list of ways to spend your money!

But the government wants its money! That’s why pension funds have a specified start date, and the government mandates you take a certain amount of distributions from 401(k)s and traditional IRAs each year. And unfortunately, even if you don’t need the money, you must take it and get taxed on it.

Despite distributions being required, there are ways to lower them and, thus, reduce the amount of tax you pay.

Here are three common ways:

Plan your RMDs and other income

Plan your RMDs and other income

The IRS doesn’t care when or how often you take distributions to satisfy your RMDs—as long as you withdraw the appropriate amount by Dec. 31, except for the first distributions, which you can wait to take until April 1 of your 74th year. This is important because if you have a large income event in your 73rd year, you may decide to wait till the next year so your income tax rate is lower. And vice versa, if you have a liquidity event in your 74th year—you can take your RMD in your 73rd year instead.

A word of caution—if you choose to wait until the next calendar year to take your first RMD, you’ll have to receive another before the end of the same year—that’s double the distribution amount (and thus higher taxes owed) in one year.

Additionally, if you need more income than your RMD provides, consider drawing upon other income sources so you don’t jump to the next tax bracket. For instance, if your ordinary income rate is higher than the long-term capital gains rates, you may wish to generate income by selling appreciated long-term securities. Or consider ways to use tax losses from investments to offset gains and other income.

Of course, these decisions involve your individual tax situation, so always consult with your tax professional.

Gift your RMDs

Gift your RMDs

The government recognizes that some individuals don’t need their distributions or would prefer to donate them to charity and use a lower-taxed income source. The latter may make sense for someone who can pull income from taxable investment accounts where they have long-term gains and would prefer to pay the typically lower capital gains tax rate than the ordinary income rate. Or for someone who has cash set aside for charitable purposes.

Gifting RMDs to charity is called a qualified charitable distribution (QCD). When done correctly, QCDs count toward your RMD amount each year and can cancel out any tax you would have to pay on the RMD.

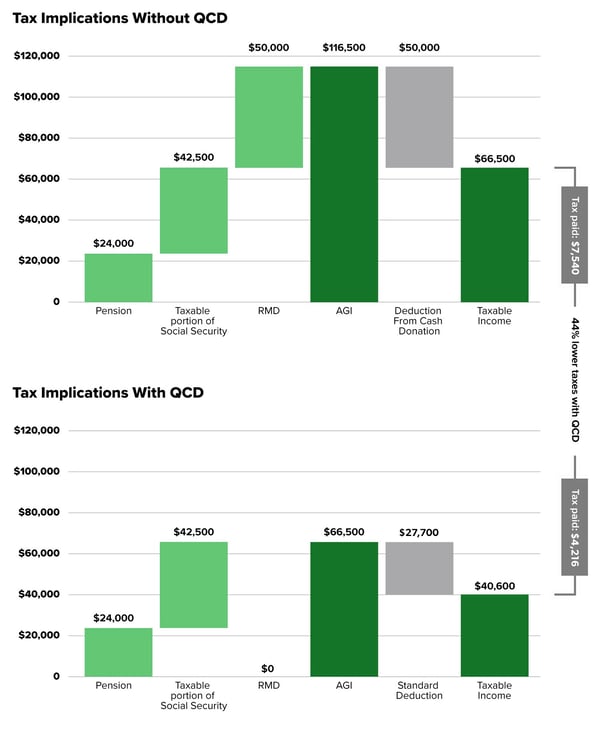

Here’s an illustration of how QCDs can work to eliminate taxes from RMDs:

Joe and Corinne file their taxes jointly. They have a combined annual income of $24K from a pension, $50K in Social Security income (of which 85%, or $42,500, is taxable), and $50K of RMDs. Remember, RMDs are considered income and taxed at ordinary income rates.

Their Wealth Advisor computed two scenarios:

- Withdrawing their RMD, making a cash donation of $50K, and taking it as an itemized deduction on their tax return

- Making a QCD of $50K and taking a standard tax deduction

Here are the results of her analysis:

This analysis is hypothetical and for illustrative purposes only. For guidance and advice on taxes, consult your tax professional.

This analysis is hypothetical and for illustrative purposes only. For guidance and advice on taxes, consult your tax professional.

In both scenarios, Joe and Corinne gift $50K to their favorite charity. But by making the QCD instead of a cash donation and taking the standard deduction, Joe and Corinne lowered their taxable income by the amount of the standard deduction, $27,700, resulting in paying $3,324 less in taxes—a 44% reduction.

Earlier, we mentioned this works when done correctly. Here are a few guidelines for using QCDs to lessen your tax burden:

- Transfer your donated money directly to the charity from your IRA (Donor-advised funds and private foundations do not qualify as a charity for this purpose.).

- Donate the gift by December 31 (not April 15).

- Contributing to your IRA may reduce the amount you can gift to a charity.

- The maximum amount each person can contribute through a QCD per year is $100K.

Eliminate your RMDs

Eliminate your RMDs

Other individuals who don’t need their RMDs may be able to eliminate all or part of them—by converting their retirement accounts to a Roth. Roth accounts do not pay taxes on distributions—whether it’s a withdrawal of your contribution or the appreciation of your money. In other words, after contributing after-tax money, Roths can potentially grow tax-free forever—for you AND your heirs. And, importantly, there are no RMDs from Roths. So that means, when someone converts from a traditional to Roth and pays taxes on the converted amount (in the year of the switch), they’re done paying taxes on those funds and any gains from those funds—FOREVER!

The decision on whether to convert to a Roth IRA is based on an individual’s unique tax situation, so always consult with your tax professional before making this or other tax decisions.

Let’s walk through illustrations with two different goals.

Goal: Minimize taxes, no legacy

Devin and Sammy, a 64-year-old married Florida couple, just retired after selling their business for $1.6M. They are working with their Wealth Advisor on a retirement budget. In addition to the proceeds from the sale, they have a $1.75M traditional IRA. Here are the details of their plan. They:

- feel confident they can live on $100K per year

- have enough money to cover this annual spend, so they don’t plan to take Social Security until age 70

- are not interested in leaving a legacy at this time

They asked their Advisor how they can reduce their taxes on their income from Social Security and their RMDs from their traditional IRA.

Their Advisor suggested a Roth conversion. Her analysis shows they should convert no more than 50% of the $1.75M to a Roth, spreading the conversion over the next five years when their income tax rate will be lowest since they’ll have no other income until Social Security kicks in.

In the next five years (ages 65-69), their income tax rate will be 24%, then reduced to 12% through age 83. After that, it would go up to 22%. Conversely, if they do not convert, it would only be 12% through age 73 when their RMDs kick in. From there, it would jump to 22% and then, even higher, to 24% in their mid-80s.

When looking into converting more, the analysis shows that more than a 50% conversion would generate higher taxes paid than not converting at all. For example, based on the same analysis, total taxes paid on a 60% conversion would be $556K versus $535K when not converting.

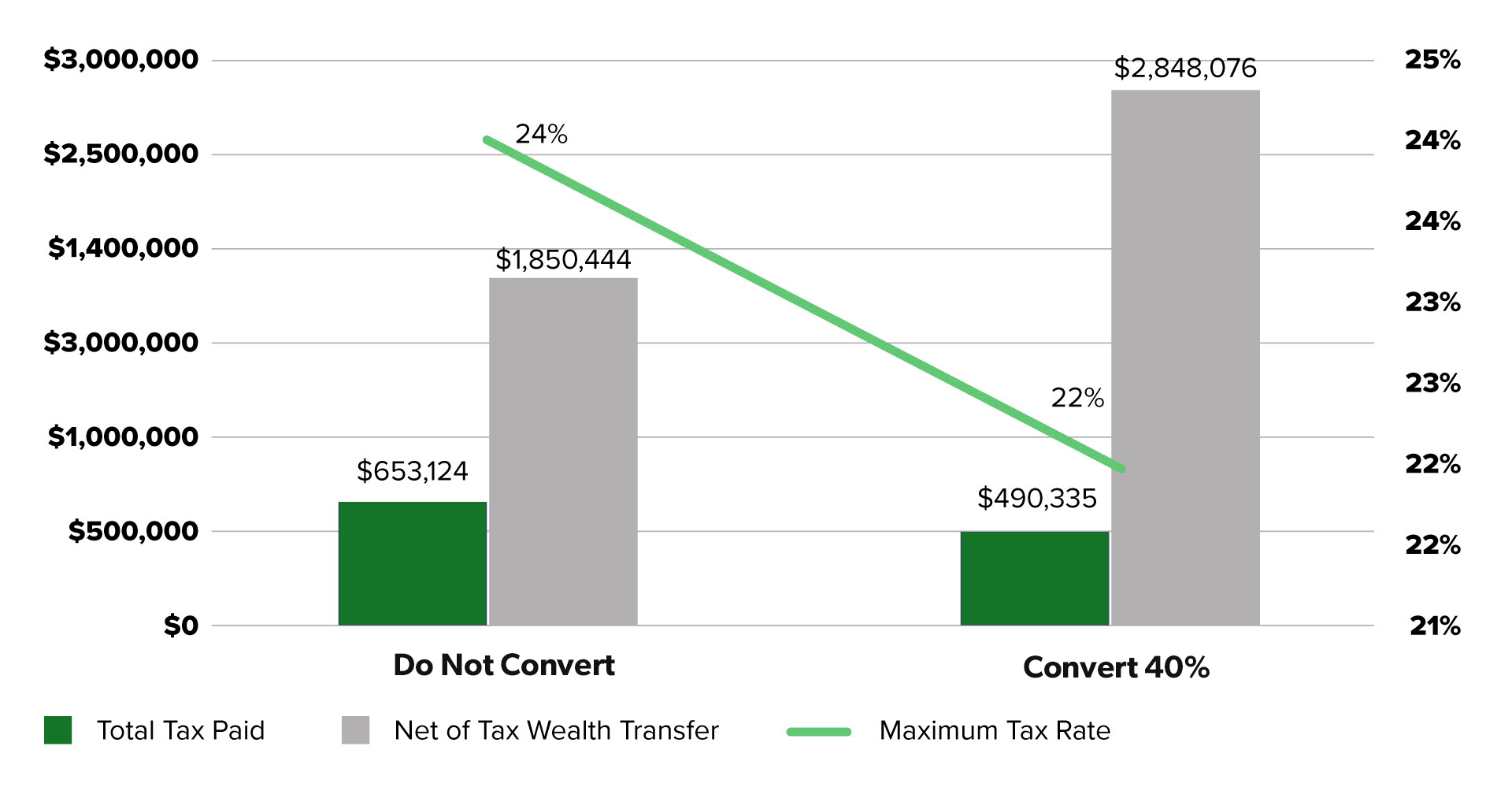

Goal: Minimize taxes, leave a legacy, and increase annual cash available

After careful consideration, Devin and Sammy decided they want to both lower their taxes and maximize the amount they can leave for heirs. But they’re also concerned about rising healthcare costs in their 80s and want to make sure they have at least $125K available each year.

In this case, their Advisor suggested a 40% conversion. Like the 50% conversion, the taxes paid would be lower than not converting at all. In addition, Devin and Sammy would confidently have $125K available each year. In the no-conversion scenario, they would also have $125K per year, but the taxes would be significantly higher. But in the 50% conversion, they would not have $125K per year unless they dipped into their Roth accounts.

Finally, they would be able to leave nearly $1M more—$2.85M versus $1.85M—to their heirs than if they did not convert. And even more important, almost all—$2.1M out of the $2.8M—will be in a Roth, so their heirs likely will never have to pay taxes on that money. If they don’t convert, their heirs will need to withdraw the inherited IRA over 10 years (same time frame as a Roth) AND pay taxes on the full amount.

Calculations by Motley Fool Wealth Management. *Discounted at 2.5% to today's dollars through age 85. Does not include a hypothetical/assumed 30% tax on the inherited amount. **Excludes tax rate on transfer to heirs. Assumes traditional IRA is invested in a balanced portfolio that delivers a market return of 5.38% from ages 63-70, then a 4.72% return through age. Past performance is not an indication of future results. For illustrative purposes only.

Calculations by Motley Fool Wealth Management. *Discounted at 2.5% to today's dollars through age 85. Does not include a hypothetical/assumed 30% tax on the inherited amount. **Excludes tax rate on transfer to heirs. Assumes traditional IRA is invested in a balanced portfolio that delivers a market return of 5.38% from ages 63-70, then a 4.72% return through age. Past performance is not an indication of future results. For illustrative purposes only.

More than RMDs

These three strategies focus on RMDs since many retirees need to take them and don’t know what to do if they don’t need them. But there are other tax mitigating strategies. For example, you can move to a no-retirement income tax state, adjust your income to stay below the IRMAA thresholds for Medicare premiums, strategically give to charities, take advantage of annual gifting limits to reduce taxable estate at death, and ensure your spouse is selected as the primary beneficiary for IRAs to preserve stretch treatment. We discuss these in greater depth in our report, 9 Savvy Tax Moves for Retirement.

It’s not how much you make, but what you take home.

Football fanatics who are enraptured with the cap structure of their teams don’t just look at a player’s headline contract number—say, the $160M for four years. Rather, they want to know a breakdown of what money is guaranteed, what the cap hit looks like this year and the subsequent years, and when their team could possibly get out of the contract without too high a dead money hit. Why is the structure important? Because the headline number isn’t the actual monetary value. The same is true for your wealth. Before-tax money, or before-fee performance, is meaningless to how much money you’ll have to spend or gift. After-tax wealth is what it’s all about.

![]()

Like what you're reading?

Join the thousands of readers getting stories like this delivered straight to their inbox every Thursday — for free. Give it a spin, enter your email to sign up.

Related Articles

Making Sense of Required Minimum Distributions

The government wants you to save for retirement. That’s why many people believe retirement savings...

Roth Conversions and RMDs

Required minimum distributions (RMDs) are a reality of tax advantaged accounts. Once you pass the...

New Job? Should You Roll Over Your 401(k)?

Transitioning to a new employer can be stressful. And for most people, their retirement account is...