Do you ever think about what it would feel like to win the lottery? (Actually, one or two of you may already know!) Many people dream about the things they’d do after winning a huge payout—like taking a dream vacation, buying a dream house, or quitting a “not-dream” job. But, all dreaming aside, what lottery winners should first consider is how they should take their winnings. Should they take a lump sum immediately or receive a fixed-income stream over a specified period?

The answer is not always straightforward. For some, it may depend on self-control. Can they limit their spending and not splurge on too many big-ticket items? For others, it may be about the security of knowing their everyday expenses will be paid for decades to come. Or a few may feel confident in their ability to manage their windfall on day one.

This decision can be similar to what people face when they consider buying an annuity.

What is an annuity?

Annuities are often guaranteed income insurance products. Here’s how they work: You purchase an annuity contract through a broker or advisor and contribute to it based on the terms of the agreement. The insurance company then invests the annuity contributions in various market instruments—like mutual funds. Depending on the terms of the contract, annuities then convert contributions to a series of payments that you’ll receive at a future date. In essence, it’s an insurance contract in which buyers pay into today but receive a benefit in the future.

How much will you get, and when? Are they truly guaranteed? Will your spouse be paid after your death? As you ponder a few starter questions, it's easy to see that it can be overwhelming to decode the sundry and diverse annuity features.

How much will you get, and when? Are they truly guaranteed? Will your spouse be paid after your death? As you ponder a few starter questions, it's easy to see that it can be overwhelming to decode the sundry and diverse annuity features.

Why? Because in addition to subtle differences among insurers’ similar products, there are also various annuities from which to choose. Below we discuss two basic categories.

Types of annuities

Fixed vs. Variable

Fixed annuities are insurance contracts that pay a guaranteed rate of interest on the account owner's premiums (or contributions). The annuity contract is owned and serviced by an insurance company and generates a guaranteed income payout (principal plus a minimum rate of interest) for a specified period or the life of the annuitant—the person who owns the annuity. There are generally two phases of annuities: an accumulation period, where the premiums earn interest, followed by a payout period. The benefits paid may be fixed at a dollar amount or by an interest rate, or grow by a predetermined formula.

Neither the growth of the annuity's value nor the benefit paid depends directly or entirely on the performance of the investments that support the annuity. For example, about 90% of an equity-indexed annuity’s payout could be based on a guaranteed minimum interest rate. But it also could offer a kicker where the annuitant can benefit from the stock market’s return. In that example, about 10% of the payout would be tied to the returns of a specified index.

Variable annuities, by contrast, pay a rate that varies according to the performance of an investment portfolio (typically mutual funds) chosen by the account owner. As a result, variable annuities offer the possibility of higher returns and more significant income than fixed annuities. Still, there's also always the risk that the account will fall in value.

Immediate vs. Deferred

An immediate payment annuity is a contract between an individual and an insurance company that pays the annuitant a guaranteed income starting almost immediately. So, after paying a lump sum, payments start right away—the amount of which depends on factors like age, prevailing interest rates, and how long the payments will continue. Older individuals typically purchase this type since they may not want to wait to start receiving their income stream.

Conversely, a deferred annuity doesn’t begin payments straightaway. Instead, income distributions are delayed and start at a future pre-specified date or event.

A few downsides to consider

Imagine someone told you could put two-thirds of your wealth away and then get an income stream that grows by inflation and pays your expenses for the rest of your life. And you have one-third of your assets left for your aspirational wants since your costs are covered. An acceptable proposal? Possibly, but before you jump in with both feet, consider the following features that tend to accompany annuities:

1. The lock-up

Many products typically have a surrender period that is usually six-eight years. The surrender period is the length of time you are not permitted to withdraw money from the annuity without penalty. If you do, you will pay a hefty surrender charge to the insurance company issuer. The surrender period exists so that the issuing company can recoup the commissions paid to the broker or advisor that sold the annuity. Yes, that’s right -- advisors who sell annuities do so to earn a commission on each one they sell. The magnitude of these sales commissions generally differs from a wealth management advisory fee—for example, a typical annuity commission is around 6%. In contrast, an advisory fee is generally 1%-2%.

Locking up some of your assets with an annuity where an insurance company provides monthly income can possibly be appropriate in some circumstances, including for folks who are risk-averse. Conversely, an alternative that may keep your wealth more liquid and accessible than an annuity could be a separately managed account (“SMA”). With an SMA, you could get the benefit of keeping ALL of the net performance on your money, rather than just the monthly income allocated by the insurance company.

2. The performance

There’s a lot of sexy language in the sales pitch. One common claim that we’ve heard is: “This is to protect you in the event of a downturn. Remember 2008, the second-worst market conditions in history?”

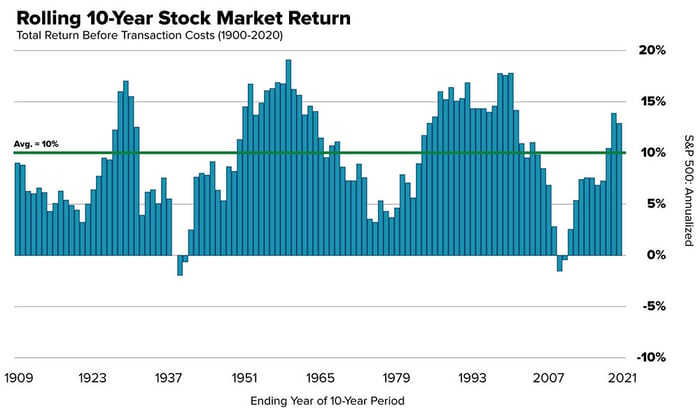

Sales pitches tend to latch on to scare tactics—like using an outlier example from the past 100 years—to highlight the benefits of the products. Instead, since annuities are long-term products, we believe, it could be more beneficial to look at a full market cycle—through both a bull and bear market—which can last for several years, not just a point in time.

One reason annuities may tend to latch onto down markets could be because annuity holders do not often fully participate in up markets. Why? Because annuities tend to cap their guaranteed return at some level. Let’s look at a hypothetical example of an annuity capped at 10% in a year in which the S&P 500 was up 18% in that same one-year period. Instead of realizing an 18% gain as the annuitant, you would've received only 10% and given up 8% to the insurance company to protect the potential of a market decline.

Could giving up a portion of your return be worth the peace of mind the protection offers? For some, the answer is a resounding “yes.”

But consider that with a 10-year average lock-up, most annuity holders invest for longer than a decade. Historically, the U.S. market has generated positive returns for every 10-year rolling period since 1909 except for two periods—the Great Depression and the Global Recession.

Source: Crestmont Research

In other words, is downside protection needed over the long term? Positive returns over the last few decades suggest it may not always be beneficial. Instead, investing long-term money earmarked for an annuity in a well-balanced portfolio may offer a greater chance for higher returns. The insurance company knows this—that’s why they implement multi-year lock-ups.

3. The mechanics

Other considerations before buying an annuity include:

Fees. When you total it up, annuity fees—which include surrender fees to get out of the contract early and sales commissions—can be high, especially if additional benefits, like a death rider, are added.

Taxes. Taxes may also be high with annuities. While contributions are tax-deferred, withdrawals incur ordinary income tax rates. Conversely, stocks are taxed at capital gains rates, which tend to be lower, especially long-term gains. Additionally, annuity owners below age 59½ may also have to pay a 10% tax penalty if they take their money out early.

Liquidity. Annuities, whether fixed or variable, are usually relatively illiquid. That means you cannot readily access your money. For example, fixed annuities typically allow for one withdrawal per year of up to 10% of the account value.1

Death benefit. Suppose you die while a deferred annuity is still in its accumulation phase. In that case, your heirs may receive some or all the account's value. However, if the annuity has entered the payout phase, the insurer may keep the remaining money unless the contract includes a provision to pay benefits to your heirs for a certain number of years.

Annuities vs. stock investing

Many people buy annuities for an investment. But are they the most effective tool for wealth accumulation or legacy planning? Not usually. While variable annuities may offer the potential to grow wealth through the underlying investments, most fixed annuities are capped at the guaranteed rate. That’s why fixed annuities are not regulated by the SEC.2 So in the true sense of the word, fixed annuities are not investments, they are insurance products.

Annuities may not be ideal for legacy planning, for two main reasons. First, there's no guarantee that your heirs will receive the remainder of your contracted benefits once you start annuity payments unless, you guessed it, you pay for an additional insurance rider. But buying this rider tends to be expensive and often lowers the estimated monthly income you receive.

Second, inherited annuities don’t offer a step up in cost basis like inherited stocks. Therefore, earnings on an inherited annuity are taxable to the beneficiary. Conversely, the cost basis for inherited stocks is reset to include unrealized gains so no taxes would be owed.

Comparison of fixed annuities vs. stocks

| Fixed Annuities | Stocks | |

|---|---|---|

| Guaranteed Income | Yes based on contract terms | None. Stocks that pay a quarterly dividend deliver income, but it is not guaranteed |

| Growth Potential/Wealth Accumulation | None | Yes |

| Risk of Loss | Low | Varies, should be aligned with your personal risk tolerance and financial situation |

| Liquidity Risk | High | Low, readily traded on the public market |

| Lock-up Period | Yes, during accumulation phase | None |

| Taxes | Ordinary income rates | Capital gains rates |

| Taxes on Inherited Assets | Yes | No, cost basis is stepped up |

| Value to Heirs | Zero after the income stream starts, unless a "period certain" rider is purchased | Market value at time of death |

| Fees | Mortality and expense risk charge (which includes sales commissions), administrative fees, surrender penalties, and others | Only the cost to buy or sell a security at the brokerage, unless with a no-fee broker |

Source: Motley Fool Wealth Management, investor.gov

An annuity-like alternative

Remember, annuities are contracts based upon insurance. So they may be a good choice for individuals who cannot stick to their wealth plan in the event of a market downturn—whether they cannot stomach losses or can't lose capital, for example.

But others who stay with their long-term plan may possibly generate a higher return with alternatives, such as owning stocks and bonds in an SMA. A wealth advisor can help structure a portfolio with the objective of mimicking the income stream that an annuity could pay while attempting to minimize volatility. All investments, including SMAs, have risks and may lose money.

The benefit? Account holders have the possibility of receiving the income they need for everyday living expenses. At the same time, the remainder of their assets should continue to grow. And even better for many—their returns are not capped or paid out to an insurance company. But while this approach may experience more volatility than an annuity, the upside, for many, is well worth some temporary market swings.

Like what you're reading?

Join the thousands of readers getting stories like this delivered straight to their inbox every Thursday — for free. Give it a spin, enter your email to sign up.

Footnotes

1https://www.investor.gov/introduction-investing/investing-basics/glossary/annuities

*During the annuity's surrender period, which can run for many years, although it is typically six to eight years from the start of the contract, withdrawals of more than 10% are subject to a surrender charge imposed by the insurer. Source: Investor.gov. "Annuities." Accessed Feb. 20, 2021.

Related Articles

Annuities: Is There a Better Way to Generate Retirement Income?

Have you thought about buying an annuity for your retirement income? You’re not alone. Many...

3 Wealth Planning Strategies at Every Life Stage

Wouldn’t it be nice if retirement happened without fuss or bother? Better yet, if you had an...

Catching Up on Your Retirement Plan: It’s Never Too Late to Start

We’ve heard it time and again. The best way to ensure a secure financial future is to start saving...